As the third quarter earnings season unfolds, market participants are witnessing significant fluctuations in stock prices in response to earnings reports. The current environment has created a scenario where traders are reacting more intensely to financial results than usual, often influenced by factors such as positioning and technical indicators rather than fundamental performance alone. This has raised questions among investors about where the most aggressive trader exposures are concentrated, which areas are ripe for potential disappointment, and where the risk of knee-jerk reactions is highest. The nature of these outsized responses highlights the need for a more careful analysis of corporate earnings and trader positioning to identify potential pitfalls.

A focal point of discussion has been the positioning of hedge funds leading up to earnings reports. In the first week of reporting, specific firms showed markedly high levels of exposure, leading to concerns that if their earnings did not meet expectations, the resulting sell-offs could be pronounced. Identifying these firms was crucial for understanding where the risks lie, as overly optimistic positions could create an imbalance, amplifying market reactions to any negative surprises. The analysis emphasized the importance of scrutinizing these positions and understanding both the underlying fundamentals of the companies and the sentiments stemming from hedge fund activities.

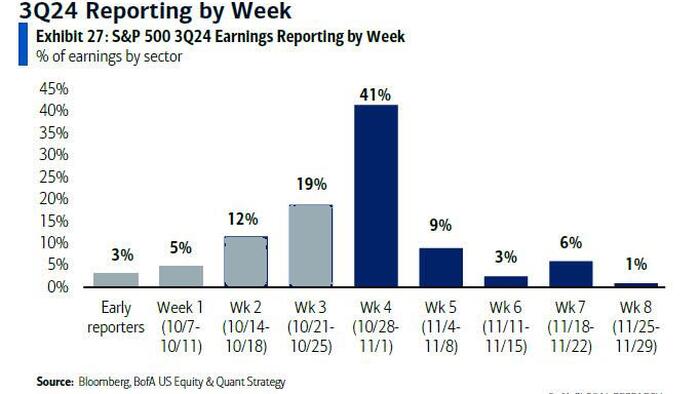

As we move into week three of earnings season, approximately 20% of the companies within the S&P 500 are preparing to announce their quarterly results. This significant volume of reports is likely to intensify the ongoing reactions in the market, as participants attempt to gauge the economic outlook based on these results. The sheer number of earnings reports could contribute to heightened volatility, as traders react not only to individual company results but also to broader trends emerging from multiple sectors. Consequently, this juncture creates a critical moment for investors to reassess their strategies and expectations based on the incoming data.

Additionally, the implications of potential earnings disappointments extend beyond individual stocks. If certain sectors or companies demonstrate weaker-than-expected performance, it may signal broader economic challenges that could ripple across the market. Investors must therefore consider both micro and macroeconomic factors when evaluating earnings reports during this period. The interconnectedness of various industries in today’s market means that a single underperforming sector could trigger a chain reaction affecting overall market sentiments and trends.

Moreover, there’s a nuanced interplay between technical trading strategies and fundamental analysis at play. While technical indicators can provide insights into stock price movements, they might also diverge from the underlying economic realities depicted in earnings reports. This divergence can lead to mispricing of stocks, as traders may become overly reliant on technical signals while ignoring fundamental developments. Therefore, a balanced investment approach that integrates both technical assessments and fundamental evaluations is essential for navigating this volatile environment successfully.

In summary, the ongoing Q3 earnings season presents a complex backdrop for market participants, characterized by aggressive trader positioning and significant reactions to earnings reports. As large portions of the S&P 500 gear up to announce their results, the potential for both opportunity and risk becomes pronounced. Investors must exercise due diligence when interpreting these reports, factoring in the broader implications of earnings surprises while being mindful of the technical influences on market behavior. By maintaining a comprehensive understanding of both the fundamental realities and the technical landscape, traders can better navigate the uncertainties of this earnings season.