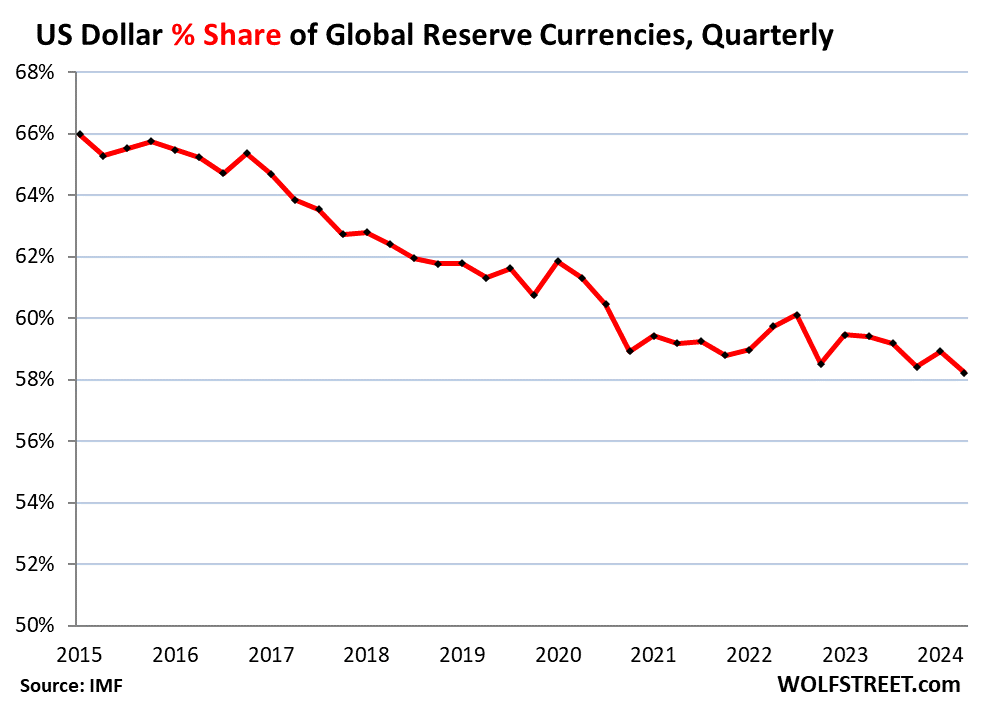

The ongoing decline of the Chinese renminbi (RMB) comes against the backdrop of a broader trend impacting the US dollar and its status as the world’s leading reserve currency. The US dollar continues to maintain its position as the foremost reserve currency held by central banks globally, though its share of total reserves is diminishing gradually. As central banks diversify their holdings by moving away from dollar-denominated assets, their appetite for currencies such as the euro has remained steady. Meanwhile, there has been a noticeable increase in bullion holdings, as gold reasserts its appeal as a significant reserve asset. Recent IMF data shows a drop in the dollar’s share of foreign exchange reserves to 58.2% in Q2 2024, a marked decline from its 66% share merely a decade ago. Should this trend persist, projections indicate the dollar could settle at around 50% in ten years.

Historically, the dollar’s hold over global reserve currency status has ebbed and flowed. In the 1970s and 1980s, the dollar’s share dropped sharply from 85% in 1977 to 46% in 1991 due to rampant inflation and waning confidence in the Federal Reserve’s fiscal strategies. By the 1990s, however, a decade of declining inflation rekindled central bank enthusiasm for dollar-denominated assets until the euro emerged as a robust alternative. Although the euro’s share remains around 20%, the growing presence of nontraditional reserve currencies signifies a meaningful shift in the global currency landscape. In particular, an increasing number of central banks are diversifying their reserves into assets denominated in various other currencies rather than solely relying on the US dollar.

Nontraditional currencies have seen significant gains since 2015, while the USD has conceded ground. Notably, the IMF identifies a set of 46 “active diversifiers,” comprising central banks that allocate over 5% of their reserves to these alternative currencies, thus augmenting their overall diversification strategies. The RMB, initially considered a potential rival to the dollar following its inclusion in the IMF’s Special Drawing Rights basket in 2016, has failed to gain traction due to persistent issues with capital controls and convertibility. Consequently, the RMB’s share in foreign exchange reserves has declined, placing it behind currencies like the Australian dollar, which now commands a larger portion of reserves.

Current data indicates that alongside the dollar’s 58.2% share, the euro maintains a consistent 19.8% share. Other significant reserve currencies include the Japanese yen, the British pound, and the Canadian dollar, all of which have seen fluctuating positions within the rankings. Despite the rise of the Australian dollar and the resilience of the yen, the Chinese RMB’s stature appears precarious. At Q2 2024, the RMB accounted for only 2.1% of foreign exchange reserves, making it an increasingly minor player in the global reserve currency arena. This dynamic highlights a growing skepticism among central banks regarding the viability of the RMB as a reliable reserve asset.

Additionally, central banks are increasingly leaning toward gold as a means to bolster their reserve assets. After a prolonged period of divesting from gold holdings, central banks worldwide have been aggressively rebuilding their gold reserves. As per IMF records, central banks currently hold approximately 1.16 billion troy ounces of gold, valued at about $3.1 trillion. This trend underscores a shift towards alternative reserve strategies emphasizing precious metals, providing an avenue for central banks to retain stability and safeguard their assets amidst ongoing global economic uncertainty.

Finally, the relationship between foreign exchange reserves and USD-exchange rates underscores ongoing complexities within currency markets. Foreign exchange reserves are reported in USD, with their value fluctuating based on exchange rate changes. Consequently, while USD-denominated assets remain relatively stable in their dollar amounts, non-USD assets are subject to evaluations influenced by prevailing exchange rates. Despite enduring exchange rate volatility, the broader trend shows the Dollar Index (DXY) has stabilized around levels observed as far back as 1998, indicating a nuanced equilibrium in global currency trading dynamics even as reserve currency preferences evolve.