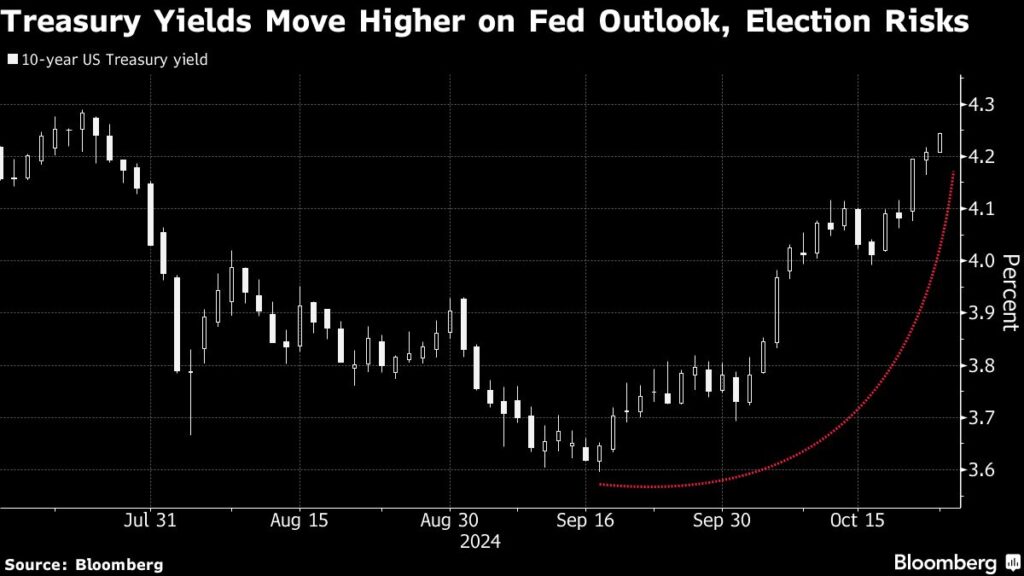

In recent market activity, Treasury yields have increased for the third consecutive day, reflecting heightened expectations that the Federal Reserve will adopt a more gradual approach to lowering interest rates. Traders are particularly concerned about the potential inflationary impacts of the upcoming U.S. presidential election, which have added to the overall uncertainty in the bond market. On Wednesday, yields across various maturities rose, with the benchmark 10-year Treasury note reaching approximately 4.26%, marking its highest level since July. This uptick in yields is, in part, driven by speculation surrounding the chances of former President Donald Trump winning the election scheduled for November 5. Market sentiment suggests that if Trump were to return to office, his proposed agenda of tax cuts and increased tariffs could likely stimulate economic growth, but also contribute to rising inflation.

The recent movements in Treasury yields are also fueled by ongoing indications of a resilient U.S. economy contrasted with persistently high inflation. The dynamics have led traders to temper their expectations regarding the pace and scale of potential Federal Reserve rate cuts in their upcoming meetings. Current swap prices suggest that while the market anticipates some reductions, there is less than complete confidence that policymakers will lower rates in both of their remaining meetings for this year. This uncertainty will likely be addressed in the near term as participants await detailed updates on the labor market for October, which could provide insights into the Fed’s future policy direction.

Market observers note a shift in sentiment among traders who had previously expected a more aggressive cutting cycle initiated by the Fed. Kathryn Kaminski, the chief research strategist at AlphaSimplex Group, observes that as the anticipated reductions failed to materialize, market participants have begun to reprice their expectations. As a result, yields have risen, with systemic models at AlphaSimplex remaining long on Treasuries, although adjustments were made due to weakening trend signals amid the recent selloff. Kaminski emphasizes that the fluctuations reflect broader economic signals, specifically recent inflation and robust labor data, which have prompted a reassessment of Fed policy forecasts.

The current state of the bond market highlights a stark contrast between U.S. Treasury performance and short-term European bonds. While Treasuries have experienced a decline, losing 2.1% this month alone through Tuesday, European bonds are witnessing a rally. Traders are increasingly positioning themselves in anticipation of the European Central Bank lowering rates by half a point in December to support a sluggish economic landscape in the region. This differing outlook on rate cuts—especially the possibility of more aggressive actions in Europe versus a cautious approach by the Fed—has led investment firms like Pacific Investment Management Co. and Vanguard to favor European debt over U.S. government securities.

Investor sentiment has shifted as concerns regarding the bond market’s stability rise. Suhail Shaikh, chief investment officer at Fulcrum Asset Management, points out that previously aggressive market pricing of Fed rate cuts appears misaligned with the actual economic needs, suggesting a realignment of expectations amidst current economic indicators. The increasing prices of options that protect against a sustained downturn in Treasury values highlight investor anxiety about potential deepening losses. Investors are becoming wary of the implications of Fed policy decisions and their ramifications for the stability of U.S. Treasury yields, which have typically been viewed as a safer investment.

As the scene unfolds, it is evident that the intersection of economic indicators, inflation concerns, and the political backdrop of the presidential election creates a complex environment for bond markets. With traders vigilant on upcoming labor-market data, the overall trajectory of Treasury yields will likely hinge on the Fed’s response to prevailing economic conditions and the sentiment leading up to the elections. The current fluctuations serve as a reminder of the sensitive balance between macroeconomic factors and market expectations, which will be closely monitored by both institutional investors and individual traders in the forthcoming weeks.