As the U.S. election approaches on November 5, financial markets are increasingly factoring in election-related risks, particularly in Treasury and volatility markets. Goldman Sachs strategists are advocating for short positions in 10-year Treasuries compared to German bunds, viewing this as a strategic play tied to the anticipated volatility surrounding the elections. Meanwhile, Citi opted to take profits on a long breakevens strategy, indicating a cautious approach to market movements. BMO is eyeing a potential entry into long 10-year breakevens, contingent on more favorable rates. This change in sentiment highlights a broader awareness among rates traders of the election’s potential impact on the financial landscape.

The VIX index, a measure of market volatility, remains elevated despite recent all-time highs in the S&P 500. Goldman trader Brian Garrett observed that it is unusual for the VIX to exceed 20 when the S&P is surging, suggesting a growing unease regarding the election’s outcome, which market participants had previously discounted. This increasing concern can be observed in how equity traders are reacting to the prospect of distinct political shifts. Major banks’ reports reveal varying strategies and recommended adjustments to portfolios as election risks heighten, illustrating a shift in focus from purely macroeconomic factors.

Bank of America, for instance, endorses a dip-buying strategy while maintaining a bias toward steepening the yield curve. They suggest stakeholders wait until the election risk stabilizes before committing to longer durations. In contrast, Barclays emphasizes the need for more pricing stability in U.S. rates, implying that the current rates do not adequately reflect the economic environment. Other institutions like BMO maintain strategies focused on specific yield spread relationships but are also adapting their outlook based on recent inflation data and the potential for Federal Reserve policy shifts.

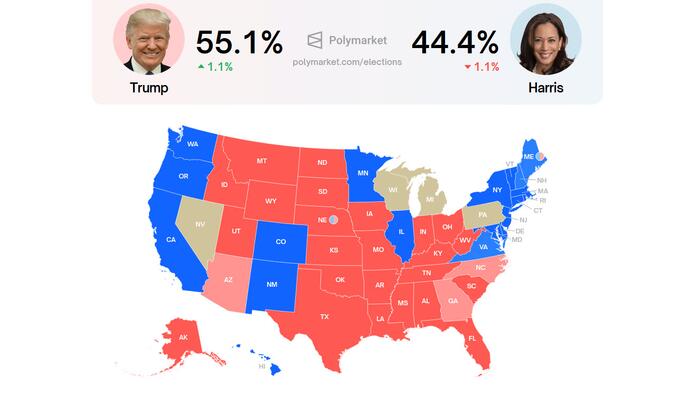

On the equities side, there is a notable divergence in sentiment between traders. Recent movements indicate an uptick in support for the Republican candidate, Donald Trump, which analysts suggest might boost risk sentiment for U.S. assets. The shifts in public and betting markets reveal a trend where traditional polling might not fully capture voter sentiment, as evidenced by Trump’s improving odds against Kamala Harris. This changing landscape indicates that market players may be adjusting their views and positioning based on perceived election outcomes.

Goldman Sachs further advises investors to prepare for potential election outcomes, suggesting they position themselves strategically based on expected party performances in the elections. This recommendation reflects the heightened sensitivity of stocks associated with Republican policies to election events. The analysis underscores how critical the upcoming election is for shaping market dynamics, with investor focus shifting significantly towards electoral implications over traditional economic indicators.

As speculative and formal betting markets continue to show rising support for a Republican victory, UBS has noted an outperformance of Republican-linked investments relative to Democratic ones. This trend indicates a broader sentiment shift among traders who are increasingly confident in the potential for a Republican sweep in the upcoming elections. The diverging outcomes in mainstream polling versus market expectations further illustrate a complex interplay between politics and finance, driving traders to recalibrate their strategies as they gauge the electoral landscape’s influence on economic performance.