The immediate aftermath of the recent US presidential election has yielded a surprisingly clear and favorable outlook for stock-market investors, as articulated by Jan-Patrick Bartner, a Bloomberg markets live reporter and strategist. Traders in the options market are adjusting their strategies in anticipation of a prolonged stock rally, driven by the swift resolution of the electoral process. Unlike previous elections that lingered with uncertainties, this time, the clear outcome has invigorated investor confidence, leading to a dramatic shift in market dynamics.

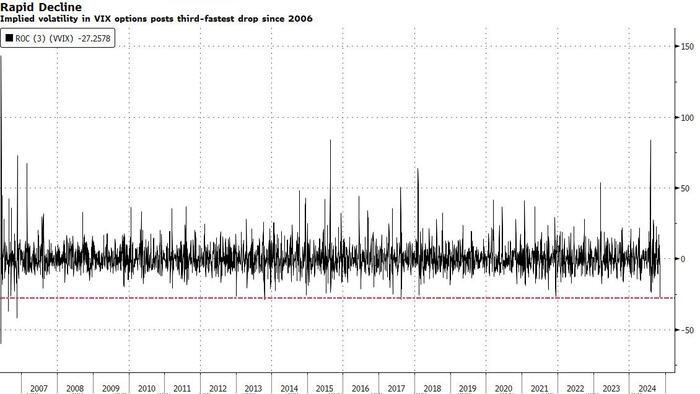

One of the most notable trends occurring post-election is the significant decline in demand for hedging. This reduction in hedging demand is occurring at one of the fastest rates observed since the last financial crisis, indicating that many traders are feeling more secure about their investments. Hedging typically acts as a safety net against potential market downturns, but as the market sentiment shifts towards optimism, traders are diving into riskier assets, reflecting a bullish sentiment.

This rapid change in market behavior has fundamentally altered the trajectory of volatility. With fewer traders seeking to hedge their positions, implied volatility—the projected volatility of stock prices—is likely to decline. A decrease in volatility often correlates with favourable market conditions, suggesting that investors are confident and expect stable market performance without significant price swings. Hence, with the current bullish momentum, volatility is showing signs of decreasing, which could foster further investor participation in the stock market.

Additionally, the post-election euphoria is not isolated to the options market but reverberates throughout various sectors. As investors chase potential rallies, capital is likely to flow into sectors believed to benefit most from the election results. This enthusiasm creates an upward pressure on stock prices, further fueling the optimistic sentiment among traders. The quick resolution of the election has allowed investors to make decisions based on known variables rather than the uncertainties that often plague post-election markets.

Despite the general optimism, analysts advise caution. While excitement may be driving the short-term rally, market conditions can shift rapidly based on various external factors, such as economic data releases, global economic conditions, and potential legislative changes. Traders need to remain vigilant and assess their risk exposure to avoid being caught off guard if the market sentiment turns due to unforeseen events.

In conclusion, Jan-Patrick Bartner’s insights highlight a transformative moment for the stock market post-US presidential election. With a significant drop in hedging demand and a widespread shift towards risk-taking, traders are positioned for a potential rally. However, while the optimism is palpable and volatility decreases, maintaining a cautious approach is necessary in an ever-changing financial landscape. Investors are navigating through a landscape that, while favorable now, holds inherent risks that cannot be overlooked as they chase the market’s upward momentum.