In the wake of a recent election, there is an emerging sense of hope that long-standing socio-economic issues such as unaffordable housing and homelessness can now be effectively addressed. However, these issues persist as daunting challenges, prompting reflection on their root causes. The primary factor contributing to these crises is financialization—defined as the expansion of financial activities’ influence and prioritization over physical and social capital. This phenomenon has led to a situation where housing is increasingly perceived not as a fundamental need but rather as a lucrative investment opportunity, catering to the wealth accumulation strategies of affluent individuals and corporations.

This reallocation of housing towards investment fundamentally alters the dynamics of the housing market. As the wealth held by the affluent has surged, their capacity to invest in real estate has outpaced the demands of ordinary citizens seeking homes. In Fort Worth, for example, approximately 26% of single-family homes are owned by corporations, a statistic indicative of a broader trend across the United States. This misalignment places immense strain on traditional housing structures, pushing prices beyond the reach of average earners. As investment capital continues to inflate housing prices, individuals who do not have substantial financial portfolios find themselves marginalized, unable to afford adequate shelter.

The unrelenting rise in housing valuations due to financialization has led to rampant gentrification. Initially affordable housing options are being consumed by investors seeking to renovate properties and generate profits, resulting in immediate spikes in rents. The displacement of lower-income populations becomes an inevitable consequence, with many finding themselves forced onto the streets. Gentrification, while economically beneficial for some, devastates those who can no longer compete in the financialized housing market, thereby intensifying the visibility of homelessness.

Moreover, statistical analyses highlight that while there appears to be a robust number of housing units in the U.S., the problem lies within ownership disparities rather than a quantitative shortage. The rising incomes and wealth concentration in the hands of the top 10% exacerbate the issue, as they now control a disproportionate share of financial assets, including real estate. The top segment of the population captures an overwhelming amount of national income and wealth, while the financial wealth of the bottom half has diminished significantly since the 2008 financial crisis, illustrating the profoundly unequal economic landscape that has emerged as a result of financialization.

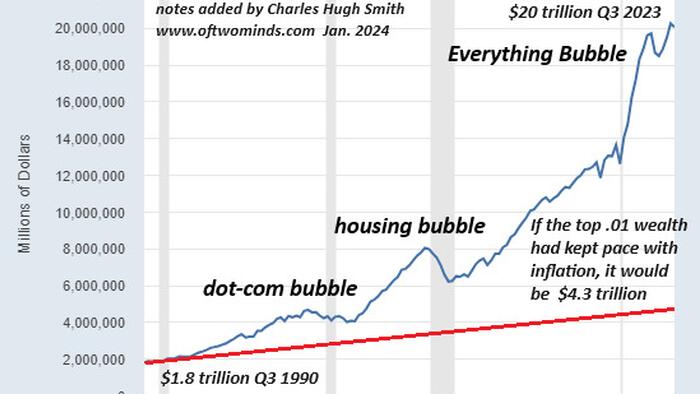

The dynamics of financialization are further evidenced by the vast influx of capital seeking stable investment opportunities in the wake of the 2008 crisis. This led to an unprecedented increase in non-bank financial assets, with the wealth of the top 0.01% skyrocketing to levels unimaginable in previous decades. Such disparities are not only alarming but also foreshadow potential social unrest. As the socio-economic fabric frays, the divide between the affluent and the impoverished threatens to ignite broader societal tensions, underscoring the urgent need for a reevaluation of financial mechanisms governing housing.

To remedy the issues of unaffordable housing and homelessness, a fundamental shift away from financialization is imperative. Simply constructing more homes will not suffice to tackle the core problem, as the wealth disparity created by financialization guarantees that the elite will continue to dominate housing markets. Thus, a holistic approach aimed at reversing financialization is essential. The solution lies not merely in quantity, but rather in redefining the relationship society holds with housing as an essential need rather than a mere financial asset. Engaging with this complex scenario requires a comprehensive understanding of the underlying economic structures and a commitment to reestablishing the notion of housing as a basic human right, paving the way for a more equitable socio-economic future.