European equity futures showed an upward trend while Asian stock markets experienced fluctuations, buoyed by a record-setting day on Wall Street. Following a report from the Washington Post indicating that Israel is unlikely to attack Iranian oil or nuclear facilities, energy stocks faced a decline, contributing to a drop in oil prices. Asian technology stocks mirrored their U.S. counterparts’ performance, as Taiwan Semiconductor Manufacturing Co. led gains in the region’s chip sector despite later erasing those gains. Meanwhile, Japan’s Nikkei 225 Index reached its highest point since July, and other regional benchmarks also advanced. David Chao, a strategist at Invesco Asset Management, noted an optimistic shift among APAC investors, suggesting a “risk-on” attitude due to improving macroeconomic conditions.

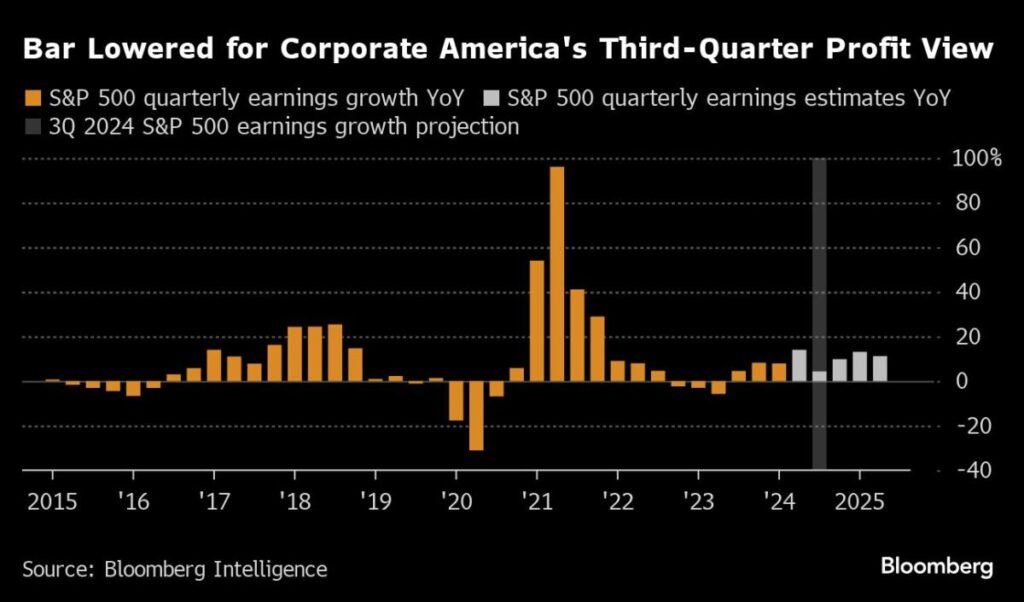

In the U.S., the S&P 500 climbed almost 1% on Monday, marking its 46th record high for the year. Investors appeared undeterred by lowered forecasts for third-quarter earnings, focusing instead on potential positive surprises in upcoming reports. Major corporations like Nvidia Corp., Apple Inc., and Tesla Inc. were key contributors to this upward movement. Financial giants Goldman Sachs and Citigroup also advanced in anticipation of upcoming earnings. However, the sentiment was mixed in China and Hong Kong where shares declined amidst expectations for greater government stimulus, which had fallen short of investors’ hopes.

The Chinese government is reportedly intending to raise 6 trillion yuan ($846 billion) through ultra-long special government bonds over three years to stimulate a sluggish economy. However, some experts indicated that this approach does not represent a significant expansion in fiscal stimulus but rather continues the country’s incremental policy measures. Additionally, domestic banks are expected to reduce interest rates on a substantial amount of deposits, responding to the finacial pressures from current stimulus policies. Data released, showing a mere 2.4% increase in exports during September compared to the previous year, points to broader economic challenges, although certain sectors, such as automobiles and ships, did experience growth.

In Japan, solid demand for Tokyo Metro Co.’s recent initial public offering highlighted investor interest, with the offering raising ¥348.6 billion ($2.3 billion). Anticipation surrounding Hong Kong leader John Lee’s upcoming speech also grew, with expectations that he would prioritize economic stimulus and financial sector measures. Japanese markets performed well against this backdrop, aided by favorable currency movements, as the yen remained stable near significant psychological levels against the dollar. The undervaluation of Japanese stocks coupled with a lack of macroeconomic selling pressure provided a positive environment for investors.

As earnings season commenced in the U.S., financial institutions like JPMorgan Chase and Wells Fargo were in the spotlight, and investors were keen to assess corporate performance alongside broader market conditions. Analysts observed that Corporate America appears to be benefiting from the early stages of the Federal Reserve’s monetary easing cycle. Competing narratives emerged from ongoing discussions in the Biden administration regarding limitations on AI chip sales, which could impact international competitive dynamics for technology firms like Nvidia Corp.

Looking forward, key financial indicators and events scheduled for the week include Eurozone industrial production data releases, further earnings reports from major banks, and economic indicators from the U.S. and China, including inflation metrics and GDP growth forecasts. These developments will shape investor sentiment and influence market trends as global financial actors respond to ongoing economic conditions and corporate earnings reports. Overall, the interplay between these diverse market factors illustrates a complex macroeconomic landscape poised for continued volatility as it approaches the end of the year.