Homebuilders are currently facing a challenging market where they are compelled to make significant adjustments in order to maintain their businesses amid soaring inventories and fluctuating demand. In response to the current landscape, builders are focusing on creating homes at lower price points, implementing mortgage rate buydowns, and offering various incentives to attract buyers. Despite these efforts, the levels of demand for new homes are telling a different story. As interest in existing homes continues to decline due to elevated prices, builders find themselves with an increasing number of unsold properties. This situation has reached a critical point, with statistics indicating a year-over-year rise in unsold single-family houses, including a striking 48% spike in completed homes. Such an inventory buildup has implications not only for builders’ bottom lines but also for the overall health of the housing market.

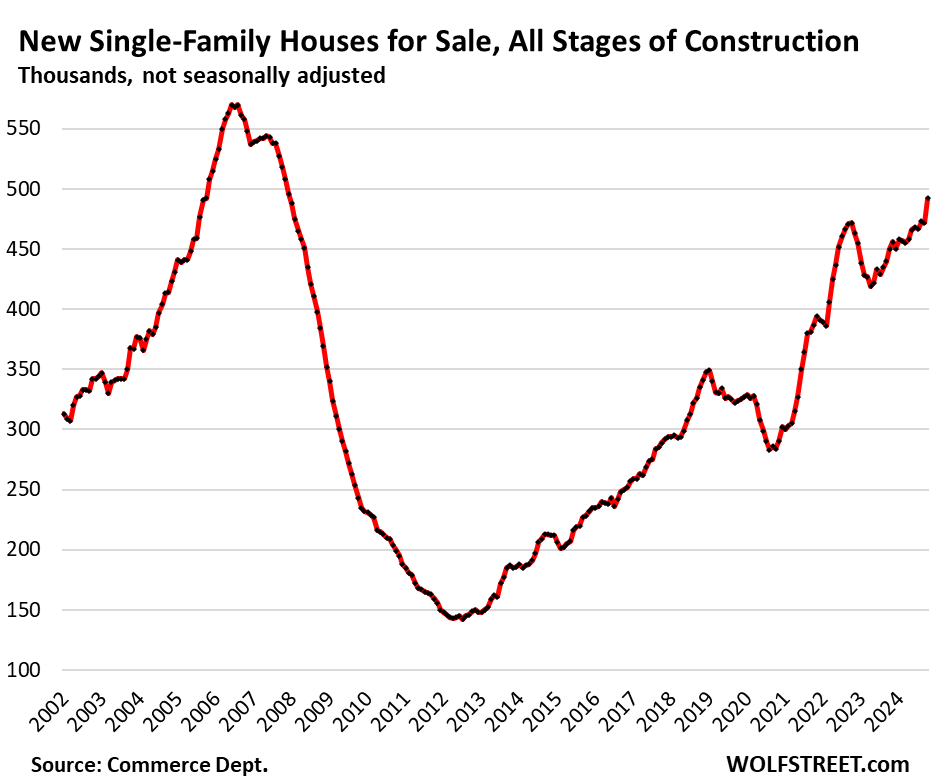

According to recent data from the Census Bureau, the unsold inventory of new houses across all stages of construction has risen to the highest level since December 2007, landing at approximately 492,000 units. This increase equates to an 8.2-month supply of homes, triggering significant concerns for builders who now have substantial financial investments tied up in these properties. The unsold inventory of completed houses—the so-called “spec houses”—rose by a staggering 53% year-over-year, highlighting a concerning trend where builders are struggling to find buyers for move-in ready homes. Given the substantial financial commitment builders have made in constructing these properties, it becomes imperative for them to move inventory quickly in order to preserve cash flow and maintain operational stability.

While the surge in housing inventory might seem problematic on the surface, it could also serve as a catalyst for necessary price adjustments within the housing market. With builders now under pressure to sell off their completed houses, there is a strong incentive for them to offer discounts and attractive deals, potentially realigning prices that have become misaligned. Notably, sales of completed new houses saw a sharp decline of 25% month-to-month in October, prompting many to speculate about the implications of a continuing downturn. If this trend persists, homebuilders may have no choice but to further lower prices, which could result in a more competitive and healthier housing market in the long run.

Interestingly, sales of newly built homes have maintained a positive trajectory despite the inventory challenges facing builders. January data indicated that new single-family home sales at all stages inched up slightly in October and revealed a year-over-year increase of 7.3%, suggesting that demand is gradually shifting towards new builds as opposed to existing homes. Year-to-date statistics show that total sales of new houses have risen by 3.3% when compared to the previous year, and forecasts suggest that the overall sales for the year will stabilize around 686,000 homes, similar to figures seen in 2019. Therefore, despite evident challenges, the resilience in new home sales is a favorable indicator amidst the broader housing market constraints.

However, when analyzing pricing trends, builders face additional complexities as the median contract prices of newly constructed single-family homes exhibit a significant degree of month-to-month volatility. October saw a spike in these prices, reaching $437,300, although this figure comes with substantial costs related to mortgage rate buydowns and other incentives that builders are currently employing to attract buyers. In fact, data illustrates that the costs associated with such incentives have risen dramatically, placing an additional financial strain on homebuilders as they work to manage their pricing strategies in a fluctuating market environment.

The relationship between the prices of new and existing homes has undergone a remarkable shift over the last few years. Historically, new homes were consistently pricier than existing homes; however, recent trends indicate that newly built homes are becoming more economically appealing on a monthly payment basis, due to builders’ efforts to incentivize potential buyers. This has led to a portion of demand migrating from existing properties to new constructions, substantiating a relatively stable sales performance for new homes in light of declining sales in the existing home market. As this dynamic continues to evolve, builders must adapt their strategies to navigate a market influenced by rising inventory levels, changing buyer preferences, and fluctuating price trends.