South Korea’s economy grew slightly by 0.1% in the third quarter, following a 0.2% contraction in the second quarter, highlighting ongoing vulnerabilities in the nation’s export-driven economic model. This growth figure was significantly below economists’ expectations of a 0.4% increase and came in stark contrast to the annual growth rate of 1.5%, which also missed predictions of 2%. The Bank of Korea (BOK) announced that it might need to revise its growth forecasts downwards during its upcoming monetary policy meeting, where recent trends could dictate further actions regarding interest rates. As a nation largely reliant on exports, particularly in technology, the slowdown in memory-chip exports raises concerns about global demand, particularly with rising geopolitical tensions and uncertainties related to the U.S. presidential election, which may impact trade for nations like South Korea.

While the overall growth was modest, private consumption showed some resilience with a 0.5% increase, and facility investment soared by 6.9% due to heightened spending on equipment, notably in chip-making industries. However, the BOK reported a 0.4% decline in real exports, largely stemming from a significant drop in automobile and chemical product shipments. Despite these difficulties, imports increased by 1.5%, suggesting a mix of challenges and opportunities in the economic landscape. The BOK’s recent decision to lower interest rates could provide necessary stimulus, although economist Lee Seung-suk emphasized that the road ahead remains rocky due to global uncertainties and lackluster export momentum.

Amid the economic turbulence, the South Korean government appears hesitant to implement large-scale fiscal stimulus. President Yoon Suk Yeol’s administration focuses on encouraging the private sector to drive growth and maintains a cautious approach toward government spending due to lingering concerns over national debt that escalated during the pandemic. The previous administration’s massive fiscal interventions in support of small businesses contributed to housing market overheating and public disapproval, prompting Yoon to steer towards a different economic management approach. This includes maintaining limited fiscal spending while navigating the challenges posed by growing debt and economic instability.

The BOK’s decision to pivot on monetary policy by reducing interest rates had strategic considerations, particularly concerning the risk of further inflating the already overheated property market in Seoul. BOK Governor Rhee Chang-yong highlighted the importance of considering factors like economic growth potential and mild inflation in deciding to cut rates. Most economists predict that the BOK will likely hold rates steady in its next meeting, although they anticipate two additional cuts in the first half of next year, thereby reflecting a bearish outlook for both exports and overall economic growth in the near future.

The prospect of declining export growth raises alarm bells within South Korea, particularly regarding international trade dynamics that may shift with the U.S. presidential elections. South Korean businesses are preparing to face rising trade barriers and potential tariffs in 2025, regardless of which presidential candidate wins. The current geopolitical climate, illustrated by North Korea’s emerging ties to Russia amid the ongoing war in Ukraine, further complicates South Korea’s trade environment and overall economic stability. The nation’s trade ministry forecasts that export growth may still remain positive in the last quarter of the year but will be slower compared to previous quarters due to protracted global manufacturing recovery, with concerns tailing about U.S. consumption trends and the efficacy of China’s stimulus measures.

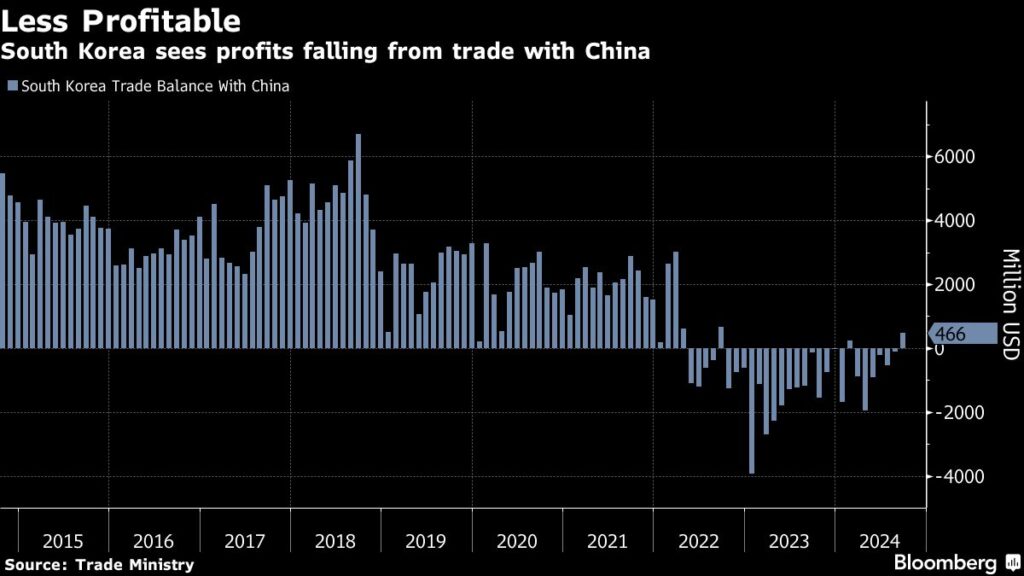

China remains South Korea’s largest trading partner, even as the country strengthens its economic ties with the U.S. under President Yoon’s administration. This shift towards closer U.S.-South Korean trade relations contrasts with growing competition from Chinese companies across multiple sectors, including automobiles and semiconductors. Notably, South Korea recorded its first trade deficit with China in nearly three decades last year, reflecting the ramifications of changing global trade dynamics and increasing competition. On the road to recovery, the South Korean economy stands at a critical juncture as it navigates a complex tapestry of domestic challenges and international pressures.