Concerns about the stability of the artificial intelligence (AI) sector have escalated significantly this week, as major tech companies like Advanced Micro Devices (AMD) and Samsung Electronics reported disappointing performance metrics. AMD’s earnings report indicated a slower-than-anticipated growth in AI sales, which has added to the uncertainty surrounding the future of AI technologies. This was complemented by Samsung’s announcement regarding its third-quarter earnings, highlighting weak demand for advanced chips utilized in mobile devices and personal computers. Despite a minor increase in overall profit that beat Wall Street’s expectations, Samsung’s chip division surprised analysts with a decline compared to the previous quarter. Additionally, the smartphone market outlook has dimmed, with projections indicating only a 1% increase in sales for 2025, casting doubt on the anticipated benefits from AI-enabled devices.

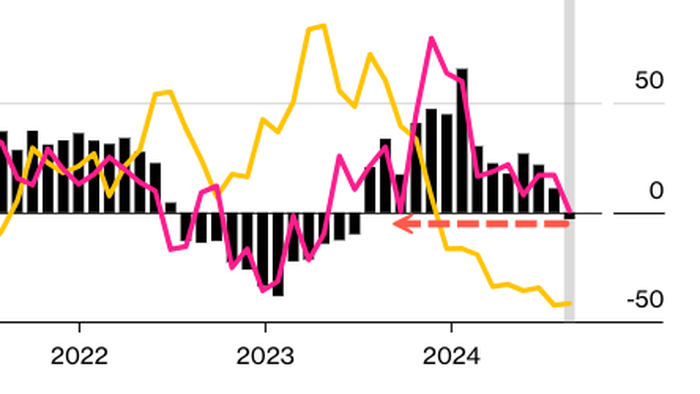

Amid these corporate announcements, South Korea’s chip manufacturing sector provided further evidence of a cooling trend. Data revealed that nationwide semiconductor production fell by 3% in September, marking the first reduction in 14 months. This striking change comes after an 11% increase in production the previous month, demonstrating a significant reversal in growth. Shipments of chips also saw a disheartening slowdown, with growth plummeting to a mere 0.7% from 17% in August. These figures illustrate a troubling shift in the semiconductor market, which has been considered a bellwether for global demand. With the increasing reliance on chips across various industries, including electronics and automotive sectors, signs of a potential cooling of the AI bubble become more pronounced.

Despite the downturn in production numbers, inventory levels in South Korea showed a positive trend, with stockpiles declining by 41.5% year-over-year in September. This suggests that while production may be decreasing, companies are working through their existing inventory efficiently. However, this dynamic may also reflect market saturation or peaking demand for memory chips, which has been a crucial component amidst the AI boom. As companies assess their stockpiles, the rapid inventory turnover could mask underlying weaknesses in ongoing demand if AI advancements fail to translate into sustainable long-term growth.

The performance indicators from these key technology firms create a narrative of increasing skepticism regarding the AI market’s near-term trajectory. The disappointing results from AMD and Samsung converge to paint a troubling picture for investors, especially given the high expectations surrounding AI’s transformative potential across multiple industry sectors. As shares in these companies react to the reported figures, market participants are left to contemplate whether the current hype surrounding AI technologies can withstand the emerging realities of demand and supply, which may not align with the optimistic narratives previously promoted.

The semiconductor industry has traditionally been a driver of technological advancement and economic growth, and any signs of a slowdown can have cascading effects on the broader economy. With South Korea being a pivotal player in the global chip supply chain, its recent production declines serve as an alarm bell for stakeholders relying on a continuous influx of innovation and product launch cycles. The convergence of disappointing earnings from major firms and declining chip production does raise concerns about the extent to which the AI narrative has driven investment and market enthusiasm, potentially signaling that the sector is now grappling with the natural limitations of rapid growth cycles.

In conclusion, the recent earnings reports from AMD, Samsung, and the data from South Korea paint a complex picture of the artificial intelligence landscape shrouded in uncertainty. While the rapid advancements in AI technology have generated immense excitement and investment, current signs of a cooling bubble suggest that the industry may need to recalibrate expectations moving forward. The interplay between production levels, market demand, and corporate earnings will be crucial in determining the AI sector’s stability and future growth potential. As these developments unfold, industry watchers will be keen to see if the AI market can recover from these challenges or whether it will succumb to the pressures of unmet expectations.