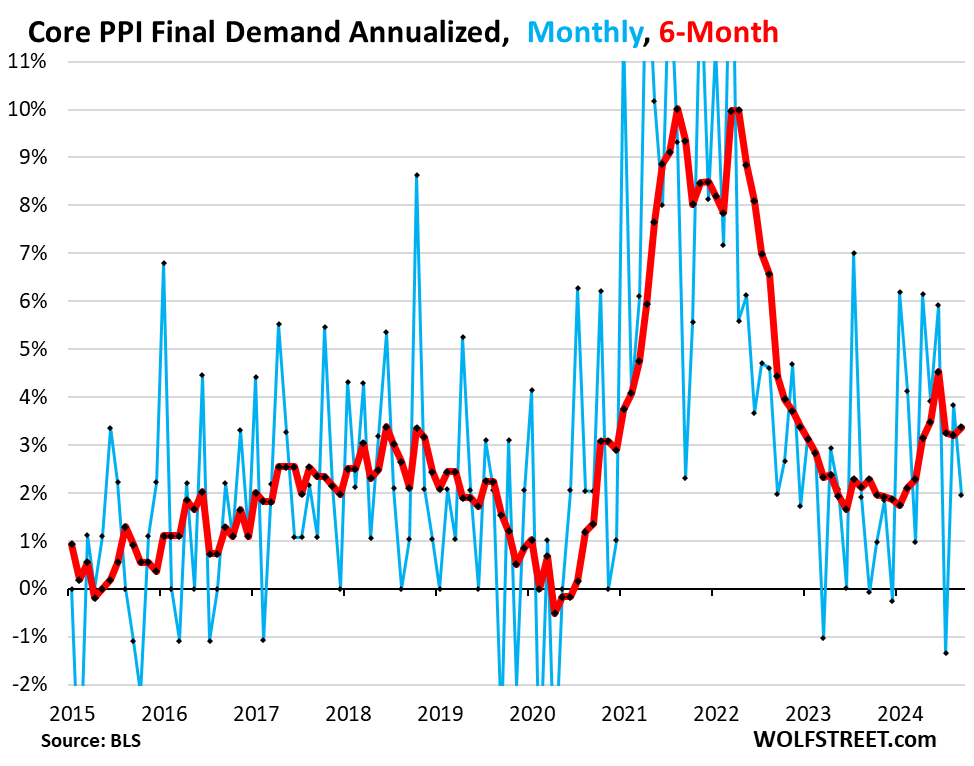

The recent trends in the Producer Price Index (PPI) highlight a complex inflation landscape, particularly influenced by the notable decline in energy prices. As reported, the overall PPI registered a minimal increase of just 0.05% in September compared to August, prompting headlines that downplayed broader inflationary concerns. However, an in-depth look reveals that, outside of energy costs, inflation at the producer level remains significant and accelerating. The six-month average core PPI saw an increase to 3.4%, a shift that denotes a concerning upward trajectory in inflationary pressures, signaling that the overall inflation environment is not as benign as suggested by the superficial figures.

The core PPI, which filters out food and energy prices to present a clearer picture of underlying inflation, rose by an annualized rate of 1.9% in September. Importantly, many previous month’s figures were revised upward, revealing a tendency toward higher inflation than initially reported. This serves to elevate the six-month average, indicating that inflationary pressures have gained traction and could suggest a shift in economic dynamics. Notably, the August revision raised the core PPI from an earlier estimate of 2.8% to 3.2%, illustrating how prior data can paint a misleading picture if viewed out of context or without consideration of revisions.

Turning to the services sector, the PPI for services rose by an annualized rate of 2.0% in September, showcasing how inflation in this sector is particularly strong. The six-month average for services PPI climbed to 3.7%, reflecting upward revisions in previous months that underscore persistent inflation in services despite fluctuations elsewhere. Year-over-year, this measure accelerated to 3.1%, which signals a broader inflation problem, particularly as services often comprise a substantial component of consumer expenditures and can indicate long-term trends in economic inflation.

At the core goods level, the finished core goods PPI reported an annualized increase of 2.6% in September, with its six-month average holding steady at 2.3% over the past three months. This suggests that while traditional inflationary pressures have stabilized in core goods, they remain in the upper range of pre-pandemic levels. Interestingly, despite recent trends in consumer price indices showing no substantial inflation pressures in this segment, the persistent inflation in services continues to keep overall inflation elevated. This distinction highlights the disparate inflationary dynamics between goods and services in the current economic context.

Though energy prices saw a sharp decline that affected the overall PPI, the broader implications extend beyond energy markets. The overall PPI, driven primarily by sharp drops in energy prices, only inched up 0.6% in September compared to the previous month. However, revisions from earlier months effectively increased the six-month average to 2.3%. This phenomenon illustrates a contrast between volatile energy prices and more entrenched inflation in other sectors, particularly services, creating a situation where misleading conclusions could be drawn by focusing solely on headline PPI data while neglecting underlying trends.

Finally, the plummeting energy prices, which have been observed since mid-2022, are unlikely to persist indefinitely. As these prices stabilize, the enduring inflation pressures in the services sector may become more prominent and contribute to overall economic conditions. The recent reports underscore that although energy prices may mask persistent inflation, the underlying economic environment suggests rising pressures that need to be addressed. The intricacies of inflation trends are critical to understanding long-term economic health, calling for close monitoring of the PPI and its influence on broader economic trajectories. Overall, the inflation landscape appears to be complicated and evolving, necessitating a careful interpretation of data amidst shifting economic conditions.