The Federal Reserve’s overnight reverse repurchase agreement facility (RRP) has recently experienced declining demand, plummeting to $238 billion, the lowest level since May 2021. This marked a decrease from the previous day’s $261 billion, highlighting a continuing trend of reduced usage since a peak in late 2022. The change in demand raises questions about the potential consequences for the Fed’s balance-sheet runoff strategy. Recent regulatory modifications introduced by the Securities and Exchange Commission have mandated U.S. money market funds to increase cash reserves, which has influenced the functioning of the $6.47 trillion money market industry, particularly impacting prime funds that typically invest in higher-risk assets.

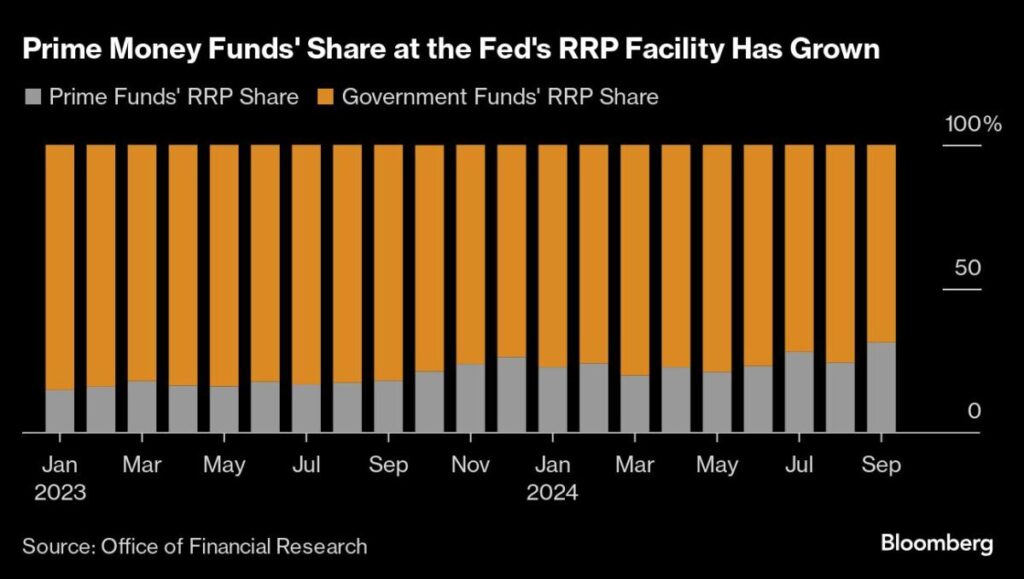

As a response to the regulatory changes, prime funds have ramped up their reliance on the RRP facility, with their share of the total rising to approximately 31% at the end of September from 18% a year prior. This shift suggests a growing habit of keeping cash at the Fed, rather than pursuing higher yields in private markets. However, this demand may have reached a plateau, as the new liquidity requirements compel funds to maintain greater cash reserves, possibly accelerating the depletion of bank reserves. This raises concerns among market players about how much further the Fed can reduce its balance sheet before liquidity levels enter a potentially problematic territory.

Experts note a tension between the incentives for funds to utilize the RRP and the Fed’s intentions regarding interest rates. Gennadiy Goldberg, head of interest rate strategy at TD Securities, emphasizes that although there is motivation for funds to continue using the RRP, the central bank seems reluctant to allow rates to drop significantly in order to avoid reaching zero utilization of the facility. The overall use of the RRP has declined by more than $2 trillion since December 2022, indicating a noticeable shift in market behaviors and money allocation strategies.

Despite the reduced demand, Dallas Fed President Lorie Logan highlighted that operating with “negligible balances” in the RRP may be appropriate, recognizing that certain participants may still prefer the safety of overnight assets due to constraints faced in the private repo market. A stagnation of RRP balances at around $400 billion occurred in July, even with rising repo rates, indicating that both primary dealer balance-sheet limits and uncertainty around the Fed’s interest-rate policies may have dampened the appetite for private repos. This suggests that existing RRP demand might not decline quickly, impacting monetary policy responsiveness.

Logan proposed that if demand for the RRP remains stagnant despite increasing repo rates, the Fed might contemplate lowering the offering rate of the facility, currently set at 4.8%, as a strategy to push participants back into private markets. Analysts argue that outright yield will ultimately influence decisions more strongly than liquidity concerns, with market participants weighing the trade-off between holding cash in the RRP versus seeking better returns elsewhere. This emphasizes the delicate balance the Fed must maintain in managing liquidity while also fostering an environment conducive to investment and economic growth.

As the landscape of the financial markets continues to evolve in response to regulatory shifts and changing market dynamics, the trajectory of the RRP and its role within the larger monetary framework will remain a critical point of analysis. The declining participation in the RRP highlights the shifting sentiments towards cash management strategies among institutional investors, reflecting broader changes in liquidity and investment patterns. How the Fed navigates these challenges will be pivotal in shaping both the effectiveness of its monetary policy and the stability of the financial system.