Last week’s market dynamics were characterized by turbulence, as outlined before the Federal Reserve meeting. Market participants encountered significant selling pressure with a noticeable shift from assets that are perceived as over-owned to those viewed as under-owned. This rebalancing came to a head following the Fed’s decision to cut interest rates, which was widely anticipated. However, what caught investors off guard was the Fed’s adjustment of its interest rate expectations for 2025, which included a half percentage point upward revision. This unexpected hawkish stance led to concerns that the Fed no longer believed inflation would return to its 2% target next year. As such, this shift stoked fears that the justification for high market valuations based on loose monetary conditions was eroding. Many believe this perspective is overly simplistic, as it may not account for the potential for slower economic growth, likely prompting the Fed to shift towards a more dovish approach as 2025 unfolds.

Adding to market anxieties was the looming possibility of a government shutdown. History suggests government shutdowns typically do not pose a significant long-term threat to the stock market since mandatory spending, such as social security and interest payments, continues unhindered. These events primarily affect discretionary spending and government employment. While short-term market reactions to shutdowns have been observed in the past, they tend to be fleeting, especially given that funding often arrives last minute through continuing resolutions. However, these resolutions have led to sustained increases in federal spending, contributing to escalating national debt since traditional budget practices were upended in 2009. Even with these challenges, an apparent short-term sell signal emerged in the market, which pointed to increased volatility, particularly as portfolio realignments were taking place.

The question of whether the much-anticipated “Santa Claus Rally” will indeed occur this year is pertinent. Traditionally, a Santa Claus Rally refers to the tendency for stock market gains to spike at the year’s end. Data from the Stock Trader’s Almanac indicates that stock prices have historically risen more than 75% of the time during the seven trading days encompassing the last week of the year and the first two days of the subsequent year, averaging a return of 1.48%. Factors contributing to this phenomenon include portfolio adjustments by professional fund managers and year-end distributions needing to be rebalanced. However, there is always the possibility that this year could deviate from tradition, with some bearish sentiment underlying the market’s trajectory.

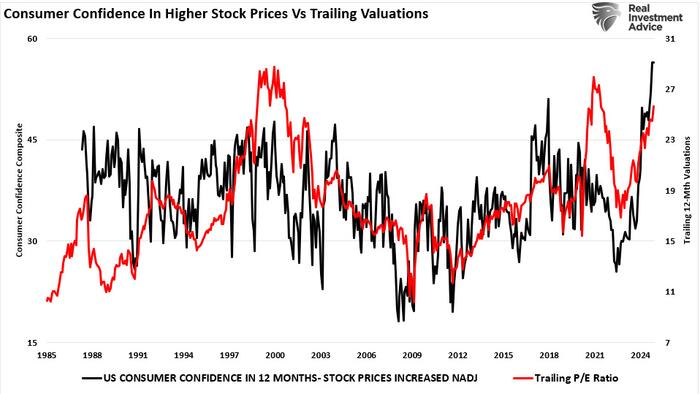

Recent market conditions echo past instances when optimism was abruptly challenged—such as in December 2018. Back then, a strong stock rally was followed by a stark realization of the Federal Reserve’s dovish stance, leading to a market correction. Similar to 2018, current investor sentiment appears buoyed yet precarious. Following a significant rally this year, investor allocations have reached an all-time high, raising concerns about whether too much bullishness exists given the conditions stipulated by the Fed. The surprise adjustment in the Fed’s projections has compounded vulnerabilities in an already tight market, particularly against a backdrop of rising valuations that are not necessarily supported by underlying earnings growth.

Moreover, broader market metrics indicate a contraction in market breadth as evidenced by declining participation rates. Observations from various market indicators—including the NYSE Advance-Decline line—point to weaknesses beneath the surface of overall gains. These technical indicators, reflecting overbought conditions and excessive return deviations from historical averages, create an environment ripe for corrections if external shocks occur. The recent hawkish pivot by the Fed and the looming shutdown could serve as those catalysts. As core valuations hover at near-record highs, this suggests a potential reassessment of earnings expectations—possibly culminating in a market reevaluation to realign growth forecasts with valuations.

Navigating this precarious environment necessitates careful risk management and a critical approach to portfolio strategy as year-end approaches. Investors often find themselves up against emotional barriers that can cloud judgment. Anticipating market movements during the holiday season can be tempting, yet there have always been underlying risks. Reaffirming fundamental investment principles can provide clarity despite the prevailing market madness. Questions regarding potential returns, downside risks, and strategies for maintaining balanced exposure are pivotal decisions that investors must face. Acknowledging the unpredictability of the market while remaining mindful of the lessons from past volatility (such as those seen in 2018) becomes essential. Ultimately, capital preservation and strategic risk management will prevail as the most prudent approach through market uncertainty and the holiday trading season.