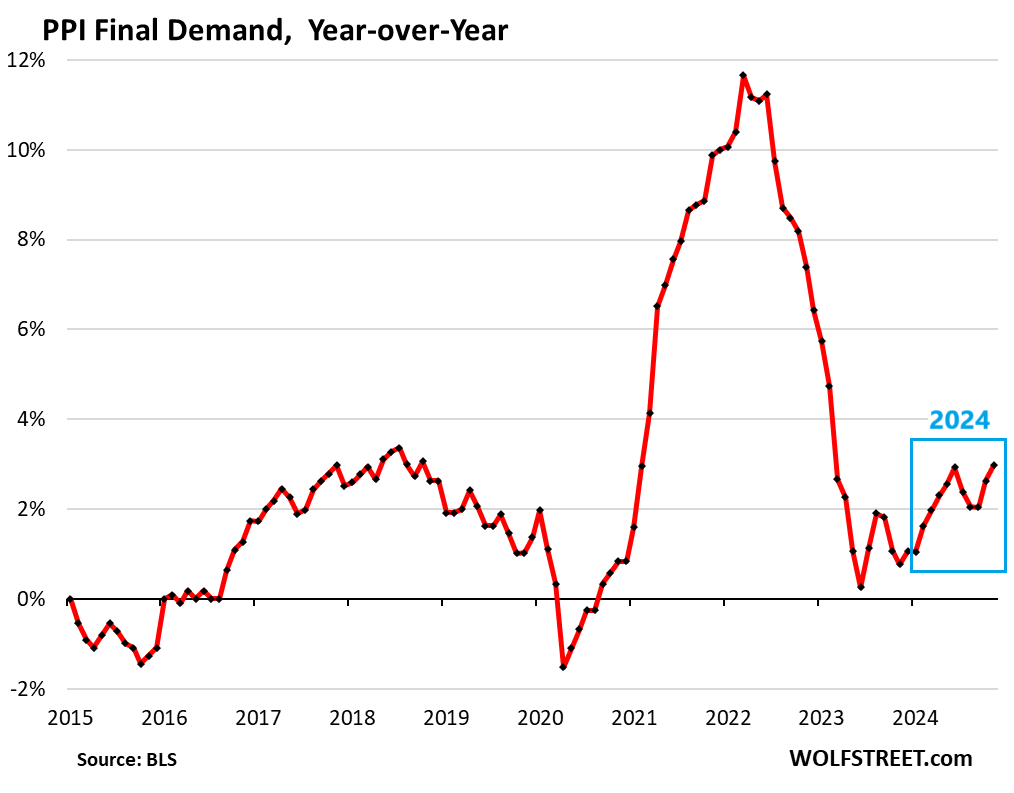

The Producer Price Index (PPI) has undergone a significant transformation, particularly within the services sector, which constitutes 67% of the overall index. Recent revisions to prior months’ data have shown substantial upward adjustments, particularly in the services PPI, suggesting a broader inflationary trend that has evolved over the past year. This upward revision, combined with notable price increases in November, indicates a re-acceleration in inflation that is much more pronounced than previously reported. As a result, the year-over-year increase in the overall PPI for final demand reached 3.0% in November, marking the most significant leap since February 2023. This stark acceleration, up from 2.4% in October and a meager 1.8% in September, reflects a concerning shift in inflation dynamics.

In examining the monthly variations, the PPI experienced a 0.38% rise from October to November, suggesting that even these upwardly revised price levels may alter again in the following months. One influential factor was the sudden increase in energy prices after a significant drop between mid-2022 and late 2023, which had previously masked the inflationary pressures emanating from the services sector. As energy and food prices surged in November alongside other goods, the correlation between rising services prices and overall inflation became evident. This indicates that the market corrections, previously anticipated as temporary, are solidifying into a broader inflationary pattern that could potentially unsettle economic stability heading into 2024.

The Core PPI, which strips out volatile food and energy prices, also showed signs of acceleration. It increased to 3.4% year-over-year, the highest since early 2023, with upward revisions from the original reported figures of 3.1% in October and 2.8% in September. This uptick signifies that fundamental inflation pressures are not limited to energy and food but are prevalent across various sectors. The month-to-month increase of 0.22% in Core PPI from October to November further underscores these persistent inflationary trends, suggesting that a de-escalation from the inflationary pressures faced earlier is not imminent.

The Services PPI for final demand, which represents a significant portion of the overall index, recorded a 3.9% year-over-year increase in November, also hitting its highest point since February 2023. This indicates that inflation within the services sector has not only accelerated but has been retroactively adjusted to reveal an even more dire landscape than previously recognized. Notably, the previous months’ readings were revised to reflect greater annualized increases, with substantial upward revisions reported since July. This escalation underscores the persistence of inflation in services and raises alarms about potential impacts on consumer spending and corporate pricing strategies.

Meanwhile, the finished core goods PPI has been relatively stable, albeit with some indicators of slight acceleration in recent months. While it rose to 2.5% year-over-year in November—marking an increase from 2.4% in October—it remains a niche contributor to the broader inflation narrative, as prices within this segment have not fluctuated dramatically. Year-over-year increases have placed finished core goods within the upper echelons of pre-pandemic price ranges. Despite this, the stabilization in core goods could suggest a concerning transition as inflation begins to navigate into more sustained territories, potentially complicating consumer price expectations and discretionary spending.

In summary, the PPI data reveal a shifting inflation landscape where traditional deflationary measures, particularly those related to energy, appear to be waning. As upward revisions highlight persistent inflationary trends primarily driven by the services sector, the implications for the economy moving forward become more complex. The return to rising inflation rates aligns with broader economic indicators suggesting a robust, albeit volatile, market environment. Addressing these inflationary pressures will be crucial for policymakers as well as businesses navigating the intricacies of pricing, consumer behavior, and overall economic stability in the anticipated inflationarily charged landscape of 2024.