Peter Tchir, writing for Academy Securities, presents a nuanced analysis of the contrasting Labor Reports recently released, particularly contrasting the Establishment Survey and the ADP report. The Establishment Survey indicated a robust addition of 227,000 jobs, including upward revisions of the previous two months by 56,000 jobs, reflecting a stronger job market than the ADP’s figure of only 146,000 new jobs. The discrepancy between these two numbers raises questions about the reliability of labor market indicators, as the ADP report faced significant downward revisions from the previous month. However, while the Establishment Survey paints a positive picture of job growth, the unemployment rate conversely increased from 4.1% to 4.2%, which indicates a complex landscape of job creation and market dynamics.

Delving deeper into the unemployment rate, Tchir highlights that its increase correlates with a drop in labor force participation from 62.6% to 62.5%, ultimately representing an effective rise of around 0.2%. This increase is informed by the Household Survey, which reported a significant loss of 355,000 jobs alongside prior losses of 368,000 jobs. Notably, both full-time and part-time employment within this sector diminished, suggesting potential underlying issues within the job market that extend beyond the positive figures of the Establishment Survey. Tchir emphasizes that the margin for error in the Household Survey is wider, complicating its interpretation and leading to uncertainties about the employment landscape, particularly when viewed against the more stable and precise Establishment Survey.

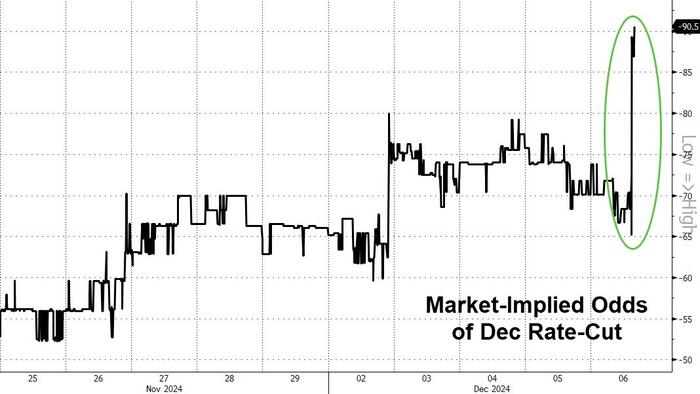

Despite the potential for misinterpretation, several indicators within the labor report suggest relative strengths, like slightly higher-than-expected earnings and stable hours worked, which slightly increased after revisions to previous data. Moreover, the birth/death model impact diminished significantly from 368,000 last month to just 5,000 this month, hinting that reported job figures are likely more accurate. These data points provide a foundation for Tchir’s perspective that might lead to action from the Federal Reserve at its next meeting, believing a 25 basis point cut is imminent but emphasizing that any further commitments will require clear validation of economic conditions.

Tchir anticipates that the Federal Reserve will remain cautious and data-dependent, with the unemployment rate serving as a focal point for vigilance amidst contrasting job growth signals from the ADP and Establishment Surveys. He notes that while inflation hints may be supported by slight wage increases and companies stockpiling ahead of anticipated tariffs, the overall economic indicators present a mixed picture that may inhibit clear-cut monetary policy responses. It implies that the Fed may find themselves in a holding pattern, monitoring for more definitive trends arising from upcoming data releases rather than rushing into additional cuts.

The potential implications for the bond market suggest a likelihood of rising yields due to the unevenness observed within the labor reports and the balancing act the Fed must perform. Tchir assumes that the recent volatility might be stabilizing, purporting a lull in stock prices driven largely by excitement and speculation rather than solid financial groundings. He perceives that in the absence of new, compelling news from political figures, particularly regarding upcoming negotiations or policy shifts initiated by President Elect Trump, the market’s current euphoria could fade without strong fiscal data to guide trading sentiments.

Reflecting on personal insights gained during his recent trip to London, Tchir notes the importance of conventional discussions and the diversity of economic perspectives regarding the observed conundrums. His experience traveling and communicating with different financial circles appears to underscore the need for adaptability and vigilance in understanding global financial environments. Ultimately, Tchir argues that the mixed bag of employment data and the resultant uncertainties necessitate tempered optimism in the markets, advocating for careful navigation of the evolving economic landscape that intertwines domestic job reports with international factors and policies.