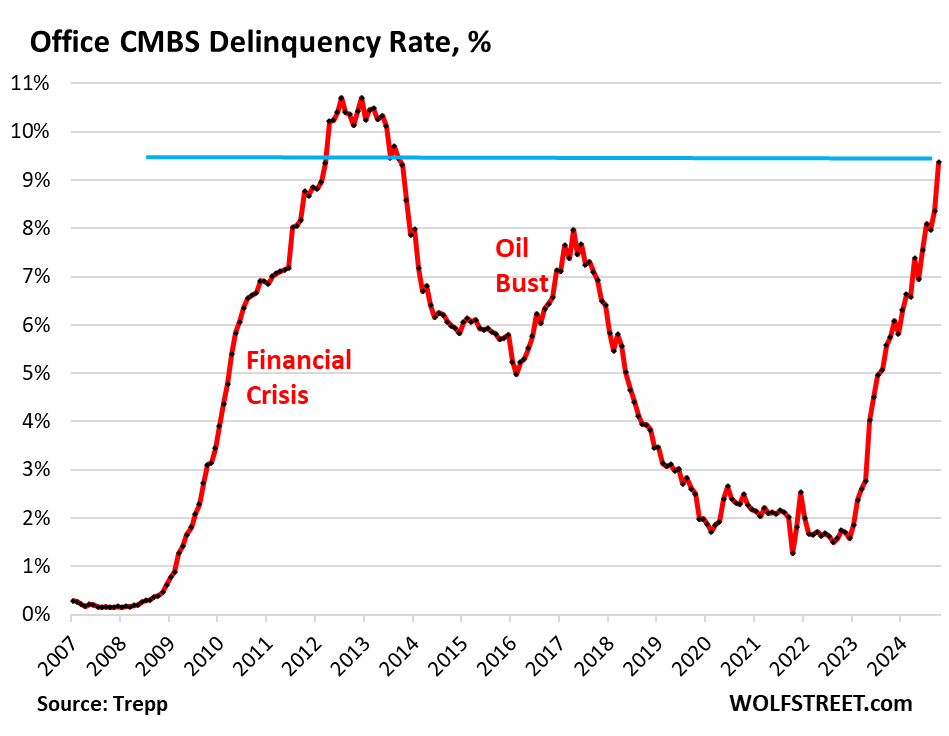

The commercial real estate (CRE) office sector is currently experiencing a significant downturn, likened to a depression that has persisted for approximately two years. The values of older office buildings have plummeted by staggering percentages—commonly between 50% to 70%—with many selling for merely land value due to their lack of appeal and occupancy. This troubling trend is most evident in major urban areas like Manhattan. The ramifications of this downturn are severe enough that landlords are struggling to generate sufficient rental income to meet their mortgage obligations, leading to an increase in defaults. The delinquency rate for office mortgages, especially those backed by commercial mortgage-backed securities (CMBS), has surged to alarming levels, indicating a growing crisis in the sector.

Despite some industry fund managers asserting that the office CRE sector has reached its lowest point, the empirical data surrounding delinquency rates tells a different story. As of October, the delinquency rate rose to 9.4%, marking a concerning increase from 4.5% just a few months prior. This spike is even more pronounced than the surge in delinquencies seen during the oil-related collapse between 2014 and 2016. The current situation reveals more than just a cyclical downturn; it marks a significant structural change in the market driven by an oversupply of office space coupled with changing work environments post-pandemic. Companies, having realized they no longer need the extensive office spaces initially reserved in anticipation of growth, are now left with vast vacancies, creating a perfect storm for the sector.

The classification of mortgages as delinquent hinges on whether borrowers make timely interest payments, with growing numbers now failing to meet these obligations. The effects of rising delinquencies are evident as lenders and CMBS holders are confronted with substantial losses. Solutions typically involve either foreclosure, which is detrimental to all parties involved, or negotiations to modify loans, yet these avenues have become less tenable under current economic conditions. The office market’s issues, particularly for older buildings that have devalued significantly, are raising doubts about the viability of these emergency solutions.

Many in the CRE industry are now adopting a “survive till 2025” strategy, pinning their hopes on potential Federal Reserve interest rate cuts. In September, the Fed reduced its policy rate by 50 basis points, fueling optimism that additional cuts may follow, thus alleviating floating-rate mortgage burdens for landlords. However, this perspective neglects the underlying issues plaguing the office sector. Even with lower interest payments, landlords of largely vacant older office towers will struggle to meet their obligations if there are no tenants willing to occupy those spaces, diminishing the prospect for recovery that the industry is banking on.

The reliance on prospective rate cuts as a remedy also ignores the fact that most real estate loans are tied to short-term rates, which are influenced by the Fed’s actions. Meanwhile, fixed-rate mortgage rates have responded to the Fed’s prior policies by rising sharply, further complicating the financing landscape for CRE. The hope remains that a substantial decline will take place, allowing struggling landlords some financial relief; however, the reality of persistent high vacancy rates dilutes these optimistic projections.

In conclusion, the office space market faces a dual crisis of immediate financial duress and long-term structural challenges that are unlikely to be resolved simply by reducing interest rates. The prevalent vacancies, particularly in older buildings, coupled with tenant flight towards more modern spaces, underscore a need for significant change in how real estate is managed and valued. As landlords and investors navigate this tumultuous landscape, they must confront the stark reality that the hope of an inevitable recovery by 2025 may be more aspirational than achievable without substantial industry overhauls and innovative solutions to adapt to changing demands.