Nvidia’s stock has recently experienced a notable downturn, dipping 17% from its record high of $152.89 on November 21, edging ever closer to bear market territory, typically defined as a 20% decline. The sell-off gained momentum following remarks by Microsoft’s CEO Satya Nadella, who indicated that the frenzy over AI chip demand may be diminishing. His comments suggested that while Microsoft has experienced power constraints regarding AI build-outs, it’s not exactly facing hurdles in terms of chip supply. This news has been unsettling for investors, particularly since Microsoft is estimated to be responsible for about 20% of Nvidia’s revenue.

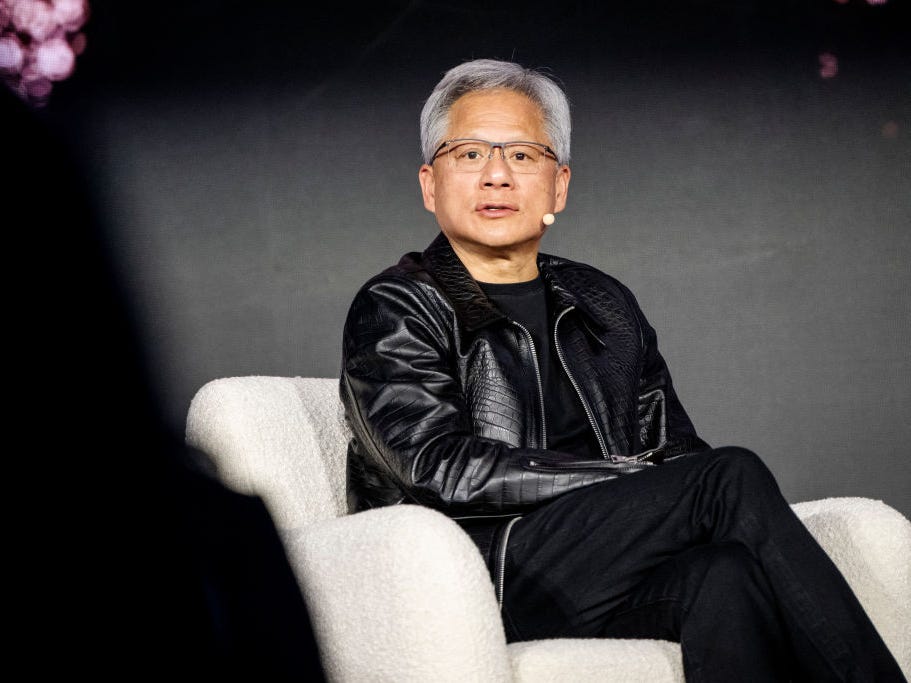

The landscape of AI demand appears to be shifting. Over the past two years, there has been overwhelming demand for Nvidia’s GPUs as companies have raced to create large language models. Reports have highlighted that Nvidia faced a situation where it had to prioritize which clients received chips, with even billionaire tech entrepreneurs appealing directly to CEO Jensen Huang for additional supplies. However, Nadella’s insights imply that supply may finally be catching up with demand rather than indicating a drop in the market for Nvidia’s main products. Despite the upbeat projections concerning Nvidia’s next-generation Blackwell GPU, which reportedly has a backlog of at least a year for new orders, investor sentiment may be dampened by expectations of waning demand.

Further complicating the outlook is commentary from other prominent figures in the AI industry. Alphabet’s CEO Sundar Pichai noted that as AI models evolve, significant progress is likely to become more difficult, citing that the rapid advancements of which the tech world has grown accustomed — fueled by scalable compute resources — may face limits. Ilya Sutskever, cofounder of OpenAI, echoed similar sentiments by suggesting we’ve reached ‘peak data’ in AI development, implying that achieving artificial general intelligence may take longer than originally anticipated. This collective signaling from tech leaders that the halcyon days of explosive AI growth may be behind us has fueled investor uncertainty.

Moreover, recent performance by other semiconductor companies, particularly Broadcom, is influencing market dynamics. Broadcom’s impressive fourth-quarter earnings, signaling growth in their AI business, have led to a potential shift in investor focus from established AI frontrunners like Nvidia to companies perceived as emerging beneficiaries in the sector. Dan Ives from Wedbush pointed out that many market participants are beginning to explore these secondary players in the AI revolution while pulling back from Nvidia shares.

Ives, however, remains optimistic about Nvidia’s prospects, viewing its recent stock decline as an opportunity for investors to enter at a lower price point. He categorizes the current phase as a temporary digestion period that he anticipates won’t last long, asserting that Nvidia continues to hold its position as a premier player in the AI space. He insists that CEO Jensen Huang’s leadership and strategic vision make Nvidia a scalable solution provider for the impending technological advancements of the fourth Industrial Revolution, with promising potential leading into 2025.

In summary, while Nvidia experiences pressures from declining stock prices amid changing narratives surrounding AI demand, the fundamentals underpinning its business remain robust according to some analysts. The challenges painted by industry executives signify a temporary inflection point rather than a long-term decline, prompting some market observers to advocate for a cautious investment strategy offering potential rewards as the broader AI landscape evolves.