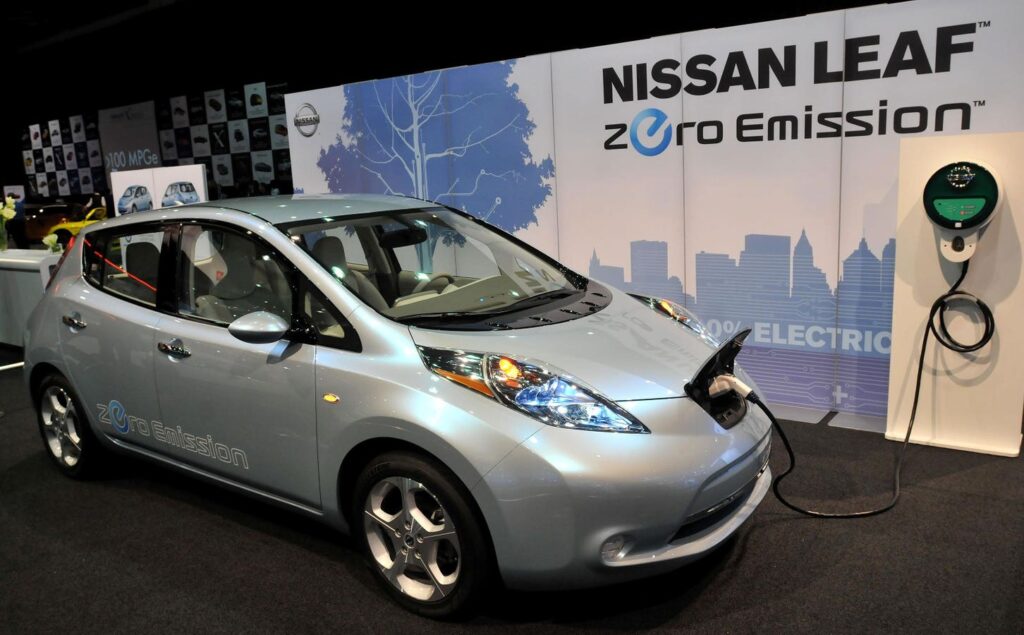

At the recent Detroit Auto Show, Nissan unveiled a prototype of its Leaf electric car, underscoring its long-standing role as an early leader in the electric vehicle (EV) sector. However, the competitive landscape in the automotive industry is shifting dramatically, particularly as companies that have lagged in electrification grapple with increased pressure from global operations and more advanced competitors. The auto industry is witnessing a wave of consolidation among manufacturers struggling to adapt to the transition to electromobility, driven largely by the leadership of Chinese firms in technology and EV production. This competition is causing even established leaders, such as those in Germany, to reevaluate their strategies as they face existential challenges posed by the rapidly changing market.

One of the most notable discussions currently is between Nissan and Honda, two companies that have come under fire for their slower transition to electric vehicles and software-defined cars. According to Professor Stefan Bratzel, director of Germany’s Center of Automotive Management, this potential alliance is part of a necessary consolidation of players that have fallen behind the electromobility race. Both Nissan and Honda are viewed as laggards in embracing this wave of innovation, leaving uncertain their ability to successfully transition along with the industry.

The ongoing dialogue between the two companies includes the prospect of forming a merger that could create a collective automotive force with annual sales approaching 7.5 million vehicles, propelling it to become the world’s third-largest automotive manufacturer, trailing only Toyota and Volkswagen. Alongside these discussions, whispers of Taiwan’s Foxconn potentially seeking a controlling stake in Nissan highlight a broader interest in restructuring the automotive landscape. Earlier this year, Nissan and Honda’s respective CEOs announced a partnership aimed at developing electric vehicles to better compete with both established players like Tesla and emerging Chinese firms, particularly BYD.

Further complicating matters, Nissan is dealing with its corporate relationships, including a significant stake in Mitsubishi and a partnership with Renault, which is now reconsidering its long-term alliance with Nissan. Recent financial troubles have prompted Nissan to announce a global cost-saving plan that includes job cuts. As Nissan contemplates a closer alliance with Honda, such a move would not only offer an opportunity to increase competitiveness against Toyota domestically but could also support Renault in distancing itself from its troubled investment in Nissan, as reported by the Financial Times.

Market analysts are cautiously optimistic, suggesting that a merger between Honda and Nissan could create opportunities for improved profit margins, despite cautionary tales such as Stellantis, which has faced considerable challenges despite similar consolidations. A successful merger would ideally allow the companies the time to streamline expenses while enhancing their lackluster electric and hybrid offerings. Analysts have highlighted the importance of not merely focusing on consolidation, as history indicates that partnerships alone won’t guarantee the creation of successful automotive brands unless they prioritize the production of vehicles that resonate with consumers at competitive prices.

Investment research suggests that a union between Honda and Nissan, alongside Mitsubishi, could breed a formidable global enterprise with a combined output of around 8 million units annually. This consolidation would not only simplify the Japanese automotive market into approximately two major entities but would also enhance the companies’ ability to invest in critical areas such as electric vehicles, autonomous technology, and software development. Analysts warn, however, that the shift might lead to difficulties for manufacturers unable to keep up financially with the costs associated with these advancements, echoing concerns seen recently in Europe with Volkswagen and Renault struggling to maintain their competitiveness amid rising demands for innovation in the electric vehicle landscape. Ultimately, the question remains: can a merger between two underperforming players result in a competitive advantage against more established leaders in the evolving automotive market?