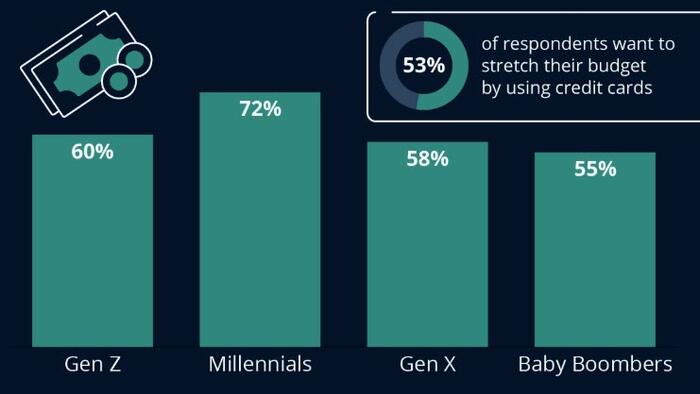

Millennials are leading the way in adopting credit financing options like credit cards and Buy Now, Pay Later (BNPL) schemes for their Black Friday and Cyber Monday shopping in 2024, according to a Deloitte consumer survey. This trend contrasts sharply with Baby Boomers, where only 55% are likely to utilize these options for maximizing discounts. The survey highlights the generational divide in shopping habits, with Millennials showing a stronger propensity to leverage flexible payment methods. Notably, credit cards emerged as the most widely used financing option, favored by 53% of respondents. This indicates a clear inclination towards more immediate yet perhaps more financially risky purchasing behaviors among younger shoppers.

Despite the increasing reliance on credit and BNPL methods, the survey suggests that overall consumer spending is set to rise, with the average amount expected to reach $650 from Thanksgiving through Cyber Monday. This projection remains resilient even amid ongoing global challenges such as the COVID-19 pandemic and geopolitical conflicts like the war in Ukraine, which have adversely affected economic stability. Since 2019, the trend in consumer spending has maintained a consistent compound annual growth rate of nearly ten percent, illustrating an enduring willingness among consumers to engage in holiday shopping, despite financial pressures.

The burgeoning popularity of credit cards and BNPL options reflects broader shifts in consumer behavior. In 2022, credit card transactions in the U.S. exceeded 50 billion, underscoring their prevalence in purchasing decisions. Meanwhile, BNPL schemes, although newer to the market, have gained traction, with a notable increase in their share of domestic e-commerce payments—from 2% in 2020 to 5% in 2024. This accelerating growth demonstrates the shifting landscape of payment methods as consumers seek more flexible financing solutions to manage their budgets while capitalizing on seasonal sales.

Globally, the interest in BNPL is particularly pronounced in select countries, such as Sweden, Germany, and Norway. In these nations, BNPL accounted for substantial shares of e-commerce purchases, reaching 21% in both Sweden and Germany, and 15% in Norway. Sweden’s prominence in the BNPL domain can be traced back to the establishment of Klarna in 2005, which has significantly shaped consumer payment preferences in the region. This trend is reflective of a broader global movement towards alternative payment methods that cater to consumer demands for convenience and flexibility.

The implications of the survey findings indicate potential risks and rewards for both consumers and retailers. For consumers, the reliance on credit and BNPL might lead to increased debt levels if not managed carefully. Retailers, on the other hand, can benefit from heightened consumer spending, particularly during peak shopping events like Black Friday and Cyber Monday. However, they must also navigate the challenges that come with rising credit dependency, including the potential for increased returns or cancellations as consumers manage their finances in the aftermath of hefty purchases.

In conclusion, the shift towards credit cards and BNPL schemes, particularly among Millennials, highlights evolving consumer behavior in the face of economic uncertainties. The projected increase in spending during key shopping periods, despite ongoing global challenges, signals a robust consumer appetite for holiday shopping. With alternative payment methods gaining traction and reshaping the retail landscape, both consumers and retailers must adapt to these changes and carefully consider the financial implications involved. As holiday spending continues to grow, understanding these dynamics will be crucial for navigating future consumer trends and ensuring sustainable financial practices.