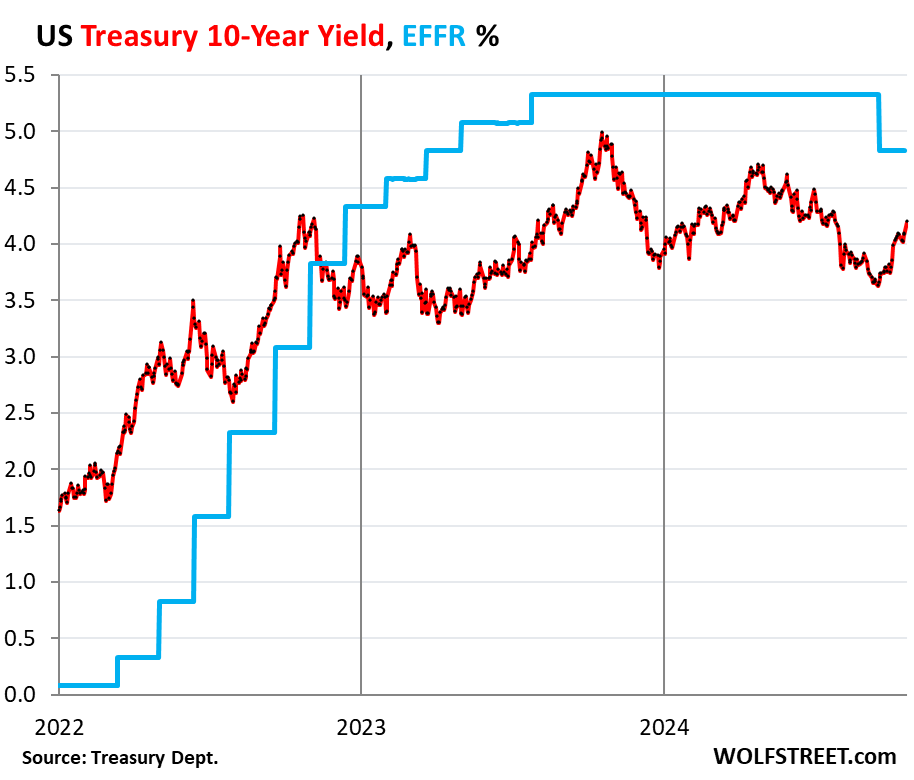

The recent surge in the 10-year Treasury yield, which rose around 12 basis points to reach 4.20%, has unsettled predictions regarding lower mortgage rates in the housing market. This yield, the highest since late July, has seen a significant increase from a low of 3.65% recorded just before the anticipated major rate cut by the Federal Reserve. Influences behind this rise include hawkish statements from key Fed officials, increased concerns regarding inflation, and apprehensions surrounding the escalating national debt, which could result in greater supply issues in the bond market. Consequently, bondholders are facing what can be termed as the “triple enemies” of their investments: Quantitative Tightening (QT), inflation, and increased debt supply.

In immediate effect, the jump in Treasury yields has caused a consequential spike in mortgage rates. The average 30-year fixed mortgage rate jumped 14 basis points to 6.82%, marking the highest rate since July and an increase of 71 basis points from before the rate cut announcement. Before the Fed’s decision which included a 50-basis point cut, mortgage rates had fallen from their peak the previous October, but now they are quickly climbing again as inflation continues to rise month-over-month. The initial optimism has begun to fade as market conditions evolve, leading to a reassessment of the previously exuberant outlook on mortgage rates and housing demand.

Adding to this complexity, the yield curve has started to un-invert, as reflected by the 30-year Treasury yield rising to 4.50%, thereby matching the 6-month yield. This dynamic, where typically the longer-term yields are higher than their short-term counterparts, signals a significant market shift. The inversion observed in July 2022, when the short-term yields surpassed long-term ones due to aggressive rate hikes, has now reversed, further complicating the expectations for real estate investors who believed lower mortgage rates would follow the Fed’s cuts.

Real estate professionals are now grappling with the implications of this un-inverted yield curve and rising mortgage rates, which contradict their previous assumptions about the relationship between Fed rate cuts and long-term borrowing costs. They had anticipated the yield curve to normalize through a phase of substantial rate reductions leading to a decrease in mortgage rates, yet they are finding that along with easier monetary policy, inflation fears and mounting government debt are pushing yields higher.

The reaction in the Treasury market reflects the shifting expectations around continued rate cuts. The 1-year yield, for example, has seen a noticeable increase to 4.25% as market sentiments pivot away from expecting further substantial cuts. Meanwhile, the short-term yields have reacted to rate cut expectations while long-term yields have climbed, depicting a challenging environment for bondholders and those reliant on mortgage financing.

Lastly, the yield fluctuations of the 2-year and 10-year Treasury yields have further illustrated the market’s volatility. The 2-year yield recently rose to 4.04%, the highest it has been since mid-August, solidifying the trend of rising yields. The interplay between these bonds and their reactions to the Fed’s monetary policies indicate that market participants are continuously reassessing their strategies and expectations based on evolving economic signals. The previously held hopes for strong recovery in the housing market are now met with skepticism as mortgage rates fluctuate and inflation concerns loom large.