In the ever-changing landscape of financial markets, events such as elections, central-bank rate adjustments, and geopolitical conflicts have made it essential for investors to adopt strategies that offer more predictable returns. Traditional investing approaches have been challenged by the volatility and unpredictability brought forth by these global events. As a result, many market participants—from retail traders to sophisticated hedge funds—are exploring new options to manage risk and enhance potential payoffs. A notable trend has emerged: the use of zero-day-to-expiry (0DTE) listed options, which allow traders to make rapid, short-term bets on market movements.

The surge in popularity of these 0DTE options is driven by the need for immediate responses to market fluctuations. This trading strategy enables participants to capitalize on quick changes in asset prices as they approach expiration. Retail traders have found these options particularly appealing because of their lower cost and the potential for high returns within a short time frame. However, this strategy is not without its risks, as the rapid expiration means there is little room for recovery should trades go against them. Nevertheless, their accessibility and the allure of quick profits have made 0DTE options a favored tool in today’s market environment.

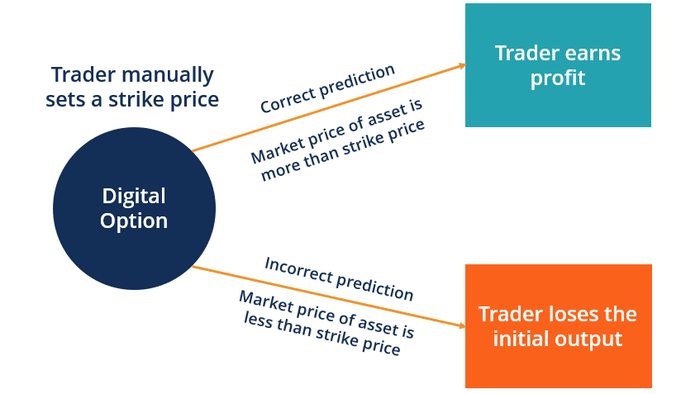

Moreover, while retail trading volumes in 0DTE options have increased, institutional investors are leaning towards over-the-counter (OTC) binary contracts to hedge against tail risks. Unlike traditional options, binary options provide a fixed payoff based on a yes/no proposition at expiration—essentially allowing investors to insure against extreme market moves. These contracts enable large investors to effectively manage risk across various asset classes and enhance their investment strategies by offering defined payoffs. The customization available in OTC contracts gives institutional players flexibility to tailor their risk profile according to their market outlook.

The rise of these binary contracts reflects a broader trend among institutional investors to be proactive in addressing tail risks. As markets become more unpredictable, large investors recognize the importance of preparing for worst-case scenarios. By utilizing these contracts, they can safeguard their portfolios against significant adverse movements, which are often exacerbated during times of geopolitical uncertainty or economic stress. This strategic focus on tail risk hedging underscores a growing awareness within investment communities of the need to enhance resilience in uncertain environments.

Furthermore, the growing popularity of 0DTE options and OTC binary contracts indicates a shift towards more sophisticated and innovative trading strategies. Investors are increasingly relying on data analytics and technology to inform their trading decisions, with many using algorithmic trading to take advantage of short-term market movements. This reliance on technology makes it possible for traders to respond to market changes with extraordinary speed, potentially increasing their chances of profiting in volatile settings. However, the fast-paced nature of these strategies also raises concerns about market stability, particularly in the face of systemic risks.

In summary, the increasing frequency of events that disrupt market stability has prompted investors to seek out more defined payoff structures such as 0DTE options and OTC binary contracts. While these strategies present opportunities for rapid profits and effective risk management, they also require careful consideration of the associated risks. The juxtaposition of retail and institutional approaches to these financial instruments reflects the broader changes in investor behavior and underscores the need for adaptive strategies in a rapidly evolving market landscape. As the market continues to face uncertainties, the balance between risk and reward will remain a primary focus for investors looking to navigate through turbulent times successfully.