Lululemon Athletica Inc. presents an intriguing near-term investment opportunity, primarily due to its current undervaluation and the growth potential within the Chinese market. Following a period of heightened expectations, Lululemon’s growth rates have shown signs of slowing, prompting a reevaluation of its market position. The company’s ability to pivot towards expanding its footprint in China, where it has already seen notable revenue increases, could serve as a catalyst for a valuation rerating. Despite ongoing concerns regarding its reliance on the U.S. market and execution risks in China, the firm’s strong operational foundations and innovative marketing strategies make it a contender for generating alpha over the next few years. The management team’s strategic vision will be crucial in exceeding the market’s current expectation of 8% annual revenue growth.

Lululemon’s business model is distinguished by its vertical integration, encompassing design, manufacturing, and retail, with over 700 stores worldwide and a burgeoning focus on online sales. The brand has cultivated a loyal customer base through its unique marketing approach, leveraging local fitness ambassadors and organizing community events. Recently, the company experienced significant sales growth in China, marking a 34% increase year-over-year in Q2 2024, an impressive expansion from just 10 stores in 2018 to over 130 stores. Conversely, U.S. revenue has stagnated, growing only 1% year-over-year during the same period. As Lululemon continues to capitalize on its 2% market share in China, there lies an opportunity for substantial revenue gains relative to its current scale in the region. As the firm seeks to diminish its dependence on U.S. revenues, successfully executing this transition will be vital.

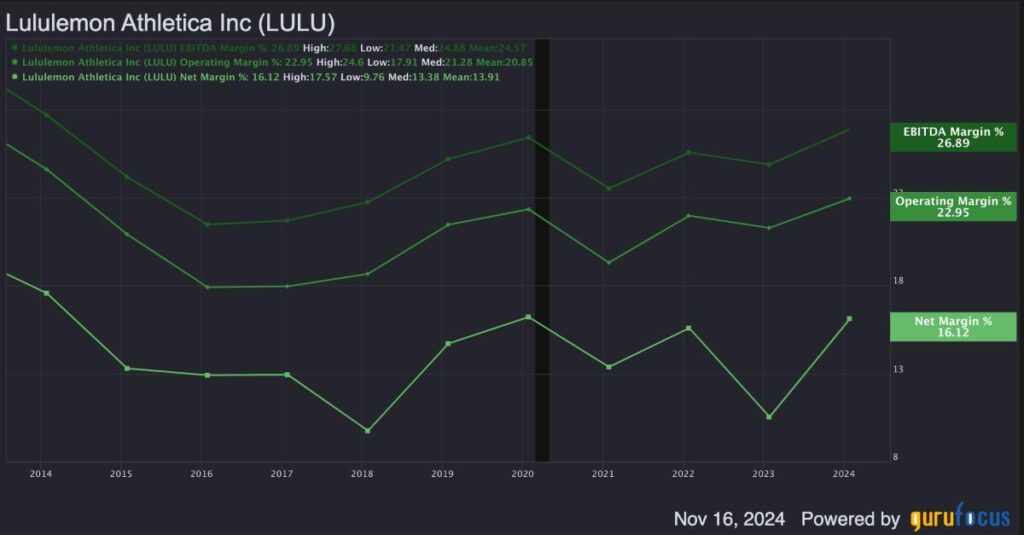

From a valuation perspective, Lululemon is currently positioned well against its competitors, boasting solid EBITDA growth amidst a general industry slowdown. Lululemon’s EV-to-EBITDA ratio stands at 14.5, marking a significant discount compared to its 10-year median of 22, indicating that current growth expectations may not accurately reflect the company’s potential. Analysts forecast Lululemon’s revenue to reach approximately $12.5 billion by January 2027, with an expected EBITDA of about $3.31 billion. Discounting the expected future enterprise value back to the present, the calculated intrinsic enterprise value is $48.09 billion, supporting an 18.61% margin of safety. This valuation reflects a compelling investment landscape where Lululemon could achieve a compound annual growth rate (CAGR) of nearly 19.85% over the next two years.

However, several risks could hinder this growth thesis. The primary concern is that the market may resist rerating Lululemon’s EV-to-EBITDA multiple unless tangible improvement in growth is demonstrated moving into 2028 and beyond. This apprehension could limit upside potential. Additionally, despite China’s promising growth opportunities, ongoing geopolitical tensions, and economic shifts could pose challenges to the company’s premium pricing strategies. For example, potential tariff policies could restrict profit margins, and consumer sentiment shifts may affect demand for higher-end athletic gear. Another risk factor involves Lululemon’s reliance on efficient management execution. Previous missteps, such as the unsuccessful acquisition of Mirror, underscore the importance of strategic focus on core competencies rather than diverging into uncertain ventures.

The upcoming Q3 2024 earnings announcement, scheduled for November 29, adds a layer of anticipation for investors. Expectations are for a normalized earnings per share (EPS) of $2.72, reflecting a year-over-year growth rate of 7.66%. Revenue estimates are pegged at $2.36 billion, showing a slight quarter-over-quarter decline but suggesting continuity of performance given prior trends of beating consensus estimates. A primary focus will likely be on management’s insights regarding growth in China and efforts to reinvigorate its women’s product offerings, particularly after a reported 3% decline in U.S. comparable-store sales attributed to product decision limitations. Stakeholders are eager to hear about strategies around product novelty and seasonal updates to drive increased sales momentum by spring 2025.

In summary, Lululemon represents a compelling investment consideration at this juncture due to its attractive valuation metrics and growth potential, particularly in the Chinese market. While there are inherent risks associated with execution and market dynamics, the prospect of achieving a 19.85% CAGR and maintaining an 18.61% margin of safety makes it an appealing candidate for those seeking short to medium-term returns. The company is well-positioned to leverage its operational strengths and market opportunities, particularly if it navigates the challenges across its core markets effectively. Overall, investors should monitor Lululemon closely as it aims to optimize growth strategies and reinforce its position in a competitive landscape.