In October, the labor market displayed a significant resurgence, according to the Job Openings and Labor Turnover Survey (JOLTS) data from the Bureau of Labor Statistics. This rebound comes in the face of challenges, including a prolonged strike at Boeing and various hurricane impacts, which had affected job ratings for the month. Despite these setbacks that lowered payroll figures, analysts anticipate a notable recovery in the next jobs report. October’s figures reveal an interesting turnaround, suggesting a tightening labor market is emerging, countering the earlier trends of caution seen in the economy.

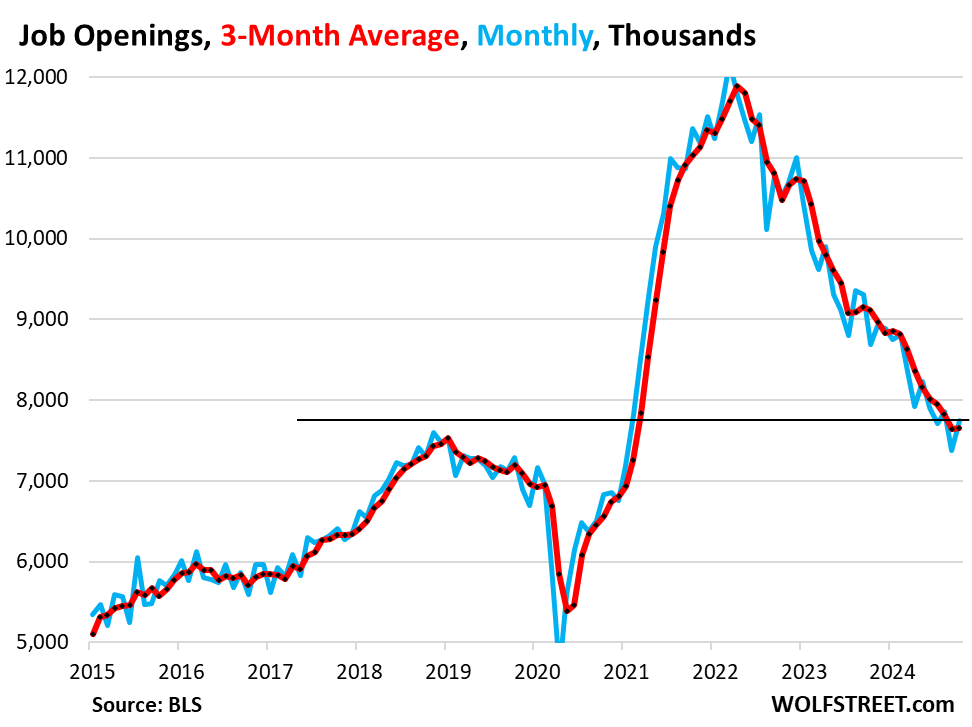

October witnessed a remarkable increase in job openings, with a rise of 372,000, reaching 7.74 million, marking the highest number since August 2023. This climb reflects renewed demand for labor, also appearing above pre-pandemic benchmarks. Notably, the number of unfilled positions exceeded the number of unemployed individuals searching for work, signaling a competitive environment for hiring. The three-month moving average for job openings also rose to 7.66 million, highlighting a consistent trend upward, contrary to the mass churn observed during the previous two years.

Voluntary quits experienced a significant uptick as well, spiking by 228,000 to 3.33 million, representing the highest level since May 2023. This increase suggests an encouraging sign of worker confidence in the labor market. While fewer quits typically indicate lower employee turnover, which is favorable for employers seeking stability, this recent surge may point to regained trust among workers in their ability to search for better opportunities. A continued pattern of rising quits could indicate a revitalized labor market where employees feel less constrained and more optimistic about making changes for advancement or better conditions.

The data also revealed a drastic reduction in layoffs and discharges, plunging by 169,000 in October to 1.63 million, the lowest since June. This trend indicates that organizations are retaining their workforce, contributing to lower turnover rates. The layoff rate as a percentage of nonfarm payrolls is now at 1.03%, suggesting that companies are maintaining their staff levels in the current economic climate. Historically low figures in these layoffs underscore employers’ strategic maneuvers to hold onto skilled workers amidst an evolving labor landscape, further indicating a potential shift in workforce stability.

Despite the positive developments in job openings and layoffs, the hiring rate saw a decline of 269,000, totaling 5.31 million transactions for the month. Though the hiring rate has decreased, it remains significant in the context of filling roles left vacant by quits or discharges. With a three-month average of 5.44 million hires, efforts to fill positions indicate employers are still actively recruiting, albeit at a reduced pace. This trend aligns with the overall labor market transition, where fewer immediate openings compel a recalibration of hiring strategies.

In summary, October’s JOLTS data illustrates a labor market undergoing noteworthy changes, characterized by increased job openings and a dramatic drop in layoffs. The rise in voluntary quits signals a shift in worker confidence, suggesting that employees are considering their options more favorably. These trends together may serve as indicators of a labor market poised for recovery, hinting at declining economic fears and a newfound vigor among the workforce. As the Federal Reserve continues to monitor these developments, these metrics not only provide insights into current labor dynamics but also shape future economic policies and decisions regarding interest rates and employment strategies.