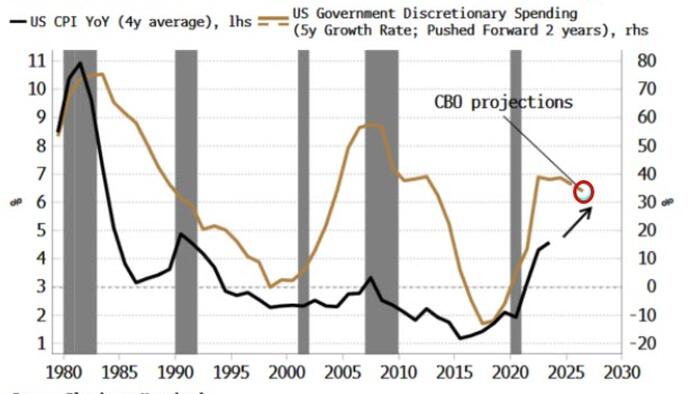

In the current economic climate, TIPS (Treasury Inflation-Protected Securities) are viewed by Simon White, a macro strategist at Bloomberg, as an undervalued asset in the face of rising inflation risks in the U.S. The persistent inflationary pressures are being driven not by consumer excess, but rather by expansive government spending. This perspective highlights a disconnect between market pricing and fundamental economic realities, suggesting that TIPS offer a compelling opportunity for investors seeking to hedge against potential inflationary surges.

White argues that the prevailing sentiment in the market underestimates the likelihood and intensity of inflation in the near future. As the government continues to inject significant capital into the economy, the inflationary effect is becoming more pronounced. Fiscal policies and stimulus measures contribute to rising price levels, indicating that current inflation is not merely a temporary phenomenon but likely to persist. In this context, TIPS could provide a buffer against the erosion of purchasing power as they are designed to increase in value with rising inflation rates.

Furthermore, the historical performance of TIPS suggests that they can serve as an effective hedge against inflation. The securities are indexed to the Consumer Price Index (CPI), which means their principal value rises in line with inflation increases, ensuring that investors’ returns keep pace with or exceed the rate of inflation. This attribute makes TIPS particularly attractive now, especially as expectations of inflation are beginning to materialize in consumer prices and broader economic indicators.

Despite the evident inflationary backdrop, TIPS have not seen commensurate price adjustments in the market, leading to White’s assertion that they are underpriced. This mispricing presents a unique opportunity for investors to capitalize on TIPS before the market corrects itself. As the perception of inflation becomes more pronounced in the financial markets, prices of TIPS are likely to rise, making them a timely investment for those wary of potential economic instability caused by rising costs.

Moreover, the anticipation of continued government expenditure and the ongoing recovery efforts post-pandemic will likely exacerbate inflationary pressures. As spending continues on infrastructure and social programs, demand may outpace supply, further pushing prices upwards. Consequently, investors are advised to consider TIPS as a means of safeguarding their portfolios against these inflationary risks, particularly in an environment where inflationary indicators across various sectors, such as housing, gas, and goods, are on the rise.

In conclusion, Simon White’s insights highlight the pressing need for investors to rethink their strategies in light of persistent inflation risks. By recognizing the inherent value of TIPS in this inflationary phase, investors can make informed decisions to protect their capital. As government policies continue to shape economic conditions, TIPS represent a prudent choice for hedging against inflationary trends that are likely to persist in the foreseeable future. This underscores the potential for TIPS to not only preserve but also enhance investment returns amid an increasingly volatile economic landscape.