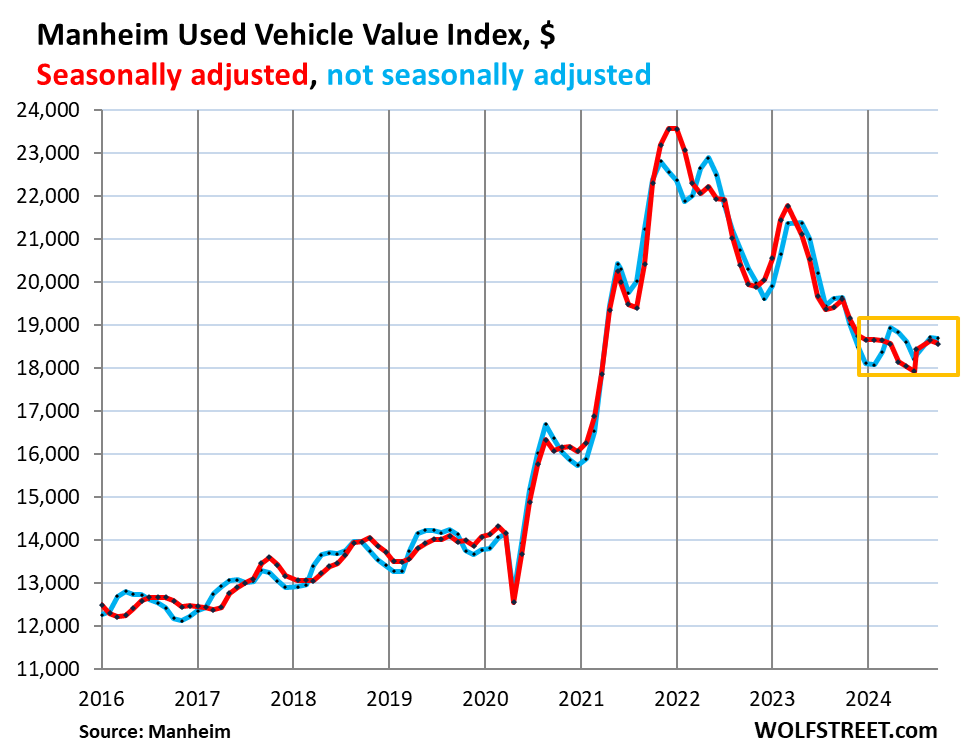

Amidst a climate characterized by tight supply and strong demand, the wholesale prices of used vehicles in the United States showed only a slight decline in September. According to the Manheim Used Vehicle Value Index, prices dipped by just $26, or 0.1%, settling at an average of $18,693 per vehicle, a minor adjustment following a $513 increase over the previous two months. This performance runs counter to the typically expected seasonal declines. Historically, the month of September sees greater price reductions; for instance, in pre-pandemic 2019, prices fell by 0.7%. The muted decline this year suggests a shift in the pricing dynamics of the used vehicle market, with forecasts indicating that future depreciation may be less dramatic than in previous years.

Year-over-year metrics reveal a 4.9% price drop, a stark contrast to the heavy declines seen earlier in 2024, marking the aftermath of heightened valuations caused by the pandemic. Over the past several months, wholesale prices have reverted to nearly half of the initial surge seen during Covid-19, hinting at a market stabilization. The persistence of elevated prices reflects supply constraints, influenced significantly by a previous downturn in leasing activity, which diminished the availability of off-lease vehicles in the market. Given that retail prices, which often lag behind wholesale trends, may also stabilize, the potential implications for consumer inflation are notable since previously plunging used vehicle prices had significantly impacted overall inflation rates.

The dealership sector continues to rely on auctions to replenish their used vehicle inventories. Supply sources primarily consist of vehicles retired from rental fleets, finance companies unloading off-lease or repossessed cars, and trade-ins from corporate and government fleets. A notable constraint has been observed in the three-year-old vehicle sector due to an ongoing scarcity of off-lease vehicles. The leasing downturn from the past few years, driven by new vehicle shortages and resultant uncertainty about residual values, has contributed to a scarcity of vehicles entering the resale market. This shortfall is expected to persist into 2025 and 2026 as the effects of these trends materialize further.

Despite these supply limitations, there remains a robust demand for used vehicles, evidenced by a September sales conversion rate of 60.3%, surpassing the typical average of 53%. This increased demand can be attributed partly to dealers striving to replenish stock amid diminished inventories. Retail inventories at the start of September were approximately 2.18 million units, showing a decline from pre-pandemic levels of between 2.8 million and 3 million. This indicates that the overall market remains constricted, with dealers motivated to source additional used vehicles from auctions as they navigate fluctuating supply dynamics.

The production slump in the new vehicle sector from 2021 to 2022 due to semiconductor shortages has had lasting repercussions on the used vehicle market. Over this period, automakers sold six million fewer new vehicles than in the pre-pandemic era, further limiting future supply. As these lost vehicles cannot be instantaneously replaced, their absence continues to affect the dynamics of the used car market. Nevertheless, retail sales of used vehicles show promising growth; preliminary figures for September indicate a 9% increase year-over-year in the number of units sold.

Evaluating the nuances between electric vehicles (EVs) and internal combustion engine (ICE) vehicles reveals distinct trends. In September, wholesale prices for EVs fell by 1.1% after having shown a 5.1% spike in the previous month, while ICE vehicles saw negligible changes from August. Overall, after experiencing dramatic price surges during the pandemic years – with EVs peaking at a 145% increase – both vehicle types have observed significant retracements, with used EV prices approximately 68% higher than January 2020 levels and ICE vehicles about 35% higher. Certain segments, such as SUVs and compact cars, experienced minor upward movements or declines, illustrating the uneven recovery trajectory in the used vehicle market. This ongoing fluctuation accentuates the complexities of a revitalizing sector still grappling with past upheavals.