This week in the financial market is marked by significant events unfolding in the U.S. economy, particularly centered around labor statistics from last Friday and an anticipated Consumer Price Index (CPI) report due on Thursday. According to Jim Reid from Deutsche Bank, the labor report exceeded expectations, with an impressive headline increase of 254,000 jobs compared to a forecast of only 150,000. The unemployment rate also saw a decline, dropping to 4.1%. However, this decrease was largely driven by a substantial influx of 785,000 jobs in government sectors, suggesting that the private sector may not be experiencing the same level of growth. This positive labor report—despite being likened to a “random number generator”—significantly reassured markets and resulted in a surge of the dollar and uptick in interest rates, notably pushing 2-year U.S. Treasury yields up by 21.6 basis points. Reid contends that the market’s earlier pricing of rate cuts was excessively pessimistic unless a recession were on the horizon.

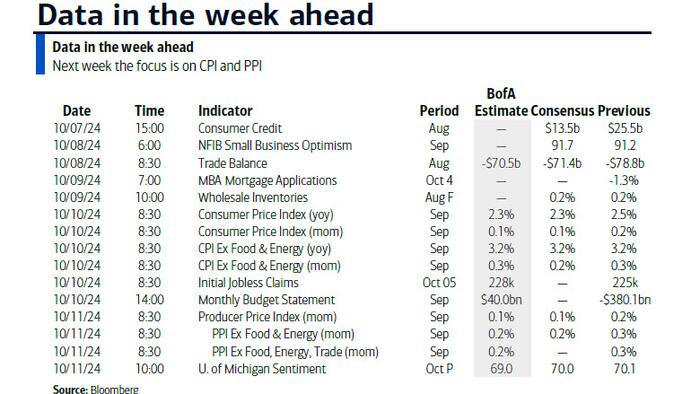

The week ahead is relatively unremarkable for U.S. economic data until the CPI report is released on Thursday, which is expected to provide insights into inflation trends. Other notable global economic indicators this week include German factory orders and Eurozone retail sales data, which were weak, alongside various reports from Japan and the ECB’s last meeting minute release. Additionally, several U.S. banks, including JPMorgan and Wells Fargo, will kick off the earnings season on Friday, with analysts anticipating slower growth in earnings for the S&P 500 in the third quarter compared to the second. The earnings reports will reflect majority performance in energy and large-cap tech sectors, while other sectors are projected to remain steady.

Regarding the CPI projections, consensus anticipates a modest increase of 0.1% for the headline CPI, down from 0.19% in the previous month, with the core CPI estimated to rise by 0.2%. It is expected that year-over-year headline CPI will decrease slightly to 2.3%, while core CPI is projected to remain steady at 3.2%. The six-month annualized core rate is forecasted to drop from 2.7% to 2.4%. A particular focus will be on rents, which have demonstrated significant strength lately. Moreover, the Producer Price Index (PPI) report scheduled for Friday is also expected to echo the CPI results, with estimates suggesting similar growth rates.

This week will also see a flurry of Federal Reserve officials scheduled to speak, providing insight into their reactions to last Friday’s robust payroll report. Although the FOMC minutes from the previous meeting, released on Wednesday, may offer stale data, they could still shed light on the Fed’s potential policy progression amid evolving economic conditions. Central bankers have indicated a careful watch on inflation and the labor market, with various officials advocating for a gradual approach to rate adjustments while expressing concerns over inflation exceeding the Fed’s targets.

The economic calendar is packed with various data and events. For instance, the release of German industrial production, along with several central bank speeches, will contribute to shaping market sentiment. Observers will be eying specific PPI data and consumer sentiment surveys from the University of Michigan since they could add context to broader inflationary trends and the public’s inflation expectations. Fed officials have shown differing views on how policy should evolve in light of strong labor statistics; thus, any developments impacting expectations of further rate cuts will be closely monitored.

In summary, key takeaways from this week involve the unexpectedly high job growth reported in the U.S. labor market, which is shifting sentiments in financial markets and possibly influencing Federal Reserve policy. The forthcoming CPI release is set to be a pivotal moment for gauging inflation dynamics and its impact on monetary policy moving forward. As the opening of the earnings season adds further complexity to the economic backdrop, analysts will be assessing the performance across sectors, especially with central bank policymakers articulating their perspectives that could inevitably shape market expectations for interest rate moves in the upcoming months.