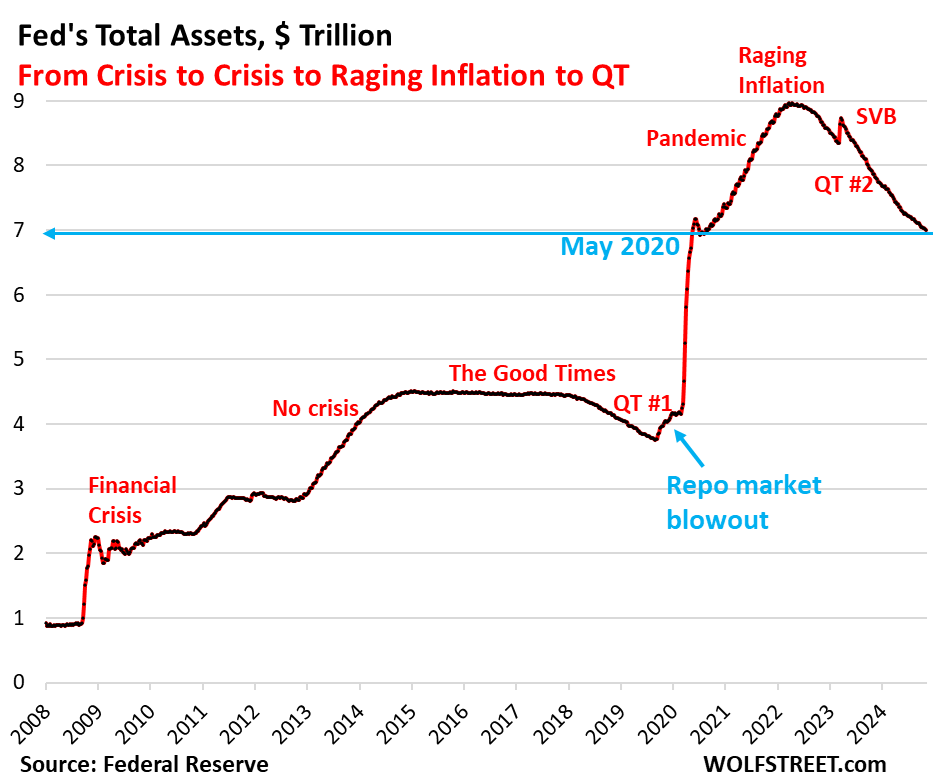

The Federal Reserve’s Quantitative Tightening (QT) program has reached a significant milestone, shedding 41% of the assets accumulated during the pandemic through Quantitative Easing (QE). As of a recent report, total assets on the Fed’s balance sheet have reduced to approximately $6.99 trillion, a level it initially reached in May 2020. This reduction in assets, having declined by $1.97 trillion since the conclusion of QE in April 2022, symbolizes a notable contraction in the balance sheet as the Fed continues its focus on controlling inflation and normalizing monetary policy. The most recent monthly figure reflects a decrease of $53 billion in October, indicating that the Fed is actively pursuing its QT strategy.

The assets held by the Fed can be categorized into Treasury securities and Mortgage-Backed Securities (MBS). In October, the Fed saw a decline of $24 billion in Treasury securities, reducing their total holdings to $4.34 trillion— the lowest level since August 2020. Overall, this marks a 44% reduction from the peak of Treasury securities acquired during the pandemic, which reached $3.27 trillion. Treasury securities are removed from the balance sheet when they mature, and currently, the roll-off is capped at $25 billion per month. The reduction reflects the Fed’s strategic approach as it continues to prioritize economic stability and prepare for potential future monetary adjustments.

Additionally, MBS have also been a key component of the Fed’s QT strategy. During October, the Fed’s MBS holdings fell by $16 billion, bringing the total down to $2.27 trillion— the lowest level since June 2021. In total, the Fed has shed approximately 35% of the MBS added during the QE phase. These securities primarily come off the balance sheet through various payments linked to mortgaged homes. However, the recent decline in home sales and refinancing has resulted in fewer mortgage payments, hindering the pace at which MBS have been removed from the balance sheet. Discussions at the Fed have emerged regarding the possibility of directly selling MBS to expedite this process, given their limited liquidity in current market conditions.

In terms of bank liquidity facilities, two programs—the Discount Window and the Bank Term Funding Program (BTFP)—still show significant balances, while others remain at or near zero. The Discount Window serves as a traditional liquidity source for banks, maintaining a balance of approximately $1.6 billion as of October. While its borrowing capacity spiked to $153 billion during the March 2023 banking crisis, usage remains low due to the cost and stigma associated with borrowing from it. Furthermore, the BTFP, originally created to provide liquidity following the failure of Silicon Valley Bank, has seen its balance decline to $56 billion. This program has faced scrutiny due to its rate structure and the ability of banks to utilize it for potential arbitrage, prompting the Fed to take corrective measures.

The BTFP, initially viewed as a panicked response to a specific banking crisis, will cease operations by March 11, 2024, thus removing an additional $56 billion from the Fed’s balance sheet. Loans granted under this program can be held for up to one year, leading to an eventual decline in the total balance sheet as these obligations are settled. The termination of the BTFP is part of a broader strategy by the Fed to withdraw liquidity and stabilize financial markets amid evolving economic conditions. As the Fed continues to navigate the complexities of inflation and economic stability, these adjustments to its balance sheet signify its commitment to normalizing monetary policy.

Overall, the ongoing QT program highlights the Fed’s efforts to reduce its balance sheet and curb inflationary pressures that have emerged in the post-pandemic economy. With a significant focus on asset reductions in both Treasury securities and MBS, the Fed is working to align its policy response with prevailing economic indicators. The path ahead remains influenced by various factors, including market conditions and potential future rate adjustments as the Fed balances its dual mandate of price stability and maximum employment. As the financial landscape evolves, the Fed’s balance sheet actions will be closely monitored as they play a crucial role in navigating potential economic challenges and fostering a stable financial environment.