Colombia’s Congress is currently reviewing a significant fiscal proposal that aims to nearly double the central government’s financial transfers to regional governments. The proposed reform seeks to raise the share of government revenue allocated to cities and provinces from the current 26% to 46.5% by 2036. While proponents argue this initiative is fundamental for stimulating regional economies and decentralizing growth, detractors warn that it could exacerbate the country’s already precarious fiscal situation, potentially raising national debt by almost 15 percentage points of GDP over the next decade—a figure that amounts to an estimated 327 trillion pesos ($76 billion) over the same period.

During discussions, economists from the finance ministry and planning departments have issued stark warnings, suggesting that the initiative is financially unsustainable and could lead to a “fiscal disaster.” Roberto Steiner, co-director of the central bank, has pointedly criticized the reform, emphasizing that its implementation carries substantial risks for Colombia’s macroeconomic stability and monetary policy. Despite these cautions, the bill has already advanced through five of the eight required legislative debates, raising concerns that, if approved, it could face potential challenges in the constitutional court.

As the full Senate engages in debates this week, there is a strong likelihood that the proposal will pass, particularly given the government’s significant majority in the lower house. Interior Minister Juan Fernando Cristo defended the proposal during a congressional session, dismissing opposition critiques as overly centered on Bogotá, claiming that detractors are failing to recognize the needs of regional economies. He acknowledged the government’s willingness to consider amendments despite the prevailing fiscal apprehensions that surround the legislation.

Colombia’s fiscal outlook has deteriorated notably since losing its investment-grade rating in 2021, which occurred amid a fiscal deficit exceeding 7% of GDP. Since then, efforts to rein in this deficit have proven unsuccessful, with current figures still above the pre-pandemic threshold of 3%. Concerns over the government’s fiscal health are compounded by a technical study from the finance ministry revealing that the proposed reform would undermine public finances and necessitate a search for additional funding through either increased debt or taxes.

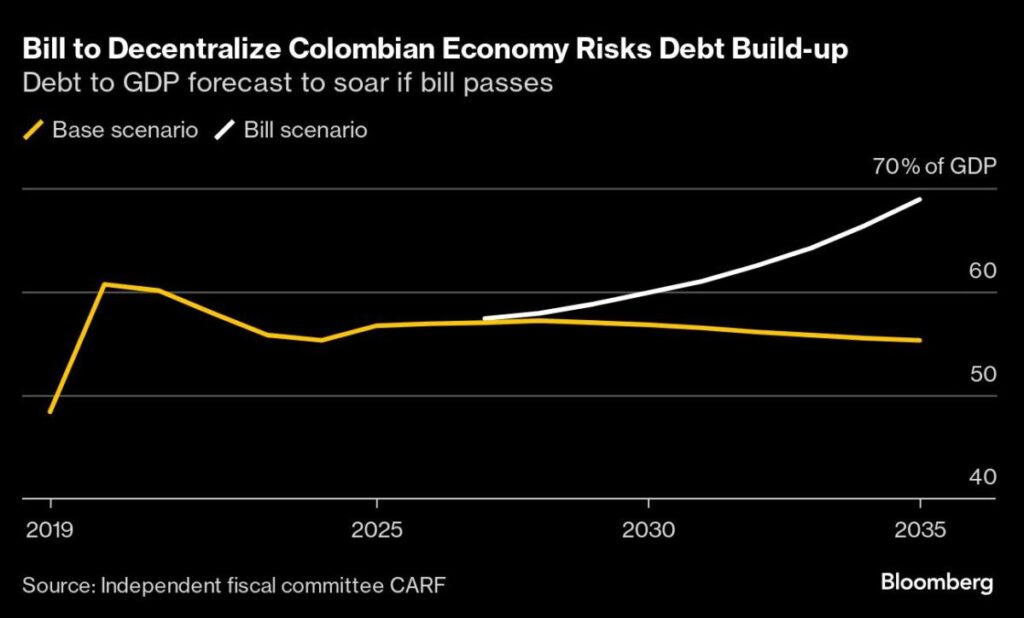

The oversight committee on the nation’s fiscal rules has projected that, if the bill is enacted, the debt-to-GDP ratio could rise almost 70% by 2035, up from 55% in the current year. The anticipated increase in public debt poses considerable challenges, raising alarms among fiscal analysts and policymakers about the long-term sustainability of Colombia’s economic framework. Even as advocates push for greater financial resources for regional authorities, the associated risks suggest a growing rift between aspirations for equitable regional development and the pressing need for a stable fiscal environment.

In summary, while the proposed reform for increasing central government transfers to Colombia’s regions is driven by a vision for equitable growth and development, it faces significant scrutiny regarding its fiscal viability. The interplay between regional needs and national economic stability remains a pivotal concern as legislators grapple with the implications of such a substantial fiscal shift. If approved, this could set a precedent for future financial governance in Colombia, making the decision all the more critical for the country’s economic trajectory.