China’s economy is seemingly trapped in a toxic cycle where policymakers announce stimulus measures aimed at reviving the sluggish property sector, but these efforts consistently fall short of expectations. Despite initial optimism that Beijing might have learned from past attempts to artificially inflate its stock market, a recent announcement from the Ministry of Housing and Urban-Rural Development (MOHURD) has been met with skepticism. The government outlined plans that included fast-tracking credit to troubled property developers and renovating urban shantytowns. However, analysts express that, similar to previous announcements, these measures lack the specificity required to meaningfully drive liquidity to the market. This growing disillusionment amongst traders continues to push investment away from China’s stock market rather than attracting it.

The recent stimulus announcement included significant pledges, such as making available 4 trillion yuan (approximately $550 billion) in loans to support housing projects classified as a “white list” by the government. Projects on this list are eligible for government-backed financing aimed primarily at completing unfinished apartments. However, analysts highlighted several flaws within the proposed measures, including the fact that funds from these loans would primarily be held in escrow accounts and could not be utilized for servicing debts or kick-starting new projects. As a result, the recent stimulus is seen as insufficient in addressing the grievous challenges that encapsulate China’s property market, leading to a lack of optimistic home-buying sentiment.

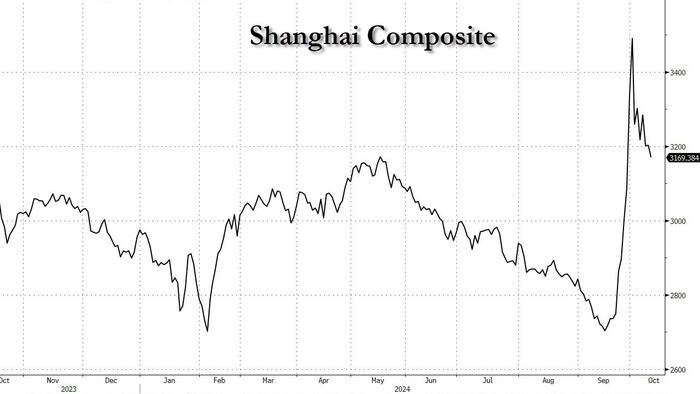

This lack of enthusiasm among market participants was reflected in the performance of various Chinese stocks following the announcement. Property sector shares in Shanghai and Shenzhen faced significant declines, with notable drops from major developers like China Vanke, leading to further concerns regarding the broader market’s direction. Similarly, the Hang Seng Mainland Properties Index saw appreciable losses, raising alarms about the market’s resilience. The skepticism surrounding the government’s plans is compounded by fears regarding the existing debt-laden situation of developers and the broader implications for lenders who might be hesitant to extend additional credit.

Analysts emphasized that while the expanded “white list” might appear beneficial, it merely accelerates construction efforts for already sold but incomplete homes rather than addressing the substantial inventory overhang that currently exists. Goldman Sachs underscored that, despite some positive aspects regarding the government’s approach to revitalizing the sector, the scope of the initiatives remains limited and lacks clear funding support, which is crucial for a more profound turnaround of the property market. The overall sentiments suggest that while policymakers may be attempting to incentivize growth, the baseline reality indicates a need for a comprehensive strategy to handle the existing property challenges plaguing the economy.

As the economic landscape continues to evolve, any potential measures from the People’s Bank of China are becoming pivotal in determining market outcomes. Recent discussions within the central bank regarding potential support for developers indicate that there may be room for further policy interventions. Banks could find added encouragement to offer loans if supported by robust lending quotas set for the upcoming year. However, skepticism remains regarding the effectiveness of these measures in propelling genuine recovery in homebuyer demand, given the structural challenges still faced in the housing market.

The upcoming National People’s Congress session emerges as a crucial juncture for potentially decisive governmental actions. Regulatory focus may shift towards an immediate need for impactful measures that could significantly alter the economic outlook, either through direct stimulant policies or more aggressive monetary easing strategies, which may include quantitative easing. Investors find themselves in a pattern of tentative engagement as they await concrete developments, clinging to hope that the government will employ the necessary tools to avert further economic calamity and substantively revive investor confidence in the beleaguered property sector.