In October 2023, significant Chinese foreign exchange (FX) outflows of $75 billion were recorded, marking the highest monthly outflow since the 2015 currency devaluation. This surge raised concerns about persistent depreciation of the yuan and increased pressures for capital outflows, suggesting that the exodus of funds from China was just beginning. Analysts predicted that this trend would contribute to rising global anxieties regarding capital flight from China, intertwined with geopolitical tensions and central bank policies. Furthermore, there were speculations on where these capital flight funds were being directed, with Bitcoin emerging as a popular option for circumventing China’s stringent capital controls—a trend supported by a substantial rise in the cryptocurrency’s value, which had been hovering around $30,000 before Bitcoin’s price skyrocketed by over 100% in the following months.

As time passed, economic analysts noticed a recurring pattern: every spike in Chinese FX outflows appeared to trigger significant upticks in Bitcoin prices. An analysis conducted in July highlighted a renewed surge in capital flight from China, prompted by the Chinese government’s decision to divest record amounts of U.S. securities. It became evident that this inert capital influx was instrumental in driving Bitcoin prices, especially when significant capital controls loomed. This pattern aligned with long-established theories in the economic community that had highlighted the relationship between China’s capital outflows and Bitcoin’s market performance since at least 2015. The consistent prediction was that the anticipated capital flight would lead to another Bitcoin surge, a prediction that proved accurate as the price of Bitcoin once more approached record highs.

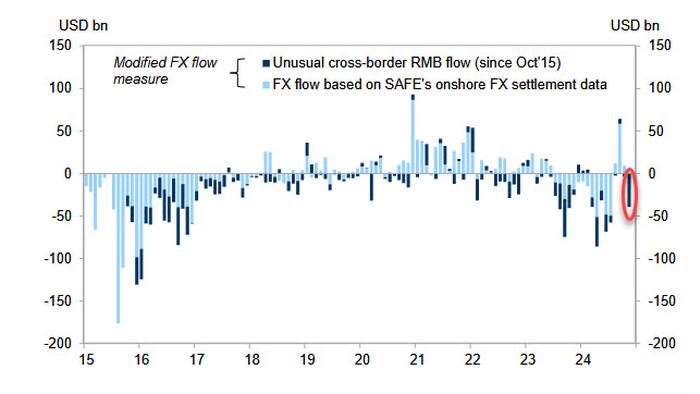

The narrative of capital flight remained murky when examining China’s official foreign exchange reserve data, which showed that reserves were near a nine-year high at $3.3 trillion. However, this starkly contrasted with the broader implications of FX flows. Alternative assessments of China’s FX data revealed a substantial net outflow of $39 billion in November, a significant reversal from previous months that had recorded impressive inflows. While the official data might have painted a picture of capital stability, investigators using more nuanced measures, such as cross-border RMB flows and portfolio investment channels, found that the real picture was one of marked capital outflows. The divergence between reported data and underlying trends suggested the complexity and unreliability of the officially presented statistics, raising questions about the true state of China’s economic health.

Diving into specific flow channels, analysts reported mixed signals regarding China’s economic transactions. While the current account channel indicated a decline in net inflows, the portfolio investment channel saw net outflows consistently in November. For instance, during this period, there were modest net FX outflows attributed to portfolio investments, primarily reflecting broader investor sentiment regarding the Chinese economy. Notably, the outflow trend appeared to lack significant volume, indicating a cautious approach by investors that could be symptomatic of increasing apprehension about China’s financial stability. Meanwhile, official FX reserves had risen slightly, creating a puzzling contrast between apparent robust reserve growth and the reality of capital flight-driven pressures.

Moreover, a deeper analysis into the Treasury International Capital data revealed that Chinese investors had been active sellers of U.S. securities, having sold approximately $17 billion worth of assets in September alone. The continuous offloading of U.S. securities over several months suggests a broader strategic move to mitigate potential capital losses linked to a depreciating yuan. This trend implied that the capital flight may have been driven, in part, by a fear of devaluation and a need for liquidity amid economic uncertainty. The selling pressure from Chinese investors formed an integral backdrop as they sought safer investments amid volatile market conditions exacerbated by external pressures such as the impending U.S. tariffs.

Despite these worrying signals, China’s policymakers expressed intentions to maintain FX stability, though their efficacy in achieving this goal came into question given the circumstances. Efforts to counter the depreciation of the yuan through policy interventions could soon clash with mounting pressures to stimulate exports—considering Japan’s aggressive devaluation of the yen—as Beijing appeared to inch closer to a potential currency devaluation. Historical patterns from 2015 suggested that such measures would likely trigger another wave of capital flight, profoundly reminiscent of past movements that had driven Bitcoin’s ascent from $250 to thousands. Indeed, indicators pointed towards a potential repeat of such turning points, reinforcing the belief that the market’s next upward movement could emerge from China’s extensive capital shifts rather than from domestic events in the U.S.

Ultimately, the interplay of capital flows, policy measures, and market sentiments creates a precarious financial landscape for China and the global economy. Observers and analysts remain watchful for signs of intensified capital outflows, particularly if economic conditions deteriorate further. The long-standing connection between these outflows and the growth of Bitcoin suggests that forthcoming movements in the cryptocurrency market may not be attributable solely to local factors, but rather reflect broader patterns emerging from China’s economic policies and capital movement strategies. If history serves as a guide, the next several months could witness dramatic shifts in Bitcoin’s price trajectory driven by core economic realities in China, setting the stage for a potentially transformative cycle in global cryptocurrency dynamics.