One month ago, as gold prices reached historic highs, Goldman Sachs’ precious metal analyst, Lina Thomas, projected that the price of gold could climb to $3,000 per ounce by the end of 2025. This increase would be driven largely by enormous central bank purchases, with China identified as a significant contributor due to its escalating demand for gold. Despite Goldman’s ambitious forecast, the bank faced skepticism from several quarters, particularly from analysts who contended that gold’s ascent would be hindered by a strengthening dollar, which is currently one of the strongest consensus trades among investors. Critics pointed out that typically, a robust dollar corresponds to lower commodity prices, including gold, as investors may shy away from assets perceived to be less stable during times of dollar strength.

In defense of the optimistic outlook on gold, Lina Thomas articulated four key arguments challenging the notion that gold cannot ascend to $3,000 while the dollar remains strong. First, she highlighted that Goldman’s economists predict a series of Fed interest rate cuts within a broader global monetary easing framework. Thomas argued that it would be the U.S. policy rate cuts, rather than the dollar’s performance, that drive gold demand from investors. In their analysis, the bank projects that a hypothetical 100 basis point decrease in interest rates would increase gold prices by 7% by the end of 2025, although even a single additional Fed cut—which appears increasingly plausible—could lift gold prices to around $2,890 per ounce.

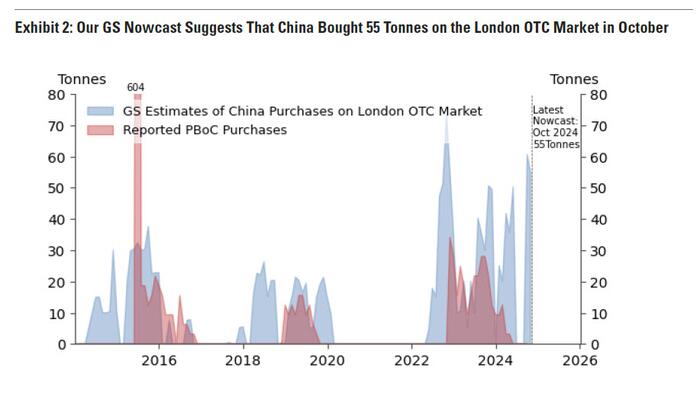

Secondly, Thomas dismissed the assertion that ongoing dollar strength would impede central banks from raising their gold purchases, which she argued could elevate gold prices by another 9% in her base case. Central banks often utilize their dollar reserves to purchase gold, particularly in times of local currency instability, where boosting confidence in their economy becomes crucial. Consequently, rather than being discouraged by a strong dollar, central banks actively increase their gold buying, particularly when their local currencies weaken, thereby reinforcing demand for the precious metal.

Thomas’ third point emphasized the historical correlation between rising uncertainty and increasing prices of both gold and the dollar. In uncertain economic conditions, both assets serve as hedges in investment portfolios. This situation could become particularly relevant amid heightened tariff escalations or geopolitical tensions, which typically spur investors to seek safe havens, including precious metals like gold. This dual dynamic suggests that the upward pressures on gold prices may not be as adversely impacted by dollar strength as critics propose.

Lastly, she addressed the implications of yuan depreciation and anticipated broader easing in China, which Goldman economists predict could have a mixed but ultimately neutral effect on the country’s retail gold demand. While lower interest rates in China could stimulate gold demand, they may also coincide with rising prices for gold in local terms, thus offsetting any potential increase in consumption. Therefore, the intricacies of China’s economic landscape point to a balanced interaction between lower interest rates and domestic gold prices, suggesting that the overall impact on gold demand may remain stable.

Overall, as Goldman Sachs stands firmly by its bullish gold forecast, the bank emphasizes that monetary policy, global uncertainty, and the dynamics of international buying behavior among central banks will play substantial roles in shaping the trajectory of gold prices in the coming years. Despite skepticism from some analysts regarding the interplay between the dollar and gold, Goldman’s comprehensive analysis suggests a multifaceted landscape where investor sentiment, policy strategies, and macroeconomic factors could collectively facilitate a rise in gold prices to $3,000 per ounce by the end of 2025, regardless of the dollar’s performance. This outlook not only reflects a strategic interpretation of current economic indicators but also underscores the evolving narratives that could significantly influence the precious metals market.