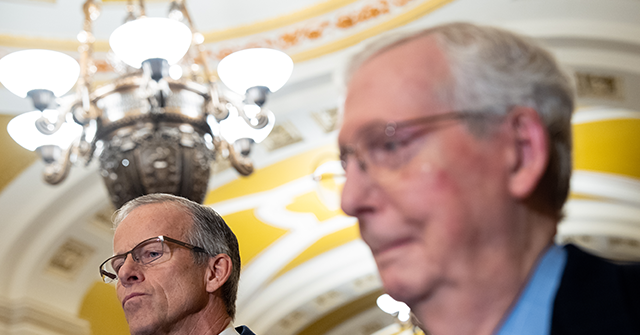

As the Republican Party outlines its legislative agenda for Donald Trump’s second term, a significant challenge arises over the decision to delay tax cuts in favor of other priorities. Key figures, including Senate majority leader-elect John Thune, advocate for a focus on border security, energy independence, and national defense through a fast-tracked reconciliation process, potentially sidelining crucial tax reforms until 2025. This proposed strategy poses considerable economic risks, particularly in terms of investor and consumer confidence. The anticipation of tax relief is crucial to maintaining current optimism, and any hesitance shown in Washington could lead to diminished investment and spending, ultimately stunting economic growth during a crucial juncture.

The importance of acting promptly on tax cuts cannot be overstated, especially considering the Republican narrative that heralds the 2017 tax cuts as pivotal in driving economic growth by incentivizing investment and consumer expenditure. Delay in extending these tax benefits could convey indecision and instability at a time when Republicans aim to showcase their responsibility in economic stewardship. Furthermore, the use of the reconciliation process—designed to bypass the filibuster—provides a unique opportunity for the GOP to advance its agenda with minimal Democratic interference. However, if they prioritize non-growth-driven measures, like border security and energy policies, instead of solidifying financial relief for Americans, it could weaken their political capital and hamper the newly minted presidency’s momentum.

Trump’s initial victory was largely fueled by a buoyant economy, making economic stability a paramount concern for voters. Polls consistently indicate that economic issues significantly influence public opinion. Hence, in order to fulfill promises of prosperity and growth, Republican leaders must recognize the implications of perceived inaction. A delay could not only jeopardize the credibility of their tax agenda but also stifle the economic growth that tax cuts are designed to support, leaving both businesses and consumers in a state of uncertainty.

Aside from the potential repercussions on the economy, Thune’s approach may face internal party challenges, particularly regarding immigration and border security. Despite public support for strict immigration policies, some experienced lawmakers remain tied to outdated stances on labor issues, while others may shy away from hardline positions due to anticipated media backlash. This internal conflict could complicate the passage of subsequent legislation related to taxes and further divide the party, drawing parallels to the failed healthcare reform efforts in 2017 that nearly obstructed tax cuts during Trump’s first term.

Additionally, delaying tax cuts could undermine the Trump administration’s trade agenda, which relies significantly on tariffs. Tariffs may inadvertently raise costs for U.S. businesses reliant on imported goods, potentially translating into higher retail prices for consumers. Tax cuts are essential for mitigating these economic impacts; without them, the burden of tariffs could adversely affect U.S. economic growth. If the tax cuts are postponed, businesses and consumers will likely pressure the government for relief by reducing tariffs, signaling a retreat from Trump’s trade strategy amid rising economic uncertainties.

In conclusion, the Republican Party has a critical opportunity to establish a pro-growth agenda in Trump’s second term by prioritizing tax cuts. Immediate action in this area is vital; delaying tax reform could obstruct not only economic growth but also send a negative signal about the party’s intent and capability to steer the economy effectively. With strong expectations for tax relief from both businesses and consumers, the GOP must capitalize on its legislative leverage and act decisively to foster a favorable economic environment, thereby reinforcing its commitment to sound fiscal policy and growth-oriented governance.