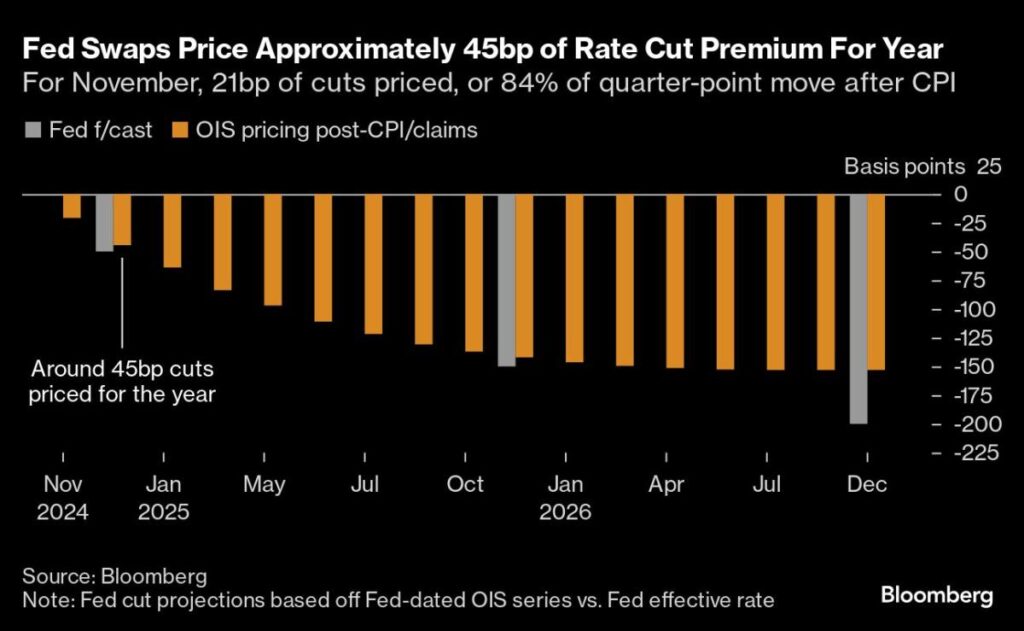

Bond investors have recently increased their expectations for a Federal Reserve interest rate cut next month, driven primarily by a sharp rise in unemployment claims, which overshadowed an unexpectedly high inflation report. Wagers indicate that swap traders now assign an over 80% probability to a 25-basis-point reduction in rates during November. The overall sentiment suggests confidence that the central bank will maintain a path of rate cuts, as traders anticipate a total of 45 basis points of reductions throughout 2024, a slight increase from earlier predictions before the recent economic data releases. This shift reveals a persistent focus on labor market dynamics amidst a backdrop of rising inflation concerns that, while still relevant, seem to take a back seat for now.

The volatility in Treasury yields was notable following the data announcements, with shorter-dated two-year yields falling below 4%, whereas 10-year yields peaked at approximately 4.10%, their highest since late July. Prior to these figures, there was a notable reduction in long positions in futures, combined with a fresh wave of bets against U.S. bonds, making the Treasuries market more vulnerable to notable buyer demand. The underperformance of long-term Treasuries, which are more sensitive to inflation, contributed to a steepening yield curve, particularly as two-year yields surged above those of ten-year maturities by a margin of around 11 basis points. This fluctuation indicates a complex interplay between short-term and long-term rate expectations, reminding investors of the potential outcomes as new fiscal data continues to emerge.

Contributing to the pressure on long-term debt was the anticipation surrounding the Treasury’s upcoming sale of $22 billion worth of 30-year bonds. This followed prior sales of 10-year and 3-year bonds earlier in the week, further complicating the landscape for fixed-income investors. Amid this environment, Fed officials, including Chicago Federal Reserve President Austan Goolsbee, have reiterated that the central bank’s focus is shifting beyond solely managing inflation. The uptick in inflation readings suggests persistence that policymakers cannot ignore, and stronger-than-anticipated core consumer price index (CPI) numbers have complicated the picture considerably.

The September consumer price index report revealed an unexpected increase, particularly in core CPI, which excludes volatile food and energy prices. Additionally, jobless claims rose to their highest level in a year, specifically spiking due to large claims coming from Michigan and areas impacted by Hurricane Helene. While the inflation data painted a complex picture, it remains the labor market statistics that hold more weight in determining future Fed actions. Analysts and strategists argue that the upcoming payroll release will be pivotal in gauging the Fed’s potential ease in monetary policy, as labor market health continues to take precedence.

Despite the growing expectations for rate cuts, recent minutes from the Federal Reserve’s last meeting suggested a more cautious approach among its officials regarding future monetary policy changes. The half-point reduction discussed came under scrutiny, with several members advocating for a more gradual approach to cuts. This perspective is largely influenced by the latent inflation risks solidified by the recent strong rising CPI data, which has cast doubt on the notion that inflation is under firm control. Analysts point out that while labor indicators are somewhat softer than what recent payroll data may imply, the overall market remains open to adjustments, particularly favoring potential yield gains in the shorter-end segments of the bond market based on these dynamics.

In review, the current situation illustrates a tug-of-war in the bond market between rising inflation fears and labor market characteristics. As markets process and absorb the implications of new economic data, all eyes are on the Federal Reserve’s policy decisions in the coming months. While increasing bets for interest rate cuts dominate discussions, the reality is that financial markets remain sensitive to any signals that could shift this landscape, making future economic reports critical in shaping expectations and strategies moving forward. Ultimately, the balance between inflation and employment indicators will continue to guide investors’ perspectives and the Fed’s subsequent policy responses as the economic narrative unfolds.