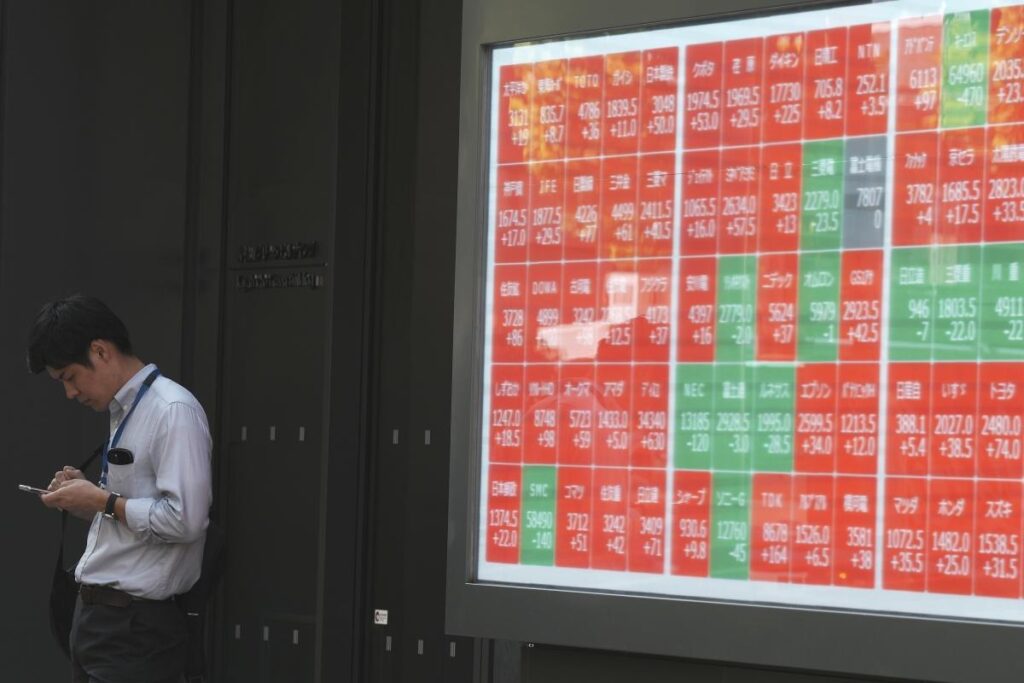

Asian financial markets experienced a decline on Thursday, as investor sentiment remained tentative with the impending U.S. presidential election set for November 5. Japan’s Nikkei 225 index fell by 0.5% to 39,069.20 points, while Australia’s S&P/ASX 200 decreased by 0.3% to 8,153.20. Conversely, Hong Kong’s Hang Seng index saw a slight increase of 0.3%, reaching 20,433.83, while China’s Shanghai Composite index declined by 0.3% to 3,258.04. Notably, South Korea’s Kospi experienced a more significant drop of 1.2%, ending the trading session at 2,562.07. This decrease was attributed to North Korea’s recent test-launch of a suspected long-range missile designed to potentially target the continental U.S., raising geopolitical tensions on the eve of the U.S. elections.

Market participants are also keeping a close eye on an anticipated monetary policy decision from the Bank of Japan, although experts largely expect the central bank to maintain its current position. The ongoing atmosphere of caution is further heightened by a series of upcoming earnings releases that are expected both in Asia and globally. This hesitation is mirrored in U.S. markets, where the S&P 500 edged down by 0.3% to 5,813.67, following a fluctuating trading session. Meanwhile, the Dow Jones Industrial Average slipped 0.2% to 42,141.54, and the Nasdaq composite decreased by 0.6% to 18,607.93. Despite these minor dips, these indices remain near their respective record highs set earlier in October.

Alphabet, the parent company of Google, stood out amidst a challenging day on Wall Street, boasting a 2.8% increase in its stock after exceeding analysts’ earnings forecasts, largely due to strong performance in its core advertising business. This positive news contributed to the ongoing enthusiasm surrounding the “Magnificent Seven,” a group of influential tech stocks that have consistently surpassed market expectations. On the other hand, the technology sector faced setbacks, particularly for computer chip companies, as Advanced Micro Devices (AMD) reported earnings that merely matched Wall Street’s predictions, leading to a downturn across the industry. Nvidia, a key player in the sector, also saw its stock decline by 1.4%, contributing significantly to the S&P 500’s losses.

Eli Lilly’s stock faced a substantial decline of 6.3% due to concerns about its popular diabetes treatment Mounjaro and another weight loss drug, Zepbound. In a striking move, the Trump Media & Technology Group, linked to former President Donald Trump’s social media platform, experienced a dramatic 22.3% drop—its largest decline since becoming publicly traded, following significant volatility where shares had previously surged to around $40 from $12 over the prior month. Such fluctuations underscore the unpredictable nature of stocks tied to high-profile figures and emerging media ventures.

In the bond market, yields exhibited a slight upward trend amid the latest economic indicators from the U.S. Government, which suggested that the economy’s growth had slowed in the summer months compared to the spring. However, this performance was slightly better than economists initially predicted. Additionally, a recent report indicated that private sector hiring outside the government saw an acceleration in October, contrasting forecasts for a slowdown and potentially offering optimism for the forthcoming and comprehensive jobs report from the U.S. government. Amid these developments, the Federal Reserve’s interest rate decisions are under scrutiny, especially as the central bank aims to manage economic growth while controlling inflation.

In energy markets, there was a modest rise in crude oil prices, with benchmark U.S. crude increasing by 21 cents to settle at $68.82 per barrel and Brent crude, the international benchmark, gaining 33 cents to reach $72.88 per barrel. Currency trading showed a slight appreciation of the U.S. dollar, which edged up to 153.48 Japanese yen from 153.31 yen. The euro experienced a slight dip, costing $1.0853, down from $1.0858. This mix of market trends highlights the complexities investors face as they navigate economic signals, geopolitical tensions, and upcoming financial reports in the lead-up to crucial elections and central bank meetings.