The current financial landscape is characterized by an exceedingly inverted term structure of volatility, reflecting the market’s anticipation of significant risk events, particularly the recent elections and the upcoming Federal Open Market Committee (FOMC) meeting. This inversion suggests a higher demand for protection against short-term fluctuations, as investors brace for uncertainty surrounding these pivotal events. Given the potential for market upheaval, many traders are weighing the implications of these catalysts on their portfolios, leading to a cautious approach in their trading strategies.

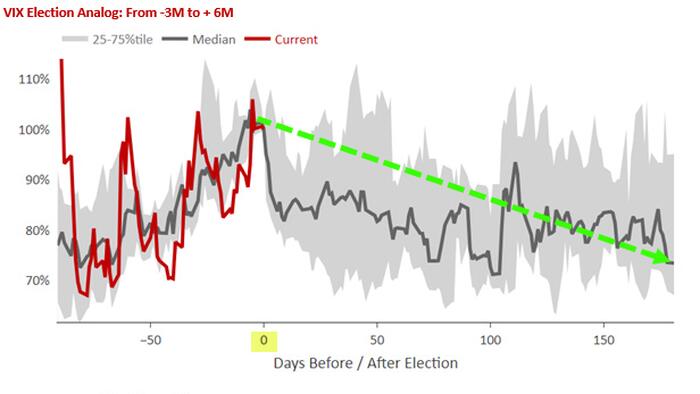

Nomura’s analyst, Charlie McElligott, points out that despite the heightened volatility leading up to the election, market participants are already starting to sell off volatility instruments. This indicates a shift in sentiment as the election results become clearer, with traders transitioning from a protective mindset to a more risk-on stance. This behavior aligns with typical post-election market patterns, where an initial spike in volatility often leads to a subsequent decline as uncertainty dissipates and investors gain clarity on the political landscape.

McElligott’s post-election playbook suggests a scenario where, following heightened volatility, there may be a considerable melt-up in spot markets as traders reposition themselves for year-end rallies. This is a common theme in the market, where once key uncertainties are resolved, capital flows into equity markets tend to accelerate, buoyed by optimism and a renewed appetite for risk. This scenario sets the stage for a robust year-end performance if the anticipated catalysts resolve favorably.

As the market adjusts to the outcomes of the elections and the FOMC’s decisions, traders must remain vigilant about potential market-moving data releases and macroeconomic indicators. The interplay between market sentiment, monetary policy directives, and geopolitical developments can lead to abrupt swings in volatility, necessitating a proactive approach to risk management. Therefore, investors are advised to keep a close eye on leading indicators, as their reactions will influence both short-term trading strategies and broader investment trends.

Overall, the period leading up to these critical events has highlighted the complex dynamics between volatility, investor sentiment, and external catalysts. While the market may have entered this phase with heightened trepidation, the potential for a post-election rally encourages traders to take calculated risks. Those who can navigate the shifting tides of market sentiment and economic indicators may find opportunities for significant gains as the year draws to a close.

In conclusion, the recent inversion of the term structure of volatility underscores the market’s cautious approach amidst looming risk factors. However, as the elections conclude and the FOMC’s policies become clearer, there is a possibility for a rebound in market confidence, prompting a sell-off of volatility and a rally in spot markets. Traders who adapt to these changes and leverage their insights on market behavior can strategically position themselves for the shifts expected in the coming months. As always, maintaining flexibility and a rigorous analytical approach remains key to successfully navigating such a turbulent environment.