On what would typically be a significant market event, the 10-year Treasury auction saw diminished attention due to a concurrent pivotal election and a notable reduction in market liquidity. Typically, the auction draws considerable interest, particularly when it coincides with a quarterly refunding, yet external factors, including a sharp spike in yields reaching 4.36% following a robust Services ISM report and the potential election victory of Donald Trump, overshadowed this auction’s importance. Traders were apprehensive, witnessing the surrounding volatility and uncertainty, impacting their focus and reactions during the day’s auction of $42 billion in 10-year paper.

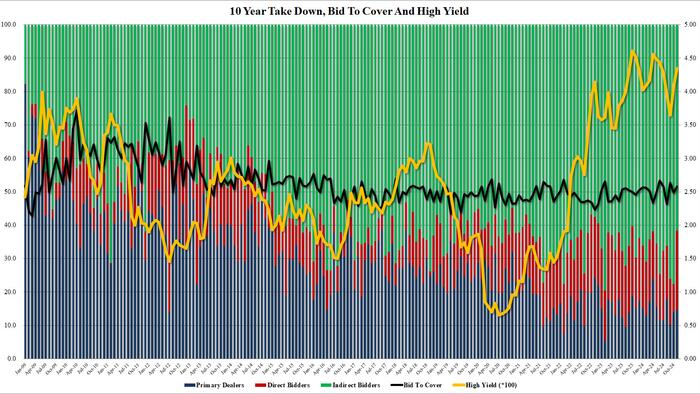

The results of this refunding auction revealed a high stop yield of 4.347%, marking an increase of 28 basis points compared to the previous auction, and achieving the highest yield since June. Interestingly, this auction managed to stop through the When Issued by 0.3 basis points, a contrast to last month when it tailed by 0.4 basis points. The bid-to-cover ratio showed improvement, ticking up to 2.58 from 2.48 in the previous auction, slightly above the six-auction average of 2.53, indicating stronger demand overall amidst the prevailing market uncertainties.

However, the auction’s internals painted a more complex picture. The percentage of indirect bidders fell substantially, with only 61.7% of the auction being taken down by this group compared to 77.6% the month prior and significantly lower than the average of 71.3% over the last six auctions. Conversely, direct bidders surged, claiming 23.6% of the auction—a notable increase from just 8.4% in October and the highest such figure recorded since March 2014. As a result, dealers were left with a smaller portion, holding onto only 14.7% of the auctioned bonds, marginally above the recent historical average of 13.5%.

Despite the less favorable internals, the overall reception of the auction was perceived as solid, albeit not outstanding. The fact that the auction did not tail served as a catalyst for yields, causing them to dip approximately 3 basis points from 4.345% before the auction to 4.31% afterward. However, this drop appeared to be a temporary reaction, and analysts warned that should Trump be declared the victor of the election, the subsequent market response could quickly revert back to an upward trajectory, reflecting the uncertainty around future fiscal policies and market stability under a Trump administration.

The dynamic of the auction underscored the broader market’s growing concerns around political developments, economic reports, and yield trends, which influenced trader sentiment markedly. The robust Services ISM report had already stirred the market’s reaction by pushing yields higher, but this auction provided a reference point for participants trying to gauge the immediate impacts of the election results on fixed income securities. Traders appeared on edge, navigating the complexities of both the auction results and the unfolding political landscape, which exacerbated the typical auction narrative with unprecedented layers of uncertainty.

In conclusion, while the auction results themselves might be classified as satisfactory and resilient under the circumstances, they were also profoundly shaped by external market forces. The intersection of heightened political risks from the ongoing election and fluctuating market liquidity rendered the typical focus on auction metrics secondary to broader implications for investors. As the political environment continues to evolve, especially with the potential implications of a Trump presidency looming, markets are likely to remain sensitive to these developments, and future auctions may experience similar volatility and diminished liquidity.