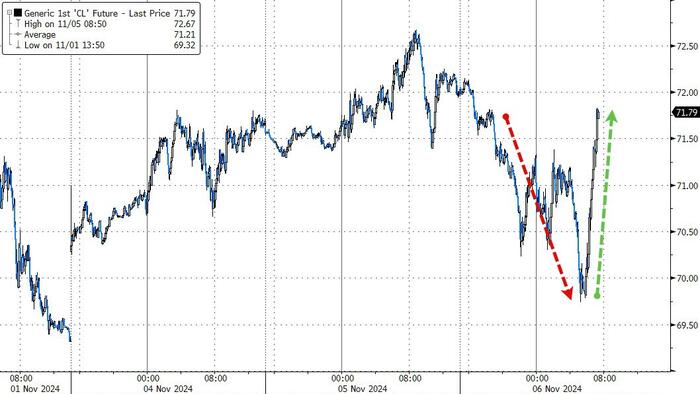

Oil prices are experiencing a rebound following a period of weakness attributed to a strong U.S. dollar and the recent election of Donald Trump, who has been vocal about expanding domestic oil production. During overnight trading, there was a notable decline across several commodities, largely driven by the expectation that Trump’s presidency would lead to tariffs on imports, specifically targeting China. This prospect raises concerns about trade tensions and potential economic disruptions. The dollar’s recent strength comes from market speculation that Trump’s fiscal policies, including his tariff proposals, might invoke inflationary pressures, thereby limiting the Federal Reserve’s ability to implement rate cuts. Traders in the oil market are currently grappling with the uncertainties stemming from the recent election and are keenly awaiting developments over the following months.

From an inventory perspective, recent reports show a green sweep of inventory builds in crude and various oil products. The American Petroleum Institute (API) indicated a crude oil inventory rise of 3.13 million barrels, well above the expected level while gasoline inventories saw a slight decrease of 928,000 barrels. On the other hand, distillate stocks experienced a significant drop of 852,000 barrels. Similarly, the Department of Energy (DOE) reported a 2.15 million barrel increase in crude and also contributed 1.39 million barrels to the Strategic Petroleum Reserve (SPR), signifying an increase in domestic crude stocks. With U.S. crude production holding steady at record levels, current market dynamics are subject to change in the aftermath of the election.

U.S. oil producers anticipate fewer regulations on crude production under a Trump administration, potentially leading to an increase in oil supply. However, the implications of such policies are not entirely straightforward. Although increasing domestic production could generally lower prices, Trump’s commitment to escalate sanctions on Iran and Venezuela could squeeze global supply, potentially exerting upward pressure on prices. Analysts from Goldman Sachs noted the ambiguous nature of how a second Trump term could influence oil prices, pointing to short-term risks related to Iranian supply amidst a possible trade conflict. In the medium term, however, escalating trade tensions could adversely impact global economic growth and thus, oil demand.

The foreign policy decisions of the new administration will likely play a critical role in shaping oil market dynamics in the near future, particularly with respect to Iran. Trump’s public remarks on enhancing U.S. oil production have raised questions about how far his administration will go in lifting drilling restrictions and expanding projects. Notably, he has attempted to downplay the implications of raising U.S. production, humorously suggesting that potential rivals, such as independent candidate Robert F. Kennedy, Jr. should avoid involvement in oil matters. While Trump’s promises to increase production might appeal to certain economic sectors, experts warn that an increase in supply could lead to significantly lower prices, impacting the revenue structures of American producers.

The sentiment among some analysts indicates that merely increasing supply under current market conditions could lead to profitability challenges for oil companies. The split in revenues, with federal lands taking a 25% share per barrel, might not leave enough margin for many producers to operate profitably at a crude price of $52.50 per barrel. Consequently, industry leaders have expressed that a pressure-driven expansion of drilling—a product of higher oil prices—could trigger competition between capex requirements and investor expectations for strong cash flow. Analyst Cole Smead emphasized that capital expenditures in the energy sector are unlikely to increase significantly unless prices reflect a strong financial incentive for producers.

As the market shifts, the inevitable question arises about when consumers will see gasoline prices rise to catch up with the crude oil market. Observations about prices being artificially suppressed leading into the election have resulted in skepticism as to how far prices will need to adjust in response to the new policies. With various uncertainties lurking in the broader economic landscape—such as potential trade wars, output levels, and international relations—the oil market is poised for significant volatility. In summary, the interplay of U.S. domestic policies, international relations, and market fundamentals will be pivotal in determining the future trajectory of oil prices.