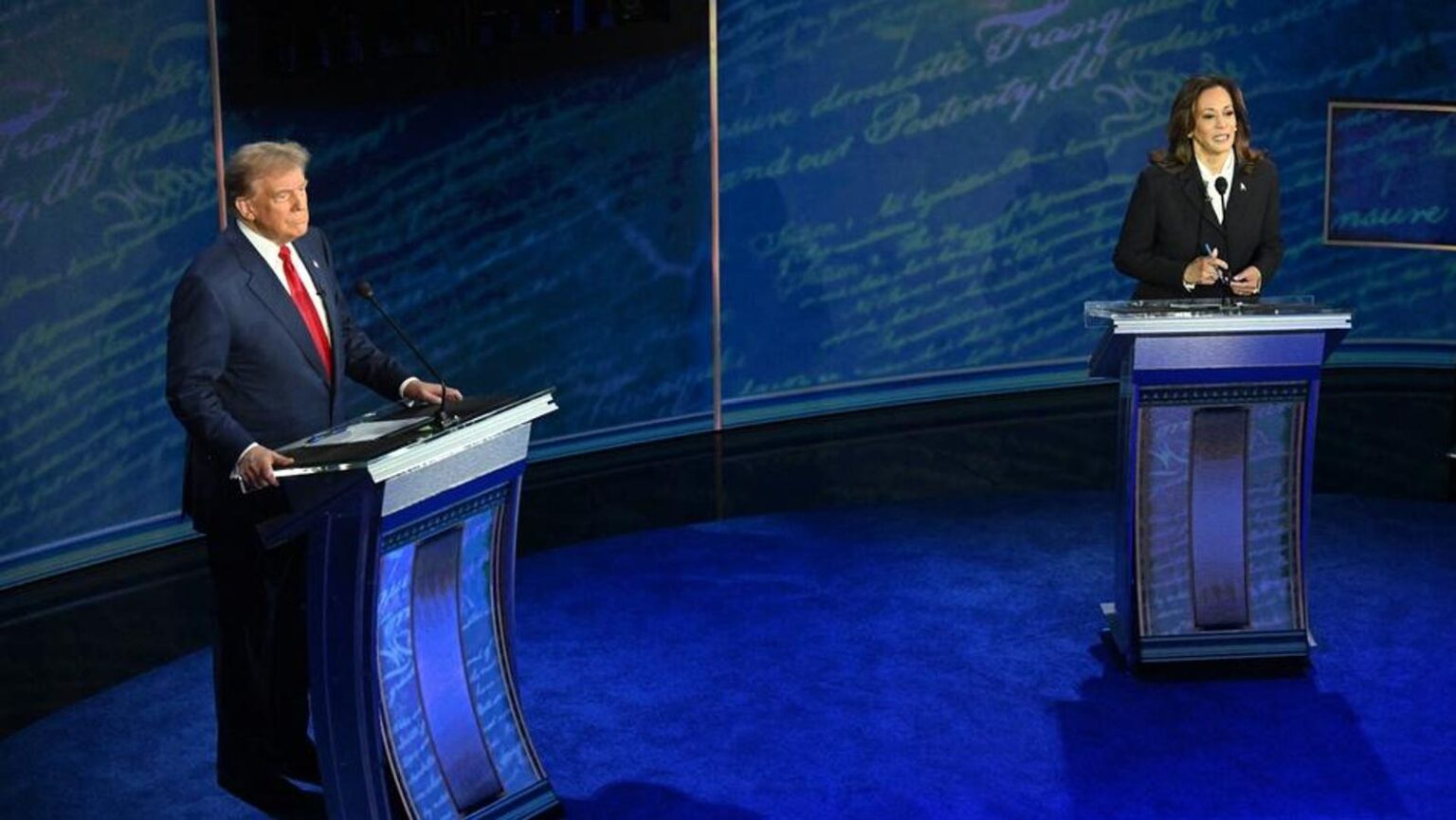

In the landscape of the upcoming 2024 U.S. presidential election, significant attention has been drawn to the differing stances of candidates regarding cryptocurrency, particularly Bitcoin. Vice President Kamala Harris and former President Donald Trump represent the two major parties in this election, with Trump proposing a strategic Bitcoin reserve as part of his campaign. While this unique policy might be seen as an attempt to appeal to a growing segment of voters interested in digital currencies, it raises questions regarding the implications and practicality of such a proposal. The concept of a Bitcoin reserve is complicated by the nature of Bitcoin as a speculative asset lacking utility, contrasting sharply with traditional reserves that represent tangible goods.

The concept of labeling government Bitcoin holdings as a “reserve” is contentious. Many critics regard it as a misnomer, arguing that unlike physical commodities like oil or cheese, Bitcoin provides no practical benefit to the public or economy. For instance, existing government cheese reserves can be directly allocated to welfare programs. In comparison, Bitcoin operates primarily as a speculative asset lacking inherent value outside trading contexts. Consequently, while advocates may view Bitcoin stash proposals favorably, skeptics contend that these holdings hold minimal value for taxpayers and are more advantageous to large cryptocurrency investors, often termed “whales,” who can manipulate market conditions without regulatory oversight.

George Selgin, an economist featured on Laura Shin’s podcast “Unchained,” articulates skepticism about government investment in cryptocurrencies, echoing sentiments that align with a broader economic consensus against such strategies. This brings into question the general applicability and efficacy of Trump’s Bitcoin reserve proposal, as well as similar suggestions made by figures such as Robert F. Kennedy Jr. and Senator Cynthia Lummis. Against this backdrop, the actual impact of cryptocurrency positions on electoral outcomes seems questionable. Political scientists argue that, despite cryptocurrency’s increasing prominence in media discourse, it does not significantly influence voter engagement or turnout, with individuals often lacking depth in their understanding of the crypto phenomenon.

Furthermore, current research indicates a limited awareness of cryptocurrency as a key political issue among voters. Political professor Justin Esarey observes that he has witnessed little interest from any sizable voter bloc regarding cryptocurrency matters. Nick Beauchamp, a political scientist, reinforces this notion, suggesting that the crypto demographic is not primarily a voting bloc, but rather a collection of affluent donors providing financial backing to candidates. Many Americans remain largely oblivious to cryptocurrency as a critical factor in policy debates, with greater focus and concern directed toward pressing issues such as inflation, healthcare, and economic recovery.

Statistical data further illuminates the state of cryptocurrency engagement in the United States. Although ownership appears to have risen, with estimates suggesting that around 10-12% of adults hold some form of cryptocurrency, the reality portrays a much different picture. A significant proportion of these individuals possess minimal amounts, with many crypto wallets holding only minor balances. The vast majority of crypto enthusiasts do not actively engage in cryptocurrency transactions, and public perceptions are often shadowed by associations with crime and fraud. While the FBI reports a substantial number of financial fraud complaints related to cryptocurrency, the percentage remains small compared to overall financial crimes.

Despite the criticisms and challenges surrounding cryptocurrency as a political issue, the big money being funneled into political campaigns from crypto donors cannot be ignored. An illustrative example is the substantial financial backing provided to Republican candidates in high-stakes Senate races—illustrating that while the average voter may remain disinterested in crypto, its financial implications are palpably affecting campaign dynamics. Political action committees have invested heavily in candidates viewed favorably by the cryptocurrency sector, particularly in opposition to more skeptical counterparts in the Democratic Party, potentially shaping electoral outcomes in certain districts. However, whether this influx of donor dollars translates into tangible crypto voter support remains uncertain, leading to a complex interplay of economic interests and public perceptions heading into the election.