Bank of America (BAC) has recently attracted attention in the financial community, particularly following significant share sales by its largest shareholder, Warren Buffett. With his ownership dropping below 10%, some investors may question the stock’s prospects. However, it’s essential to understand the context of Buffett’s actions. Buffett’s selling could reflect a variety of factors, such as portfolio rebalancing, rather than a pessimistic outlook on Bank of America. Notably, Bank of America continues to be one of Berkshire Hathaway’s largest holdings, which complicates the notion that Buffett’s selling signals a negative forecast. Thus, retail investors shouldn’t hastily follow suit, but rather consider the fundamentals that still paint a positive picture for Bank of America’s financial health.

The bank’s primary source of revenue is net interest income, derived from consumer banking services—essentially what they earn from lending after accounting for the interest paid to depositors. In early 2022, aggressive interest rate hikes from the Federal Reserve initially boosted net interest income as demand for loans remained robust. However, this trend faced challenges as rising rates led to declining loan origination and shifts in deposit behaviors towards higher-yielding accounts. Consequently, Bank of America witnessed falling net interest income through the first half of 2023. A recent trend reversal, following the Fed’s initial rate cut, has led to a renewed optimism among investors as the bank’s net interest income might have reached its trough, signaling potential growth in the near future.

Looking ahead to 2024, Bank of America is poised to benefit from favorable macroeconomic conditions. Lower interest rates are likely to stimulate loan origination as borrowing becomes less expensive, and funding pressures on the bank could ease. The recent steepening of the yield curve presents further advantages for the bank by enhancing its ability to engage in maturity transformation—borrowing at lower short-term rates to lend at higher long-term rates. Both the bank’s management and CEO Brian Moynihan have expressed optimism about a recovery in net interest income, with projections indicating further improvement in Q4 of 2024. This insight suggests that Bank of America is well-positioned to harness the benefits of a more accommodative monetary policy in the months to come.

Moreover, diversification is a cornerstone of Bank of America’s revenue generation. In addition to net interest income, the bank has solid non-interest income streams, including sectors like investment banking, trading, and wealth management. Recent performance in trading and asset management has been robust, benefiting from high market volumes and favorable market conditions. Although the investment banking sector is still recovering from past lows, a reduction in interest rates could stimulate more mergers and acquisitions, enhancing the bank’s earnings potential. A notable observation is that while the initial rate cuts have bolstered some sectors, a complete recovery will depend on sustained improvements in long-term interest rates.

From a valuation perspective, Bank of America appears reasonably positioned. The stock trades at 1.62 times its price-to-tangible book value, aligning closely with its five-year average, and notably lower than larger competitor JPMorgan, which trades at over 2.3 times. Additionally, its current dividend yield of 2.3% aligns with its historical averages, presenting an attractive option for income-focused investors. Given the bank’s upward trajectory in net interest income and the positive forecast being communicated by its management, investors are presented with a viable opportunity to enter or expand their holdings in Bank of America.

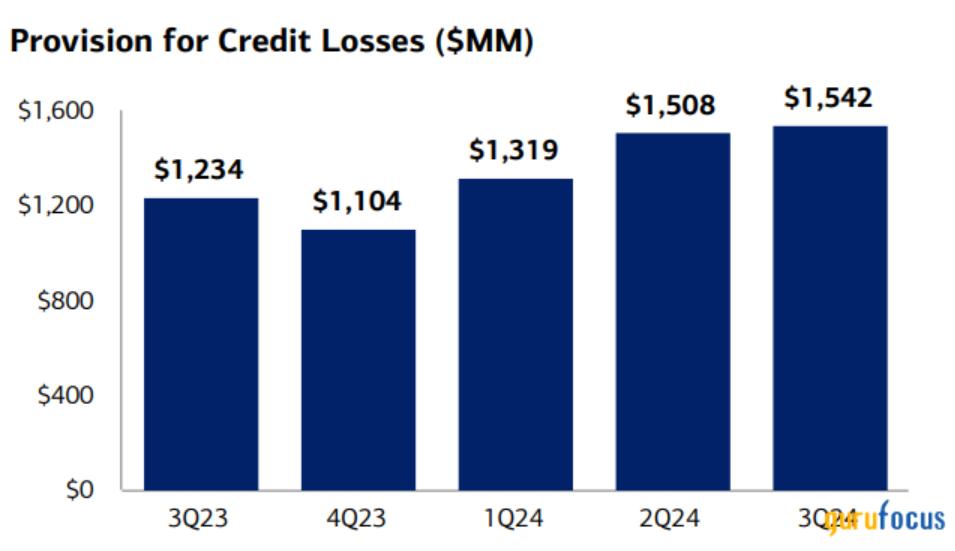

Despite these opportunities, some risks remain. An increase in credit losses has been noted, with provisions slightly rising even as the loan portfolio remains stable. Economic uncertainties, including the potential for a downturn, could heavily impact the bank’s performance, especially in the credit sector. Furthermore, after a significant 60% price increase over the past year, the potential for overvaluation exists, as high market sentiment could amplify reactions to any adverse news. The stock markets often respond excessively to shifts in investor sentiment, which could be detrimental should negative developments arise.

In conclusion, Bank of America presents a compelling investment case based on its recovering net interest income and fair valuation. While caution is warranted due to potential risks and the impacts of macroeconomic conditions, the bank’s solid positioning allows for optimism about its prospects in 2025. Investors should maintain their perspective and not blindly follow prominent investors like Buffett without considering the fundamental analysis that underpins the bank’s future potential. The favorable outlook for net interest income, coupled with diverse revenue streams and a fair valuation, underscores Bank of America’s relevance as an appealing investment opportunity.