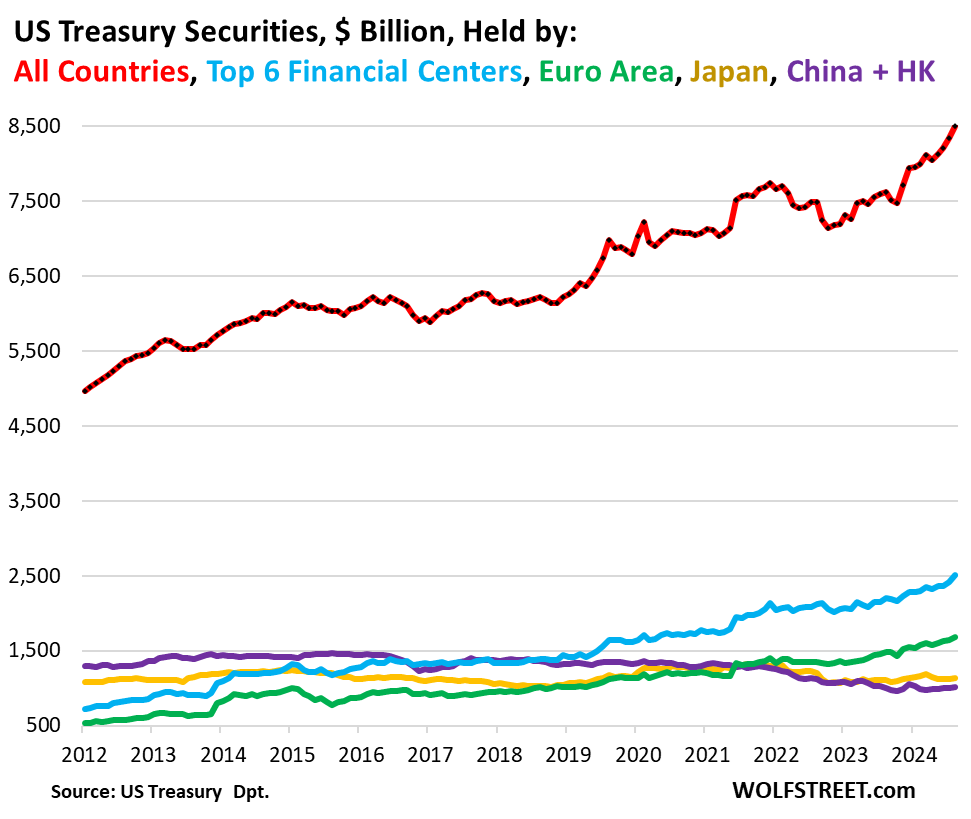

Foreign investment in U.S. Treasury securities has remained robust, with the total Treasury debt skyrocketing to $35.8 trillion as of late September 2023, highlighting the potential risks should demand from international investors wane. The critical concern lies in how sustainable this foreign appetite will be, especially given that if demand falls, interest rates must rise, leading to increased borrowing costs for the U.S. economy. Although foreign investments in Treasuries have surged since late 2022, particularly following the Federal Reserve’s interest rate hikes, the role of China and Japan as primary holders has diminished significantly compared to other financial centers, such as those in Europe and emerging markets like India and Canada.

In general, foreign appetite for U.S. Treasury securities has been driven by the relative attractiveness of U.S. yields compared to those available in other countries. Current interest rates in countries such as Italy (3.36%), France (2.90%), Germany (2.19%), and Japan (0.97%) lag behind the U.S. 10-year yield of 4.08%. For international investors, U.S. Treasuries represent a more favorable investment opportunity, offering a “cleanest dirty shirt” in a crowded field of sovereign debt riddled with various economic challenges, including ballooning debt problems. The attraction is evident, with foreign holdings of U.S. Treasuries ballooning to an all-time high of $8.50 trillion, reflecting a steady supply of funds into U.S. debt instruments.

Breaking down foreign Treasury holdings reveals that the largest financial centers (including London, Belgium, and the Cayman Islands) have continued leading the charge in acquiring U.S. debt, reflecting growth of 3.6% month-over-month and 14.2% year-over-year as of August 2023. This marks a significant increase in their holdings, further solidifying their influence in the Treasury market. Meanwhile, total Euro Area holdings also showed noteworthy increases, reaching $1.69 trillion, illustrating a substantial accumulation of U.S. Treasuries outside of traditional top-tier holders like China and Japan. The latter’s importance has continued to decline, reflecting shifting investment priorities and potentially more pressing domestic economic challenges.

Despite the persistent growth in total foreign holdings, the share of Treasury securities held by foreign investors as a percentage of total U.S. debt has seen fluctuations. Following three years of declining share from a peak of 34% in 2015 to a low of 22.2%, foreign entities have recently increased their proportion of total Treasury debt to 24.1% as of August 2023. This shift suggests that while foreign individuals and governments might be accumulating Treasuries at a slower pace, they are starting to respond positively as Treasury yields remain attractive compared to their domestic competitors. The financial landscape has changed, but the appetite for U.S. debt remains partly buoyed by these favorable yield differentials.

However, the situation varies greatly between countries. For instance, China and Hong Kong have watched their Treasury holdings shrink dramatically from a combined total of $1.45 trillion in 2015 to $1.01 trillion in mid-2023, indicating a strategic pivot perhaps fueled by diversification efforts to seek slightly higher yielding investments in U.S. Agency debt. Conversely, Japan’s holdings have only marginally increased amid currency depreciation issues spurred by Japan’s loose monetary policy. The yen has lost significant value against the U.S. dollar, and Japan’s governmental actions to stabilize the currency further complicate its stance in the Treasury market. These dynamics illustrate not only the challenges faced by significant holders but also the broader implications of currency fluctuations on foreign investment strategies.

Emerging markets and traditional allies like Canada and the UK have also increased their stakes in U.S. Treasuries. Canada reported a remarkable year-on-year increase of 23.8%, reflecting a strategic expansion over the longer term. Meanwhile, various Asian nations, including Taiwan and India, have ramped up their holdings as well, highlighting a broader trend of diversification among foreign investors looking to capture relatively favorable yield opportunities. The growing interest from countries like Brazil, which has cautiously increased its Treasury holdings after fluctuations, suggests an evolving global herd mentality that acknowledges the remaining allure of U.S. debt amidst uncertain economic landscapes worldwide. These shifting patterns underscore how critical the U.S. Treasury market remains, even as it enters a period of potentially elevated yields and increased borrowing costs due to rising debt levels.

In summary, while demand for U.S. Treasury securities remains robust, significant shifts in holding patterns among foreign investors have emerged. The decline of traditional key holders like China and Japan, balanced by gains from financial hubs both in Europe and elsewhere, signals a restructuring of global finance where diversified, emerging market players are taking a more prominent role. The implications of these trends could be profound, suggesting the importance of U.S. Treasury securities as a steadfast investment vehicle that international investors continue to leverage in an increasingly complex economic environment. As U.S. debt continues to climb, the evaluation of foreign investors’ roles will be a key element in determining the sustainability of this financial demand engine and its broader impacts on the global economy.