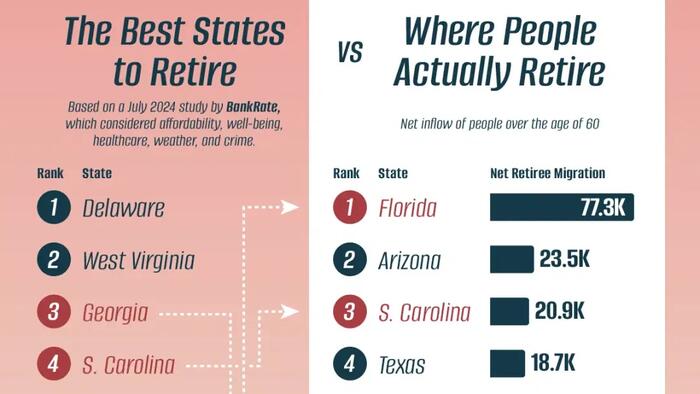

The analysis of the best states for retirement reveals a distinct divergence between expert evaluations and the actual preferences of retirees. A chart from Voronoiapp.com synthesizes data from Smart Asset and Bankrate, looking at metrics such as affordability, well-being, healthcare, weather, and crime to evaluate the best states for retirement. These metrics were weighted to reflect their importance to a fulfilling retirement, with affordability being the most significant at 40%. The study takes into account a number of factors including cost of living, healthcare access, climate, and safety, rendering a comprehensive overview of the most desirable places for retirees.

Despite the in-depth metrics used by experts, retiree migration patterns tell a different story. While Florida, South Carolina, and Georgia emerged as the top three states deemed ideal for retirement by experts, these states also align with where modern retirees are choosing to relocate. This overlap suggests that, while data-driven evaluations provide valuable insights, the actual experience and preferences of retirees are equally crucial in determining their desired retirement locations. Notably, the allure of warm summers and mild winters is a significant factor influencing retirees’ decisions, reflecting a broader desire among older adults for comfortable climates.

Furthermore, exploring retirement trends highlights the fact that many retirees prioritize lifestyle over other metrics when choosing a new place to live. For example, states that offer outdoor activities, vibrant communities, and recreational opportunities are appealing to retirees looking to stay active and engaged. The relative weight placed on specific metrics may not align perfectly with the personal experiences and choices of retirees, suggesting that more subjective measures like community and recreational opportunities are vital considerations. This aspect of retirement living can sometimes overshadow purely quantitative evaluations, contributing to the differences in preferred destinations.

The varying priorities of retirees also illustrate the importance of community and network in retirement choices. Many retirees seek states that provide a sense of belonging and opportunities to connect with others. Florida, for instance, is renowned for its large retiree population and numerous active adult communities that facilitate social interaction and support systems. This community-centric approach plays a significant role in a retiree’s quality of life and is reflected in their relocation choices, often favoring states where such social infrastructures are well-established.

Examining trends in retiree migration also sheds light on issues of cost-of-living and relocation motivations. While affordability constitutes a significant factor in evaluating ideal retirement destinations, many retirees are willing to trade off lower costs for more favorable climates and enhanced lifestyle options. Warm weather states typically attract retirees despite potentially higher housing costs, indicating a robust demand for places that promote a leisurely and enjoyable daily experience. The interplay between financial considerations and lifestyle choices illustrates the nuanced decision-making processes underpinning retirees’ relocation journeys.

In summary, the disparity between expert analyses of retirement states and actual retiree migration preferences underscores the complexity of retirement living. While data-driven metrics provide an essential framework, retirees tend to prioritize their lifestyle choices, including community engagement and climate, which directly impact their quality of life. The three states that top both lists—Florida, South Carolina, and Georgia—exemplify how climate, community, and personal preferences come together to shape the retiree experience. Ultimately, understanding this relationship can offer valuable insights for future retirees as they navigate their options for a fulfilling and enjoyable retirement.