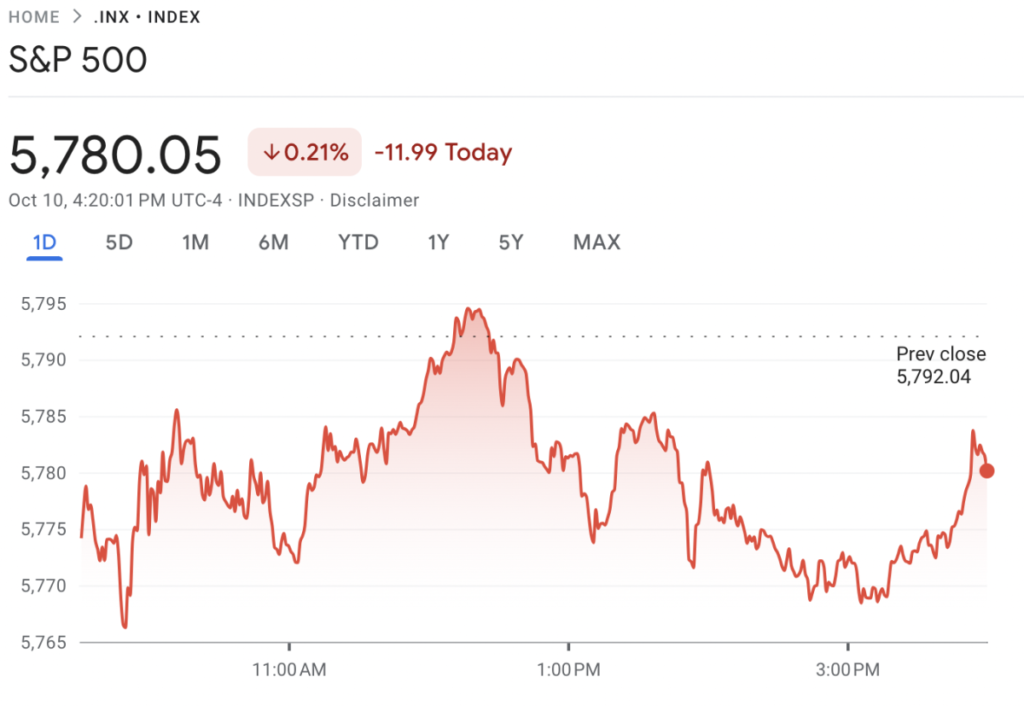

On Thursday, Wall Street experienced a notable retreat from its record highs as market participants reacted to mixed economic signals, including reports indicating a moderation in inflation alongside a rise in unemployment claims. The S&P 500 Futures posted a marginal decline of 0.22% to settle at 5,828.50, while the S&P 500 itself finished down 0.21% at 5,780.05. Furthermore, the Dow Jones Industrial Average decreased by 0.14%, closing at 42,454.12. In contrast, the Nasdaq Composite showed minimal movement, declining slightly by 0.052% and concluding at 18,282.05. The broader impact of these developments also extended to international markets, with European shares exhibiting slight declines influenced by U.S. inflation data, while the Asian markets reacted positively to potential stimulus measures.

In the U.S., the decline in equities was attributed primarily to a surprising surge in unemployment claims, which have risen following the impacts of two hurricanes as well as labor disruptions caused by a major strike at Boeing. Increased jobless claims often lead to heightened investor concern regarding economic growth and corporate profits. This shift in sentiment motivated investors to scale back their expectations for substantial Federal Reserve interest rate cuts, which had previously been anticipated to support stock market gains. The data delivered a jarring contrast to the recent bullishness following new record highs, prompting a reassessment of market fundamentals and a cautious outlook moving forward.

Across the Atlantic, European stocks trended lower in response to the U.S. inflation figures. Particularly within the U.K., the FTSE 100 slightly decreased by 0.0073% at the market’s close. Notably, British pharmaceutical giant GlaxoSmithKline (GSK) helped mitigate losses, experiencing a nearly 7% surge due to a significant $2.2 billion settlement over thousands of claims linking its heartburn drug, Zantac, to cancer cases. The disappointed performance of broader European markets was encapsulated in the STOXX Europe 600, which fell by 0.18%, reflecting lingering investor uncertainty ahead of pivotal economic data.

Meanwhile, in Asia, the mood was markedly different as both Shanghai and Hong Kong markets rebounded sharply, buoyed by renewed hopes for economic stimulus initiatives from the Chinese government. The SSE Composite in Shanghai posted a significant 1.32% gain, while Hong Kong’s Hang Seng Index surged by 2.98%. Investor optimism was sparked by announcements that the finance minister would conduct another briefing on stimulus plans, reigniting discussions around potential measures to counteract slowing economic growth and tepid domestic demand following earlier market declines.

In Japan, the Nikkei 225 experienced a modest increase of 0.26%, driven largely by gains in the financial sector. The uptick, however, was tempered by higher-than-expected producer price data, which rose by 2.8%, contrasting the projected 2.3%. This rise in production costs raised apprehensions about inflationary pressures, potentially limiting economic growth and impacting corporate profitability. The mixed economic indicators kept traders cautious, particularly in light of the pending release of further economic data from the U.S., which could influence sentiment across global markets.

As the earnings season continues, major U.S. financial institutions including JPMorgan, Wells Fargo, and BlackRock are on the cusp of reporting their quarterly results. Market participants will be keenly observing these reports as they provide crucial insights into the health of the economy and corporate sector, especially in the current environment of rising unemployment and fluctuating inflation expectations. The outcome of earnings announcements, coupled with ongoing economic developments, will play a critical role in shaping investor sentiment and market trajectory in the weeks to come. This backdrop underscores the importance of remaining attentive to both local and global economic indicators as they provide essential context for understanding broader market movements.