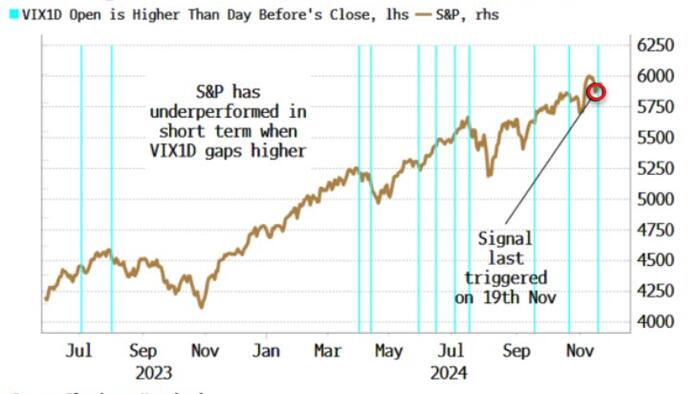

In a recent analysis by Simon White, a macro strategist at Bloomberg, a noteworthy signal has emerged related to zero-days-to-expiry (0DTE) options, specifically concerning their implications for the S&P 500’s performance. This signal, drawn from the VIX (Volatility Index) focused on 0DTE options, suggests that market participants may be poised for short-term underperformance in the equity index. White highlights how 0DTE options have surged in popularity, constituting nearly half of the average daily trading volumes in equity options, indicating a significant shift in trading behavior and strategies among investors.

The VIX1D index has been introduced to measure the implied volatility associated with these zero-days-to-expiry options. Its behavior often follows a predictable pattern: starting the trading day with an increase, only to close lower by the end of the day and open at a lower price in subsequent sessions. Such dynamics are indicative of trader sentiment and market positioning throughout the trading day. Traditionally, these fluctuations in the VIX1D can be seen as an early warning signal for potential market moves, reflecting changes in risk appetite and overall market confidence.

Historically, when the VIX1D has signaled volatility related to 0DTE options, it has often coincided with periods of increased bearish sentiment in the market, leading to short-term declines in the S&P 500. This relationship underscores the importance of monitoring these volatility indicators, as they can provide critical insight into market trends and potential downturns. As trading volumes in 0DTE options rise, so too does the power of the VIX1D in predicting market behavior, making it a valuable tool for traders and investors seeking to navigate short-term fluctuations.

Additionally, the surge in trading activity around 0DTE options reflects broader shifts in the market landscape, particularly as investors adapt to changing conditions and utilize innovative trading strategies. The growing reliance on these short-dated options has implications for market dynamics, as their quick decay and sensitivity to intraday price movements can amplify volatility. White’s analysis urges attention to the interrelationship between options trading and underlying market performance, suggesting that the ongoing trend could reshape investment strategies moving forward.

Furthermore, the findings highlight the importance of the VIX and its derivatives as barometers of investor sentiment. Fluctuations in the VIX1D not only provide insights into market anxiety but also inform traders of potential inflection points in the S&P 500. As investors increasingly turn to short-dated options for hedging or speculative objectives, the volatility indicators linked to these instruments gain in significance, shaping the approach of market participants as they interpret these signals.

In conclusion, Simon White’s insights into the implications of VIX signals related to 0DTE options underscore a critical evolution in market behavior, driven by a notable shift towards short-term trading strategies. The VIX1D serves as a potential predictor of market performance, indicating heightened volatility and possible downturns in the S&P 500. As trading volumes in these options continue to escalate, they not only reshape the landscape of equity trading but also elevate the importance of volatility indicators in guiding investor decisions and managing risk.