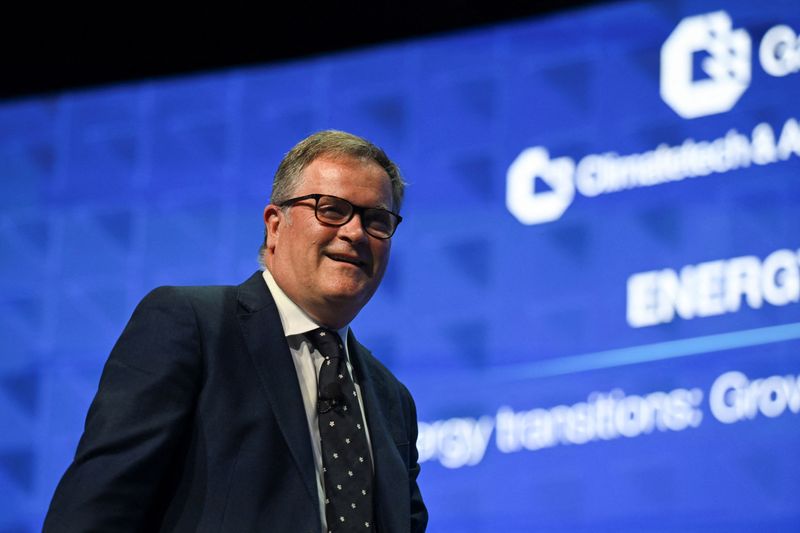

In a recent outlook shared at the FT Commodities Asia Summit, Russell Hardy, the CEO of Vitol, projected that global oil prices would remain in the $70 to $80 per barrel range through 2025, largely due to persistent geopolitical risks impacting supply. The stability of oil prices is complicated by concerns surrounding OPEC+ supply cuts potentially being unwound in 2025, along with sluggish demand growth for oil in China. Hardy pointed out that while uncertainties in the Middle East—especially concerning Iranian and Venezuelan exports—are contributing to market jitters, it is premature to assume an oversupply of oil in the years to come. The potential re-implementation of stringent sanctions under a future Trump presidency could further strain China’s access to affordable Iranian crude.

Janet Kong, the CEO of Hengli Petrochemical International, shared her insights on the current oil dynamics, highlighting that there is approximately 4 million barrels per day of spare oil capacity available worldwide. This surplus capacity mitigates immediate concerns regarding supply disruptions. Nevertheless, Kong underscored the importance of demand growth in significant oil-consuming nations like China and India in shaping global oil prices. She noted that stagnant fuel demand, combined with export constraints, has caused Chinese refining utilization rates to drop below 80%, marking a low point for the industry.

Kong further elaborated that refining margins in China are unlikely to witness a recovery in the near future, emphasizing the need for improvement in demand before any significant price adjustments could be expected. In contrast, Hardy projected a growth of 700,000 barrels per day in China’s oil demand for 2025, indicating a level of growth that, while not as vigorous as previous years, represents a return to normalcy following the pandemic recovery phase. Hardy clarifies that the anticipated demand growth for China in 2025 is expected to be subdued when compared to the more intense increases seen during the last few years.

The conversation during the summit also touched upon how the geopolitical landscape, particularly in the Middle East, influences oil pricing and availability, adding a layer of complexity to the market forecast. With oil supply safety expected to hinge on various international relations and political maneuvers, traders remain cautious. The extent to which these geopolitical factors create hesitance among oil traders is significant and can lead to fluctuations even within a seemingly stable pricing range.

In summary, the forecasts for global oil pricing highlight a balance influenced by both geopolitical risks and economic recovery trajectories. The role of China and India in oil consumption and their respective demand trends is crucial in shaping market expectations. As uncertainties in global politics coexist with market dynamics, industry leaders will need to navigate through a myriad of factors that could disrupt or stabilize oil supply chains leading into 2025. Overall, the combination of expected supply availability and the slower uptake in demand points to a cautious outlook in the oil market, emphasizing the importance of geopolitical considerations in this heavily interlinked global sector.