As of 2023, the total federal student loan debt in the United States has reached a staggering $1.73 trillion, impacting around 43 million borrowers. This debt has experienced dramatic growth over the past 15 years, climbing approximately 232.7% since 2009. In 2024, the average federal student loan debt across all 50 states, along with Puerto Rico and the District of Columbia, amounts to around $29.9 billion per state. This significant increase in debt has prompted extensive analysis and visualization efforts, including a comprehensive assessment by Visual Capitalist’s Kayla Zhu, based on data compiled from the U.S. Department of Education and the U.S. Census Bureau.

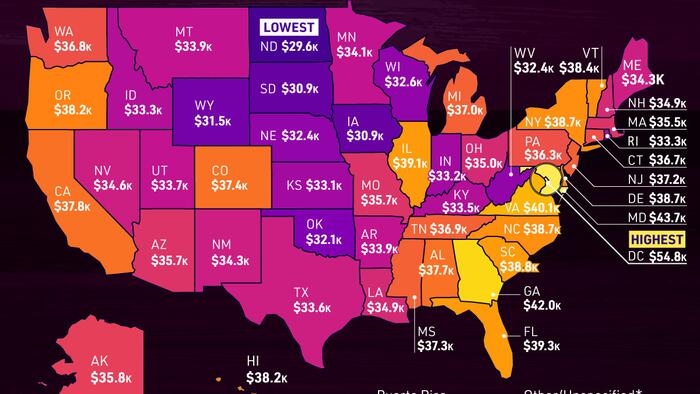

Among the states, the District of Columbia holds the highest average federal student loan debt per borrower, reported at $54,795. This figure reflects the demographic of the area, as many of the borrowers are recent graduates, including those holding advanced degrees, which places additional financial pressure on them due to the inordinately high cost of living in D.C. Maryland occupies the second position in terms of student loan debt, with an average of $43,692, supported by a highly educated population where 43% of residents hold at least a bachelor’s degree. This educational attainment is well above the national average of 35%, illustrating a connection between education levels and borrowing practices.

The state with the lowest average student loan debt is North Dakota, where borrowers owe an average of $29,647. In stark contrast to D.C. and Maryland, only about 11.2% of North Dakota residents are in debt for their education, reflecting a distinct local economic environment, educational infrastructure, and student support systems that facilitate lower borrowing. These statistics shed light on regional disparities in education financing, which can impact individual borrowers’ economic prospects long after graduation.

Many other states fall between these extremities, with notable levels of debt. For example, Georgia and Virginia show average debts of $42,026 and $40,137, respectively, indicative of the southeastern and mid-Atlantic regions’ economic landscapes. States like Florida and Illinois also report high average debts, at $39,262 and $39,055. Several more states within the top range illustrate how federal student loan debt has become a pressing issue across diverse educational and economic contexts throughout the country.

While the federal student loan debt presents a significant financial challenge for many Americans, it also raises important questions about the larger implications for the economy and workforce development. As graduates start their careers, high debt levels may limit their ability to purchase homes, contribute to retirement plans, or save for the future. These challenges can narrow economic mobility and perpetuate cycles of debt among younger generations, ultimately impacting the broader economy.

In summary, the evolving landscape of federal student loan debt reflects broader societal and economic trends, linking educational attainment, economic policies, and regional economic disparities. As policymakers and educational institutions grapple with these challenges, a deeper understanding of the statistics reveals that while high student debt may provide individuals with access to necessary education, the long-term consequences can be profound, impacting not only those who borrow but also the overall economic framework of the nation.