Verizon Communications has recently been recognized as the “Top Dividend Stock of the Dow” by Dividend Channel in its latest “DividendRank” report. This report highlighted that Verizon’s shares, currently priced at $41.50, exhibit desirable valuation and profitability metrics compared to other stocks in the Dow Jones Industrial Average (DJIA). Specifically, Verizon’s price-to-book ratio stands at 1.8, complemented by an annual dividend yield of 6.5%. In contrast, the average for dividend-paying stocks in the DJIA shows a yield of only 2.3% and a much higher price-to-book ratio of 9.4, indicating that Verizon offers more attractive returns for dividend-focused investors. The report further emphasized Verizon’s robust quarterly dividend history and favorable multi-year growth rates across essential financial metrics, solidifying its appeal for income-seeking investors.

In the context of investing philosophies, the report suggests that dividend investors often prefer to target companies that not only exhibit high profitability but are also valued attractively. This synergy between profitability and valuation is crucial for long-term investment strategies. Through its proprietary DividendRank formula, Dividend Channel ranks stocks based on these profitability and valuation criteria, aiming to provide investors with a curated list of compelling investment options. The focus is on identifying stocks that stand out in terms of both financial stability and potential for future growth, serving as a starting point for investors interested in dividend investing.

The Dow Jones Industrial Average, an iconic stock market index established in 1896, tracks the performance of 30 of the largest publicly traded companies in the United States. It is pivotal for measuring the health of the U.S. economy and serves as a benchmark for various financial products and strategies. Dividend Channel’s report ties back to this historical index, illustrating which constituents are potentially the best fits for income-oriented investors. For those looking to invest in the Dow, the report provides insights into the top-performing stocks by highlighting companies like Verizon as significant positions for dividend-oriented investment strategies.

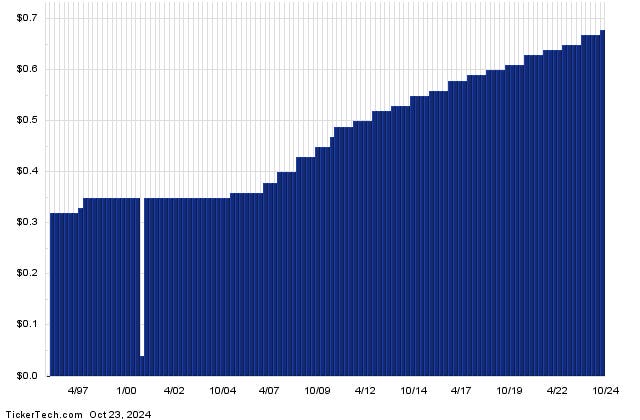

Verizon’s commitment to returning value to its shareholders is evidenced by its current annual dividend payout of $2.71 per share, which is disbursed in quarterly distributions. The company’s most recent ex-dividend date was October 10, 2024, signifying its consistent approach to maintaining an attractive dividend schedule. This long-term commitment to dividends is an essential indicator for potential investors, as it reflects not only the company’s current performance but also its historical ability to generate returns even during economic downturns.

Analyzing a company’s dividend history offers valuable insights into its future performance. Investors often scrutinize these patterns to gauge sustainability and the likelihood of dividend continuation. In Verizon’s case, the report’s emphasis on its dividend history serves as a reassuring factor for investors, indicating that the company has consistently been a reliable income source. Understanding the underlying trends in dividend payments, especially during various market conditions, allows investors to better predict future stability and growth potential.

Overall, Verizon Communications’ designation as the top dividend stock in the Dow reinforces its appeal for value-driven and dividend-focused investors alike. With attractive valuation metrics, a substantial dividend yield, and a proven track record of dividend payments, Verizon stands out as a robust investment opportunity in today’s market landscape. Such endorsements from reputable sources, coupled with Verizon’s financial stability and growth outlook, provide a compelling case for its inclusion in dividend investment portfolios. As dividend strategies continue to underline the importance of both profit and valuation, Verizon emerges as a prominent choice that aligns with investor preferences for sustainable income generation.