The used-vehicle market has experienced significant fluctuations over the past few years, marked by historic price spikes and subsequent declines, which have created a complex and challenging pipeline for the industry. Following a dramatic price increase of over 50% from mid-2020 to mid-2022—fuelled by consumer willingness to pay elevated prices amid supply constraints—dealers capitalized on this trend by raising their prices at auction. However, by 2022, consumer enthusiasm waned, leading to a notable decrease in used vehicle prices. This decline, which saw retail and wholesale prices drop substantially, is estimated to account for over half of the earlier price spike, leaving the Consumer Price Index (CPI) for used vehicles significantly lower. As the used-vehicle CPI had previously represented about 5% of the core CPI, it played a considerable role in the inflationary landscape by contributing to the deceleration of core CPI, where prices still increased, albeit at a slower rate.

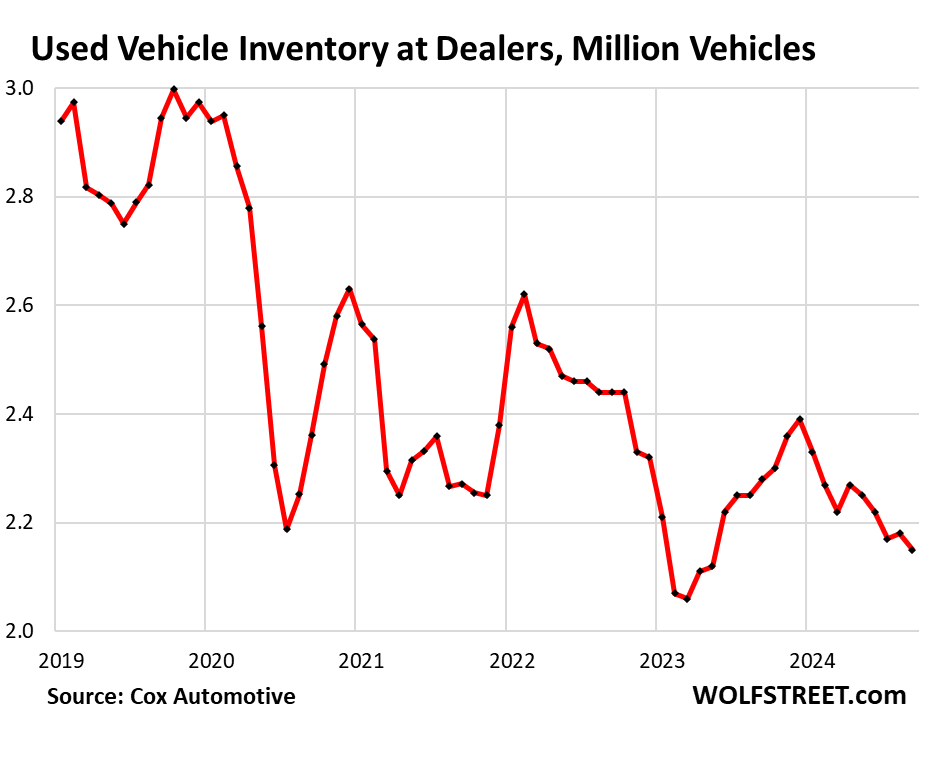

Despite the historic plunge in prices throughout 2022, the used-vehicle market has shown signs of stability in recent months. Observations from the wholesale side indicated that prices stopped falling, with September data reflecting a positive uptick in the used-vehicle CPI. This trend suggests a potential stabilization in prices after months of decline, impacting the broader inflation trend as the core CPI re-accelerated for three consecutive months. The dynamics within the used-vehicle market are exhibiting tightening behavior, which hints at a future stabilization in pricing mechanisms as dealers grapple with limited inventory. Notably, retail inventory levels of used vehicles as of October dipped to 2.15 million units—substantially lower than pre-pandemic figures—suggesting an inventory squeeze that could push prices higher as demand remains solid.

The decline in inventory primarily influences the supply of newer used vehicles in circulation, which typically consists of units retired from rental fleets, lease returns, and trade-ins. The considerable disruptions in new vehicle production, primarily due to semiconductor shortages, have led to 6 million fewer new vehicle sales during the period from Q2 2021 through Q1 2023 compared to pre-pandemic times. As a result, this constriction in new vehicles has influenced the availability of the vehicle stock designated for resale, creating difficulties for dealers aiming to replenish inventories. With tighter supplies expected, dealers are likely to bid higher at auctions to secure inventory, subsequently translating these increased costs into retail pricing for consumers.

Wholesale prices are showing signs of resilience as October unfolds, with the Manheim Used Vehicle Value Index reflecting a stable trend despite a slight non-seasonal dip early in the month. The index is anticipated to hold stable across the month, marking fewer year-over-year declines than previously observed. Current trends indicate that the wholesale depreciation typically expected at this time of year is muted, which has implications for both dealers and consumers. As inventory levels tighten and auction prices stabilize, the vehicle market may witness a gradual recovery that could reset expectations for both future pricing and availability.

In terms of retail prices, average listing prices for used vehicles have exhibited steadiness, stabilizing above $25,000 in 2024 while reflecting a gradual upward trajectory during previous years. This increase in retail prices, coupled with tighter inventories, emphasizes the overall demand for used vehicles amid a landscape of constrained supply. The recent uptick in the used-vehicle CPI corresponds with these trends and signals a shift in pricing dynamics that could support re-acceleration in core inflation metrics. The previously steep declines in used vehicle prices that contributed to slower core CPI growth appear to be waning, evident in the recent CPI data which indicated a modest increase in September.

Looking forward, the combination of constrained inventories, stable wholesale prices, and increased retail pricing suggests that the used vehicle market may be entering a new phase characterized by increased stability. Consumers may face higher prices due to tight supply chains and strong demand, which could reinforce inflationary trends moving forward. As concerns over declining prices have seemingly abated, the overall retail environment for used vehicles is becoming increasingly complex, calling for careful monitoring of market dynamics in light of consumer behavior and broader economic indicators.

In conclusion, the used-vehicle pipeline is expected to remain disrupted in the coming years, driven by a combination of supply shortages and evolving consumer preferences. The market’s recent stability amidst price fluctuations indicates a potential new equilibrium, though challenges remain prominent as dealers and manufacturers navigate these shifts. Given the intricate relationship between used vehicle prices and inflation, the sector’s trajectory will be vital for both consumer markets and economic policy as a whole, underscoring the need for ongoing vigilance in tracking these trends and their implications on the broader economy.