China’s ongoing struggle to revitalize its sluggish housing market and a faltering economy has prompted government officials to roll out yet another series of meager monetary and fiscal stimulus measures. These initiatives, while intended to stimulate consumer demand, have not been sufficiently robust to effectuate meaningful stabilizing changes. Despite disappointing results, Beijing remains committed to propping up the housing market and economy, exploring various strategies to restore investor confidence amid a crisis in the property sector. As pressure mounts to achieve the targeted 5% GDP growth by year-end, the central government is actively pursuing mechanisms to bolster the economy, with share buybacks emerging as a focal point of its revival efforts.

The recent surge in share buybacks across China’s major exchanges is a direct result of the central government’s persistent encouragement for companies to return cash to shareholders. As reported by the Financial Times, buybacks have reached a record high of Rmb235 billion ($33 billion) in 2024, more than double the previous year’s figures and significantly surpassing the Rmb133 billion recorded in 2022. This uptick in corporate behavior aligns with the government’s broader objective of reviving investor sentiment, especially against a backdrop of diminishing consumer demand and a beleaguered property market. Despite a prior rise of up to 20% in the benchmark CSI 300 index, market participants remain skeptical, as many anticipated further stimulus measures that have not materialized.

Goldman Sachs’ chief strategist for China, Kinger Lau, has noted that share buybacks represent a prudent choice for firms with surplus cash, especially given the substantial decline in Chinese stock prices. Such actions could also enhance government revenues since it maintains significant stakes in many firms involved in the buybacks. This trend gained momentum in advance of the announcement of Rmb300 billion in central bank loans aimed at facilitating these repurchase activities. With a wave of corporations, including prominent state-owned entities like Sinopec, unveiling buyback strategies of over Rmb10 billion since this announcement, the potential for further capital inflow into the markets seems promising.

However, the effectiveness of these buyback initiatives in addressing the broader economic malaise remains contentious. Financial analysts, like Jason Bedford, suggest that the government is strategically orchestrating an equity rally through these buybacks. Kin Chan from Argyle Street Management equates China’s approach to a “Japanese approach” regarding share repurchase strategies, which can elevate stock prices but does not fundamentally resolve the underlying economic issues. Critics question whether such financial engineering can lead to a sustainable recovery or simply create a temporary illusion of wealth that ultimately does not translate into enhanced economic activity.

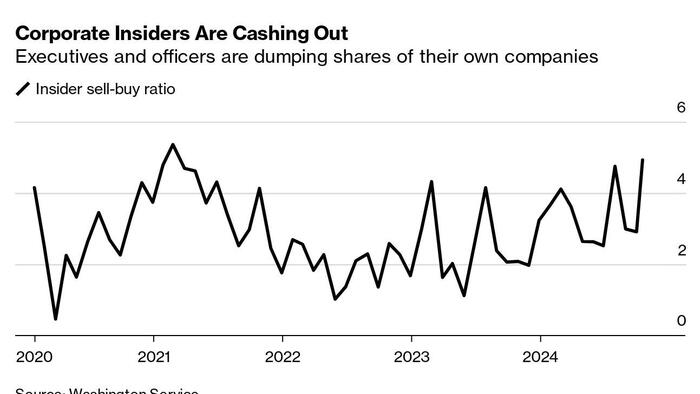

In stark contrast, the scenario in the United States reflects a different trend in stock market behavior. While domestic stock purchases are on the rise, particularly among previously skeptical hedge funds and retail investors, insiders at U.S. companies have been selling off their shares at a near-record pace. Noteworthy divestitures, including actions by investment magnate Warren Buffett and Nvidia’s CEO, raise red flags about the future performance of these companies. Insider selling historically indicates a lack of confidence in stock valuations, which may foreshadow more challenging market conditions ahead, particularly as significant insider sales have been associated with past declines in equity prices.

As analysts scrutinize the dynamics between buyback activities in China and insider selling trends in the United States, the implications for investors and market health become increasingly complex. The divergent approaches highlight differing economic narratives, with China’s efforts focused on stimulating demand through corporate buybacks and financial measures, while U.S. executives appear to be securing gains through the divestiture of shares. The last major spike in the insider-selling gauge in July preceded a substantial decline in U.S. markets, serving as a cautionary sign. The interplay between these factors suggests an intricate landscape for investors navigating the global financial climate, with potential repercussions spanning both regions.