At the conclusion of the third quarter, inflation in the United States appears to have moderated, offering reassurance to the Federal Reserve as it increasingly directs policy efforts toward protecting the labor market. Analysts predict that the consumer price index (CPI) will rise by only 0.1% in September, marking the smallest increase in three months. Year-on-year, the CPI is estimated to have grown by 2.3%, continuing a trend of slowdowns over the past six months and indicating the lowest inflation levels since early 2021. The Bureau of Labor Statistics is expected to release its official CPI report on Thursday, which will provide further insights into current price trends. Core CPI, excluding the fluctuating food and energy sectors, is anticipated to increase by 0.2% month-on-month and by 3.2% year-on-year, reflecting the underlying inflation dynamics.

The strong job growth reported for September gives further context to the expected inflation moderation. This suggests that the Federal Reserve is likely to pursue a smaller interest rate cut during its upcoming meetings on November 6-7. Fed Chair Jerome Powell pointed out that the projections released alongside the September rate decisions imply potential quarter-point reductions at the remaining meetings of the year. The CPI and producer price index serve as informative tools to the Fed, guiding their preferred inflation measure, the personal consumption expenditures (PCE) price index, which is set to be published later in the month. Economists from Bloomberg suggest that the upcoming CPI report will show subdued headline inflation with a more robust core reading, likely aligning with the Federal Reserve’s target of 2% core inflation.

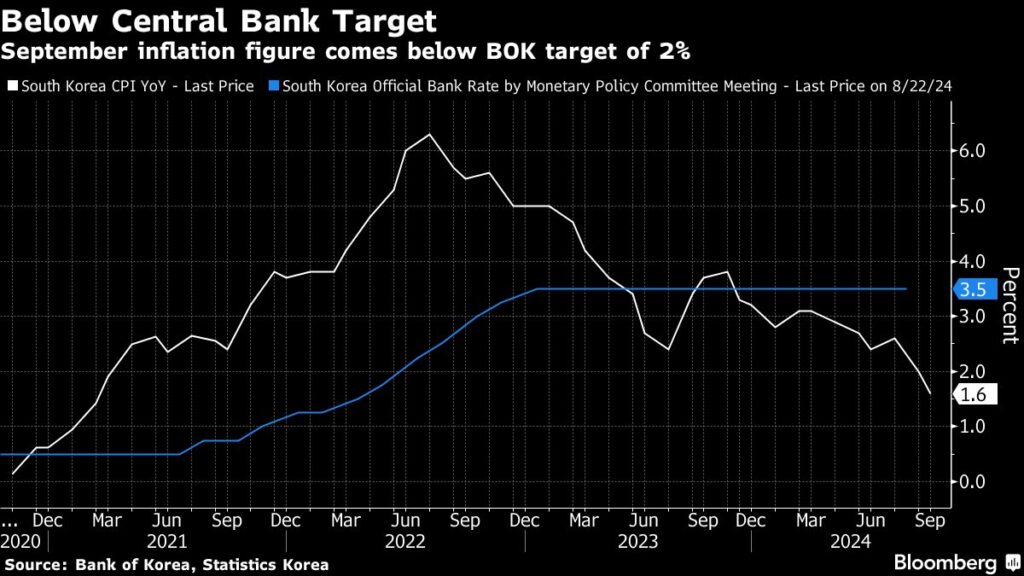

In addition to inflation and employment reports in the US, other countries including Canada are also closely monitoring economic indicators before pivotal rate decisions. Canada’s final jobs report will offer insight into labor market trends that could influence the Bank of Canada’s next moves. Governor Tiff Macklem is watching closely for signs of loosening within the labor market, which will be critical in shaping monetary policy. The coming week will also see several central banks across Asia, including New Zealand and South Korea, expected to implement rate cuts in response to weak economic signals. The Reserve Bank of New Zealand is particularly anticipated to lower rates by half a percentage point as a response to concerns about labor market stability, while the Bank of Korea is expected to adjust rates based on inflation trends.

In the European region, heightened attention will be given to Germany’s manufacturing sector, with upcoming reports on factory orders and industrial production. Forecasts suggest that Europe may abandon hopes of stimulating significant economic growth this year. As prime ministers present budgets and central banks, such as the European Central Bank (ECB), gear up for rate decisions, the economic outlook appears uncertain. This week is particularly crucial for the ECB as officials prepare for a possible rate cut close to the Oct. 17 decision date, with notable speakers providing context before a blackout period commences. In the UK, data releases will further reveal the health of the economy, influencing future monetary policy decisions of the Bank of England.

Meanwhile, other regions are witnessing their own monetary policy developments. In Latin America, third-quarter consumer price data from significant economies are anticipated by week’s end, with indicators pointing towards declining inflation in several countries. Brazil stands out with continued economic pressure and rising prices, which may lead to central bank adjustments at future meetings. Furthermore, Peru’s favorable inflation outlook may allow for continued rate reductions by its central bank. Argentina faces persistent inflation challenges, with President Javier Milei’s initiatives appearing stalled despite previous successes in managing price increases.

Overall, the global economic landscape this week is characterized by central banks evaluating their monetary policies in response to shifting economic indicators. Inflation moderation in the US is coinciding with broader efforts across various nations to navigate labor market complexities and inflationary pressures. The diverse monetary policy trajectories reflect differing regional realities, as authorities strive to balance economic growth while managing inflationary risks. As the Federal Reserve and other global central banks assess their strategies, market participants will closely watch forthcoming economic data releases that could signal further shifts in policy direction.