In November, U.S. industrial production faced a decline for the third consecutive month, with a 0.1% decrease month-over-month (MoM), falling short of the anticipated 0.3% increase. This downturn followed a downward revision of a 0.4% drop in the previous month. As a result, industrial production fell 0.9% year-over-year (YoY), marking the most significant decline since January. The decline indicates ongoing challenges in the manufacturing sector, with producers struggling to maintain momentum amid various economic pressures such as supply chain disruptions and changing consumer demands. The performance in industrial production reflects broader economic trends that have raised concerns about the potential for a slow recovery.

Factory orders experienced a slight improvement, rising by 0.2% MoM, after a previous downwardly revised decline of 0.7%. However, this uptick was still considerably weaker than the anticipated 0.5% increase. The mixed signals in factory orders suggest that while there may be some resilience in certain sectors, overall demand remains fragile. The modest recovery in factory orders could be attributed to inventory replenishment and some ad-hoc spending, yet caution prevails given the economic backdrop and uncertain consumer confidence.

When omitting transportation from the factory orders data, core factory orders demonstrated a more favorable trend, increasing by 0.13% MoM. This modest rise in core orders led to a 1.13% increase in YoY production, indicating a potentially steadier demand from other sectors outside of transportation. Despite this positive momentum in core orders, broader concerns persist regarding the sustainability of this growth. Industries reliant on consumer goods may face challenges as households adjust spending habits in response to inflationary pressures and economic uncertainty.

In addition to factory orders, the output from utilities saw a significant decline, falling the most in four months, while mining experienced its largest drop since May. These declines not only contributed to the overall decrease in industrial production but also highlight vulnerabilities across different sectors within the economy. The energy sector, in particular, faces challenges due to fluctuating demand and supply chain issues, which were exacerbated by recent geopolitical tensions. The mining sector’s downturn may also reflect stricter environmental regulations and shifting preferences toward sustainability.

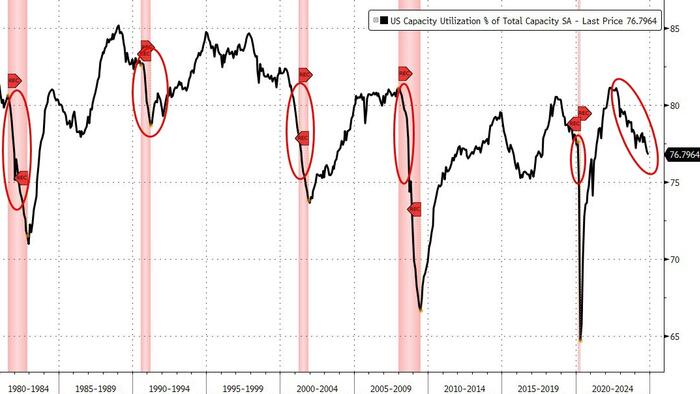

Capacity utilization, a key indicator of economic efficiency, fell to 76.8%, the lowest level recorded since April 2021 and well below economists’ expectations. This decline in capacity utilization signifies that resources within the industrial sector are not being maximized, raising questions about the economy’s health and ability to rebound. A lower capacity utilization typically suggests slack in the economy, which can lead businesses to reduce investment and hiring, further compounding the challenges facing industrial production.

Despite these concerning trends, some analysts argue that the economy is not yet in a recession. They point to the mild improvements in certain areas, like core factory orders, as evidence that some sectors remain resilient. However, the combination of declining industrial production, weak factory orders, and reduced capacity utilization underscores potential vulnerabilities in the economy. Policymakers and business leaders continue to monitor these trends closely, as the path forward remains uncertain amid shifting economic dynamics and persistent inflationary pressures.